6 SaaS FP&A-focused ideas to assist finance leaders in scaling their teams

Learn more ->

, Co-Founder & CEO, Abacum

17 min read · Published: May 1, 2024

TL:DR

Stay ahead of the game in 2024: As a CFO, you need a robust FP&A tool to navigate the challenges of slow business growth and layoffs. This list of FP&A software will help to accelerate your business’s scale-up and thrive in any economy.

What is FP&A? Financial Planning and Analysis (FP&A) encompasses a series of strategic business processes focused on crafting and overseeing long-term financial planning, analyzing organizational performance, and predicting future financial outcomes.

By integrating a profound comprehension of financial principles with strategic planning, FP&A plays a pivotal role in empowering businesses to make well-informed decisions, fostering efficiency and effectiveness in achieving their objectives. This involves not only identifying opportunities for cost reduction and enhancing profitability but also establishing a comprehensive roadmap for sustained success, taking both internal and external factors into account.

Moreover, FP&A goes beyond mere number-crunching. It entails close collaboration with various departments to grasp their needs and objectives, ensuring that financial planning harmonizes with the company’s broader goals. As a result, FP&A becomes a genuine partner to the business, providing invaluable insights to achieve better decisions and guidance that drive growth and long-term triumph.

FP&A Software is a specialized business planning platform designed to deliver comprehensive financial analysis for operational planning. It plays a critical role for businesses of all sizes by providing data-driven insights into financial budgeting, accurate forecasting, cost management, and performance optimization.

The utilization of FP&A software enables organizations to gain a profound understanding of their financial well-being, empowering them to make well-informed decisions based on the provided data. This software is highly flexible and can be tailored to suit the unique requirements of any organization. For instance, it offers detailed reports on revenue, expenses, and cash flow while generating rolling forecasts and scenarios for different business outcomes.

The significance of finance as the backbone of any business underscores the need for FP&A teams to develop a comprehensive understanding of every aspect of the organization. From management reporting and sales quota attainment to headcount planning and budget ownership, FP&A professionals play a crucial role in ensuring the financial health and success of the company.

Given their deep insight into the company’s financial operations, the role of FP&A covers both a wide range and a great depth. Forward-thinking CFOs have empowered their FP&A teams to shift from being mere budget enforcers to becoming true facilitators of revenue generation.

Here are some of the ways in which FP&A teams accomplish this transformation:

As businesses strive for efficiency and competitiveness in today’s dynamic market landscape, selecting the best FP&A software emerges as a crucial decision. The right FP&A solution can revolutionize financial planning, analysis, and reporting, streamlining decision-making processes and propelling organisational growth. When embarking on the journey of software selection, it’s imperative to meticulously evaluate several key criteria points to ensure a seamless alignment with your unique business requirements.

First and foremost, making sure the software is fit for purpose stands as a cornerstone in the evaluation process. Businesses must assess how well an FP&A solution caters to their specific objectives and operational needs. Functionality related to financial planning, analysis, and reporting should be assessed to establish its resonance with decision-making protocols.

Customization and adaptability also emerge as vital considerations in the quest for the ideal FP&A platform. An adaptable solution should be able to seamlessly integrate into existing workflows and reporting structures, offering flexibility in dashboard configuration, report customization, and modeling capabilities.

Alongside the above points, the ease of implementation and integration cannot be overstated. The challenges of software deployment are significant, hence evaluating the platform’s compatibility with existing systems, availability of training resources, and seamless integration with ERP, CRM, and BI systems becomes paramount.

Additionally, data accuracy and reliability serve as the bedrock of effective FP&A activities. A robust solution should exhibit flawless data management capabilities, encompassing data consolidation, validation, and governance practices to ensure accuracy in decision-making processes.

Lastly, ongoing support and continuous improvement from the vendor is indispensable. A responsive customer support system, frequent software updates, and a roadmap for future development underscore and highlight a vendor’s commitment to client success.

As a business trying to navigate the landscape of FP&A software solutions, employing these criteria points as a guide ensures an informed decision-making process. By prioritizing fit for purpose, customization, ease of implementation, data accuracy, and vendor support, organizations can unlock the full potential of their FP&A endeavours, driving sustainable growth and competitiveness in the market.

In navigating the ever-evolving market of FP&A software solutions, it’s important to distinguish the optimal platforms tailored to meet the needs of businesses, no matter their size or stage of growth. Our curated selection of the 11 best FP&A software platforms in 2024 reflects a comprehensive evaluation process, conducted evaluating crucial criteria such as features, scalability, pricing models, and user feedback. These criteria not only ensure transparency but also foster trust in our recommendations.

Our range of software solution providers extends beyond mere feature comparison; it covers a nuanced understanding of the evolving needs of businesses in today’s dynamic landscape. By prioritizing transparency and real-world applicability, we empower businesses of all sizes to navigate the complex terrain of FP&A software selection with confidence and clarity.

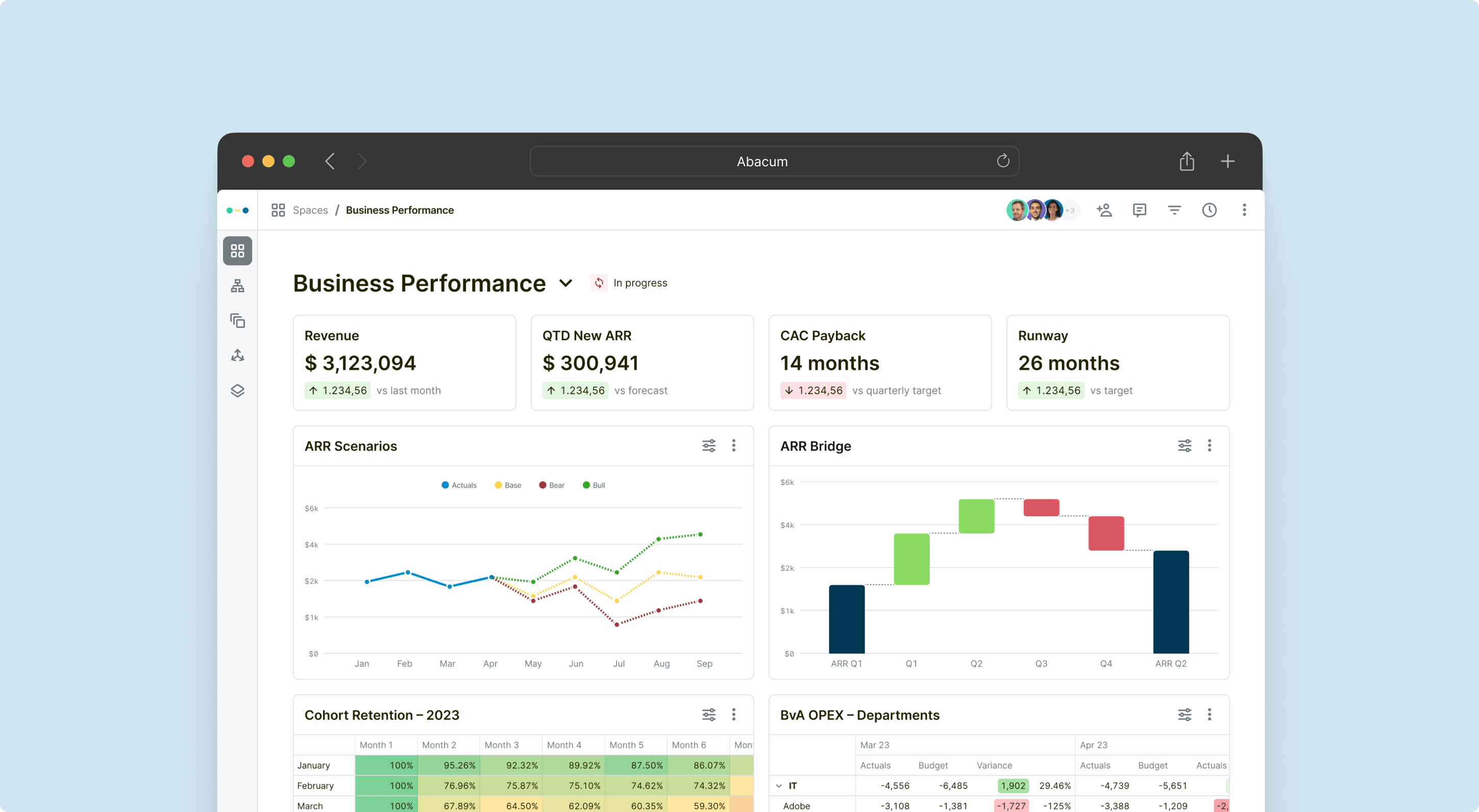

Why it stands out: Abacum enables businesses to accelerate scenario analyses, automate budgeting workflows, streamline leadership approvals, and effectively consolidate bottom-up and top-down forecasts. With quicker access to insights and enhanced analytics, Abacum acts as the single source of truth for automating critical budgeting processes, consistently delivering tangible value to its users.

Key features: Headcount planning, what-if analyses, vendor-level budgeting, reporting templates, budget approvals, and core workflow functionalities.

What to look out for: Abacum is best suited for FP&A leaders at mid-market startups and scaleups that are in need of a robust but flexible planning solution.

Customer support: Abacum provides a fully dedicated support team, along with additional resources such as an academy and in-depth updates on new features.

G2 Rating: 4.8/5

Get a custom demo of Abacum

Why it stands out: Anaplan stands as a dynamic planning platform, empowering data-driven decision-making and facilitating adaptability to market changes. Its flexible architecture empowers organizations to optimize planning processes and foster agile operations, leading to enhanced business outcomes. Anaplan is the leader in enterprise planning.

Key features: Very robust and strong calculation engine, ability to plan at any level of granularity, entity consolidation, real-time collaboration, modeling, and simulations.

What to look out for: Anaplan is most ideally suited for large enterprises with over 1000 employees, particularly when their existing processes have grown overly complex, surpassing the capabilities of smaller solutions to handle such intricacy. It has a steep learning curve, for which you will need dedicated resources for its implementation. For the implementation, Anaplan uses third-party providers.

Customer support: Anaplan provides a highly regarded support page and community as well as a dedicated support team.

G2 Rating: 4.6/5

Website: Anaplan

Why it stands out: The status quo and probably the most widely used software for financial planning and analysis. Microsoft Excel is a powerful and accessible tool that can cater to the needs of a broad spectrum of users, from casual small businesses to finance professionals who carried out financial modeling at large corporations. Its versatility and widespread adoption have solidified its position in the market.

Key features: Its wide range of formulas and customizability is second to none.

What to look out for: Nevertheless, excel comes with some limitations like automating data ingestion, driving collaboration with the different stakeholders of a budgeting process, or being able to easily use multi-dimensional modeling to build bottom-up and top-down forecasts and budgets. In terms of implementation, you will need to acquire the Microsoft Suite in order to be able to download Excel.

Customer support: In regard to customer success, there is almost endless documentation about Excel, its formulas, and how to fix or build anything.

G2 Rating: 4.7/5

Website: Microsoft Excel

Why it stands out: Pretty similar to Microsoft Excel but instead a cloud-based spreadsheet alternative. They stand out due to their collaborative nature and being cloud-based instead of on-premise.

Key features: Due to them being cloud-based they are able to offer features that Excel lacks. Multiple tools like CRMs or ERPs are able to integrate with Google Sheets, which automates the export of data. Its ability to be shared with multiple stakeholders and leave comments stand out from other spreadsheet-based solutions.

What to look out for: They also come with similar limitations as Excel. As with Excel, in order to create your google sheets you will have to create a Google account.

Customer support: Like similarly to Excel there is almost endless documentation when it comes to the features that google sheets offers.

G2 Rating: 4.6/5

Website: Google Sheets

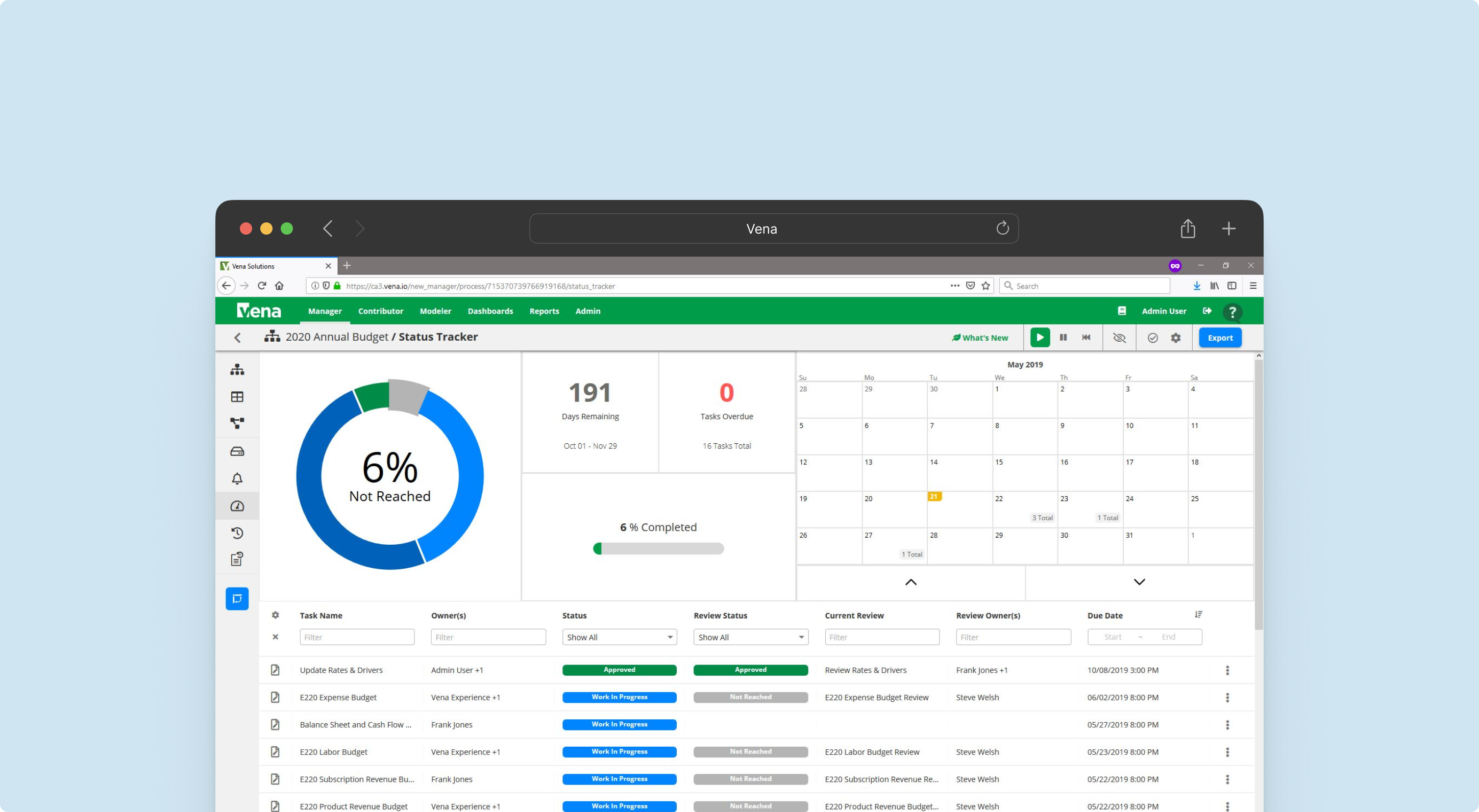

Why it stands out: Vena presents itself as a comprehensive financial management platform, ideally suited for centralized budgeting and workflow, and it shares similarities with Excel. This remarkable similarity to Excel endows Vena with unparalleled flexibility.

Key features: Key features of Vena solutions include centralized budgeting and forecasting, data integration, scenario modeling, reporting and analytics, workflow automation, collaboration and audit trail, regulatory compliance, adaptability to business needs, and comprehensive customer support.

What to look out for: Vena is best suited for finance professionals that are looking for a tool in order to overcome some of the limitations that Excel comes with but are heavily dependent on Excel. Hence, Vena is more tailored to already established organizations relying heavily on Excel.

Customer support: Vena provides in-depth resource pages, as well as a highly regarded community that heavily revolves around Excel. It provides Excel templates, forums, an academy, or blog posts.

G2 Rating: 4.5/5

Website: Vena

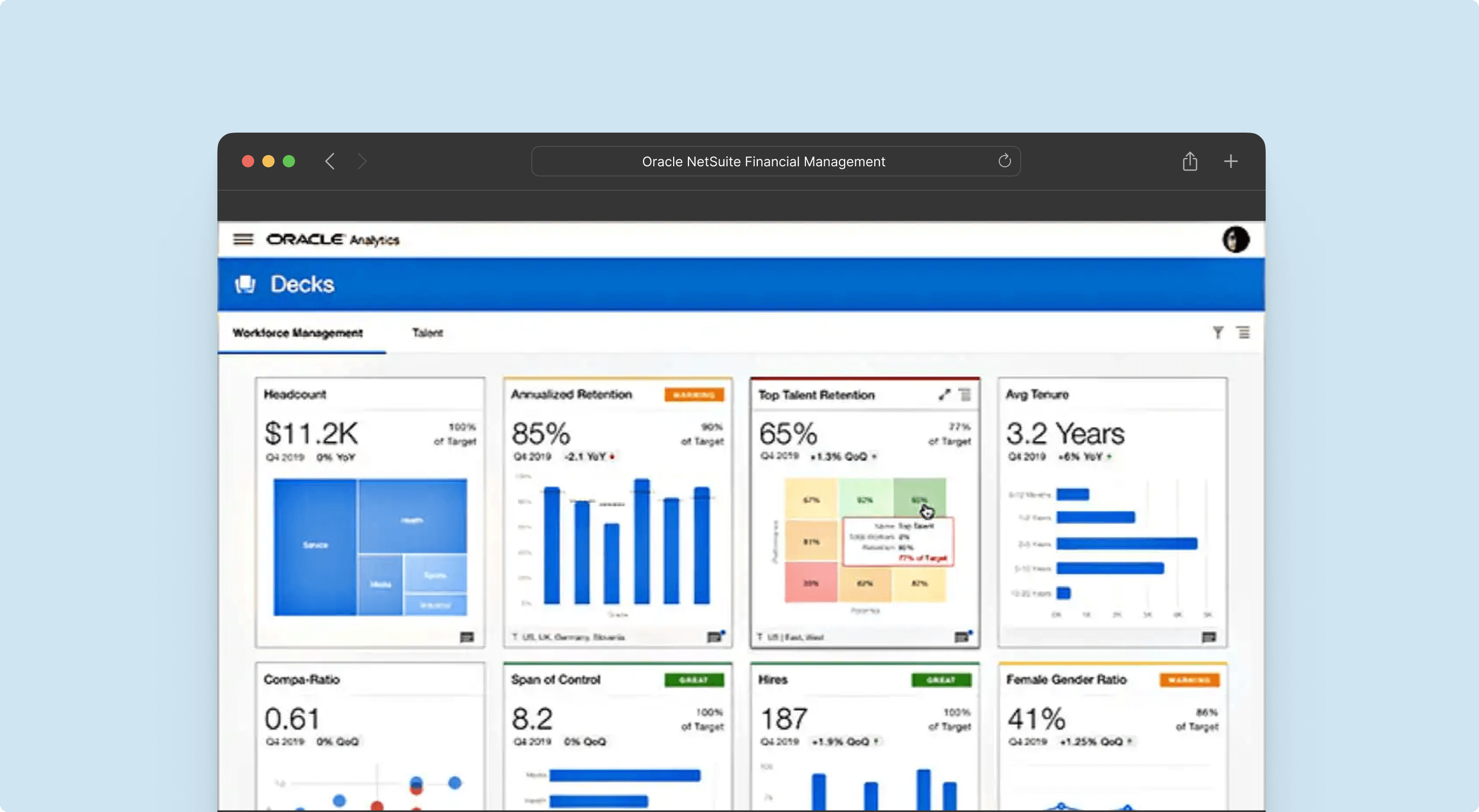

Why it stands out: NetSuite Planning and Budgeting is a powerful finance operation streamlining platform that automates planning, budgeting, and forecasting processes. It empowers efficient plan creation, what-if scenario modeling, and report generation, reducing manual tasks for finance teams. This allows them to concentrate on strategic analysis, driving impactful insights, and enhancing the company’s financial position.

Key features: This premier ERP offers seamless integration with business bank accounts and provides customizable reports.

What to look out for: The tool is best suitable for businesses with NetSuite as an ERP. On top of it, it will be necessary to acquire the budgeting and forecasting pack which will definitely drive up pricing more, on top of an already costly product. On top of this, implementation can easily last the better part of 6 months to 1 year.

Customer support: Their resource center is a trove of in-depth knowledge covering all aspects of their product and best practices for various industries. Clients express immense satisfaction with their top-notch customer service support.

G2 Rating: 4.0/5.0

Website: NetSuite Planning and Budgeting

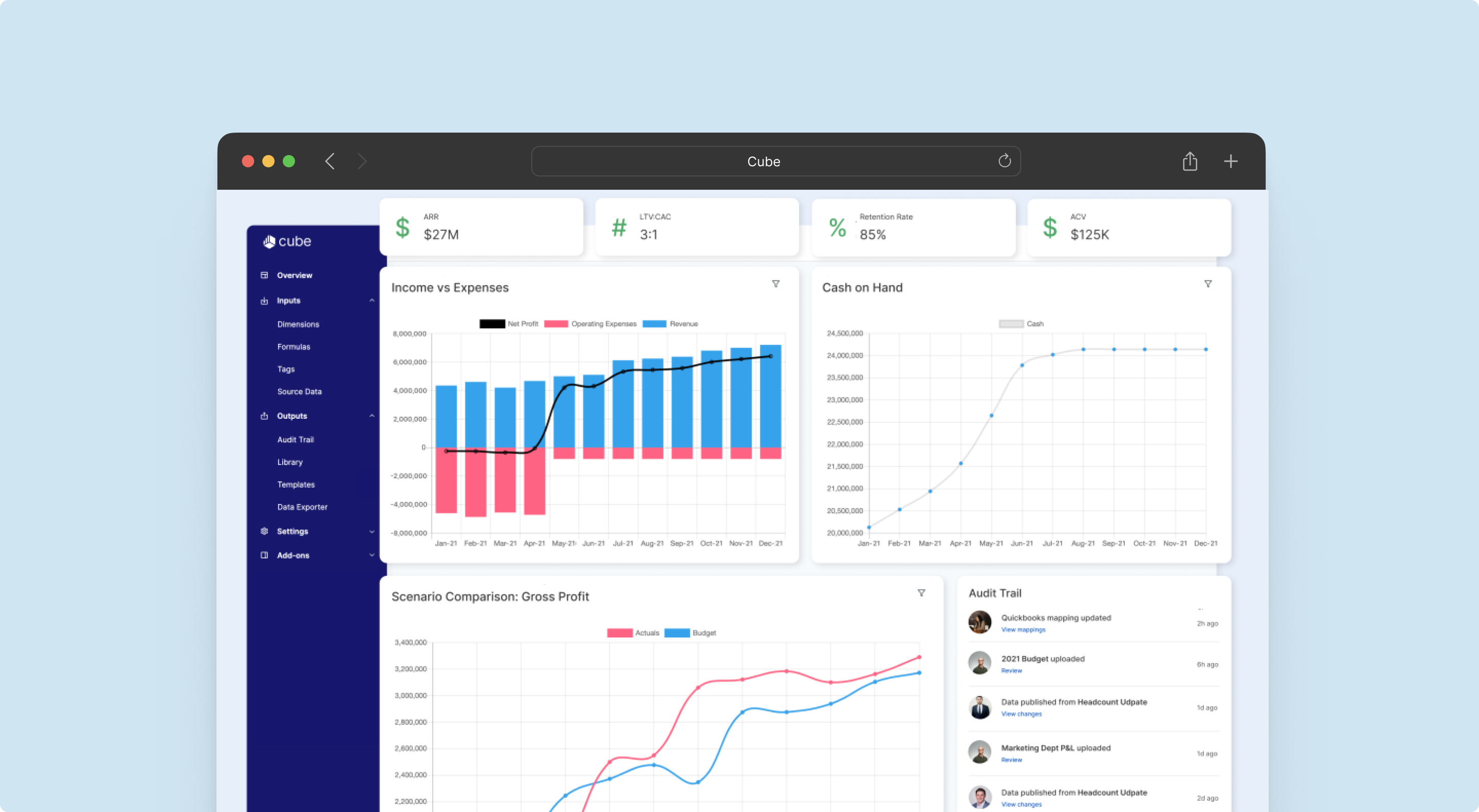

Why it stands out: Cube Software serves as a comprehensive financial planning and analysis (FP&A) solution, presenting companies with a centralized data source to manage their entire financial planning process efficiently.

Key features: Cube is a centralized FP&A solution offering secure data management, seamless integration with various tools, scenario planning, and customizable dashboards with data visualization.

What to look out for: Cube is more tailored to scaling start-ups that want a fp&a platform that can scale with them but is more Excel based. Although It seems that Cube is not as flexible and companies have to organize their financials to Cube’s platform and not the other way around.

Customer support: Cube’s implementation and Customer Success teams are highly regarded for their speed and involvement at both implementation and post-implementation.

G2 Rating: 4.5/5

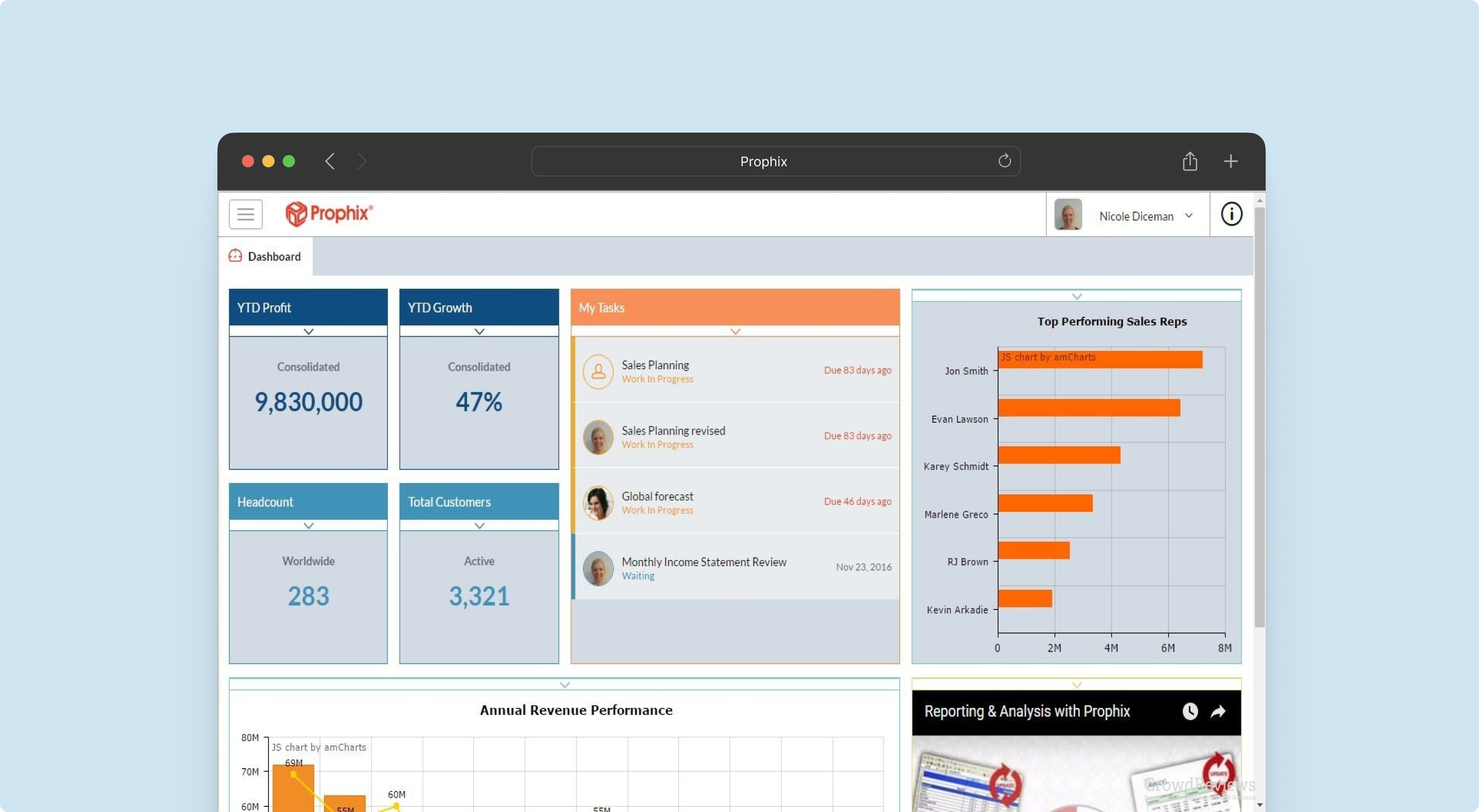

Why it stands out: Prophix is a powerful Corporate Performance Management (CPM) software designed to enhance organizational profitability while reducing the risks associated with errors.

Key features: Some of Prophix’s key features include a wide range of data visualization options, variance analysis, and multiple scenario planning.

What to look out for: Prophix is best suited for organizations that need a robust financial performance management platform to optimize their budgeting, planning, and financial forecasting processes. Prophix caters to a wide range of industries, including finance departments, planning teams, and decision-makers within enterprises seeking an efficient and comprehensive solution for financial management.

Customer support: Seems like the customer outsources their implementation but has a dedicated customer service team. Besides this, they have an in-depth academy. They also offer courses in-person, at their offices or online.

G2 Rating: 4.4/5

Website: Prophix

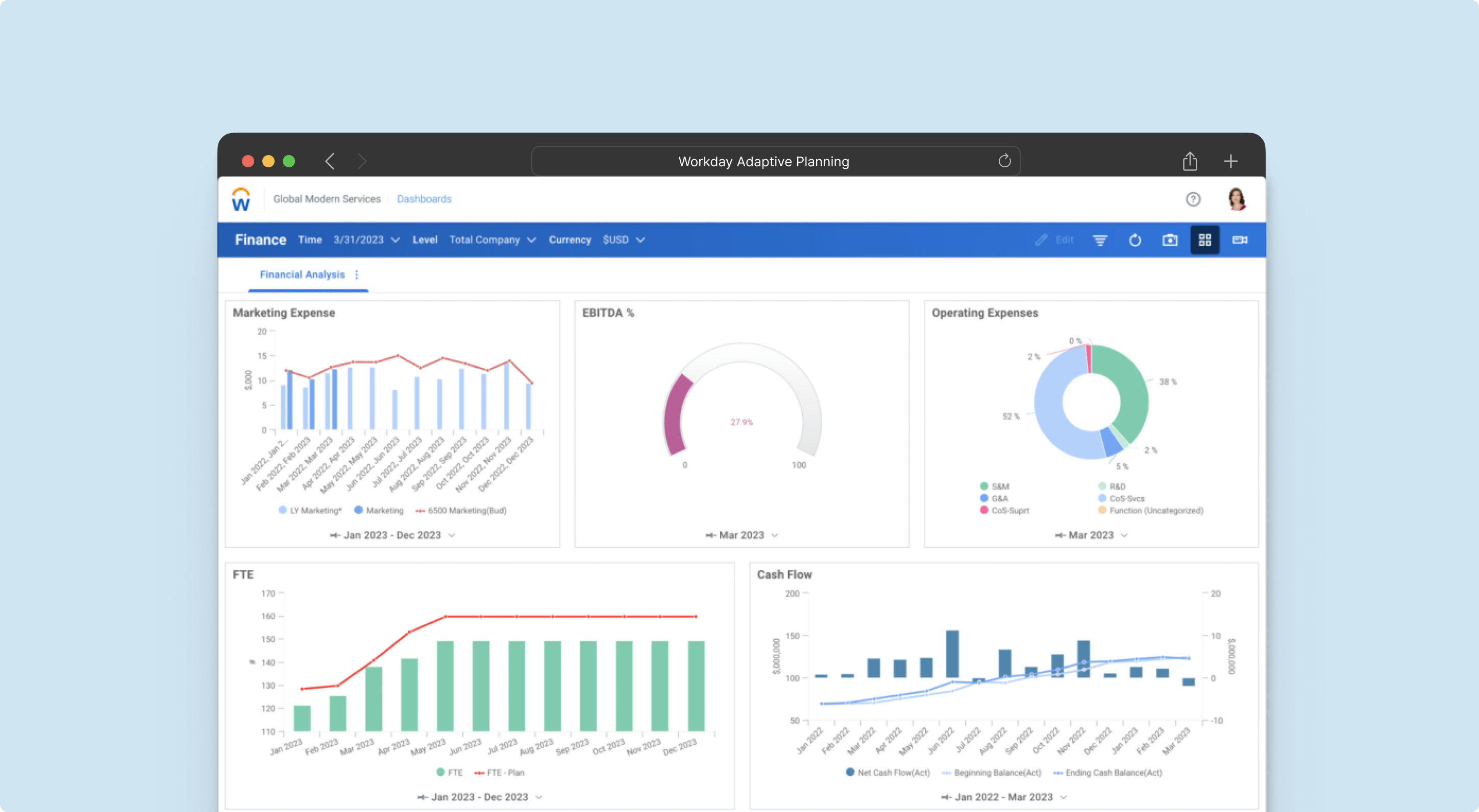

Why it stands out: Adaptive Planning empowers agile decision-making through its robust modeling and analytics capabilities. This user-friendly cloud-based application allows enterprise organizations to confidently adapt to changing business conditions with ease.

Key features: Some of the key features of Workday Adaptive Planning include multiple dimension modeling, Adaptive Planning OfficeConnect for seamless report creation in Microsoft Office, being able to connect Excel reports to the platform, and version control to manage revisions efficiently.

What to look out for: Workday Adaptive Planning is among the top FP&A software choice for large enterprises seeking a comprehensive tool to handle extensive data effectively. Its exceptional ability to manage large datasets sets it apart from other applications.

Customer support: Despite the presence of available learning resources, certain users have expressed their dissatisfaction, suggesting that these resources could benefit from improvements.

G2 Rating: 4.3/5

Website: Workday Adaptive Planning

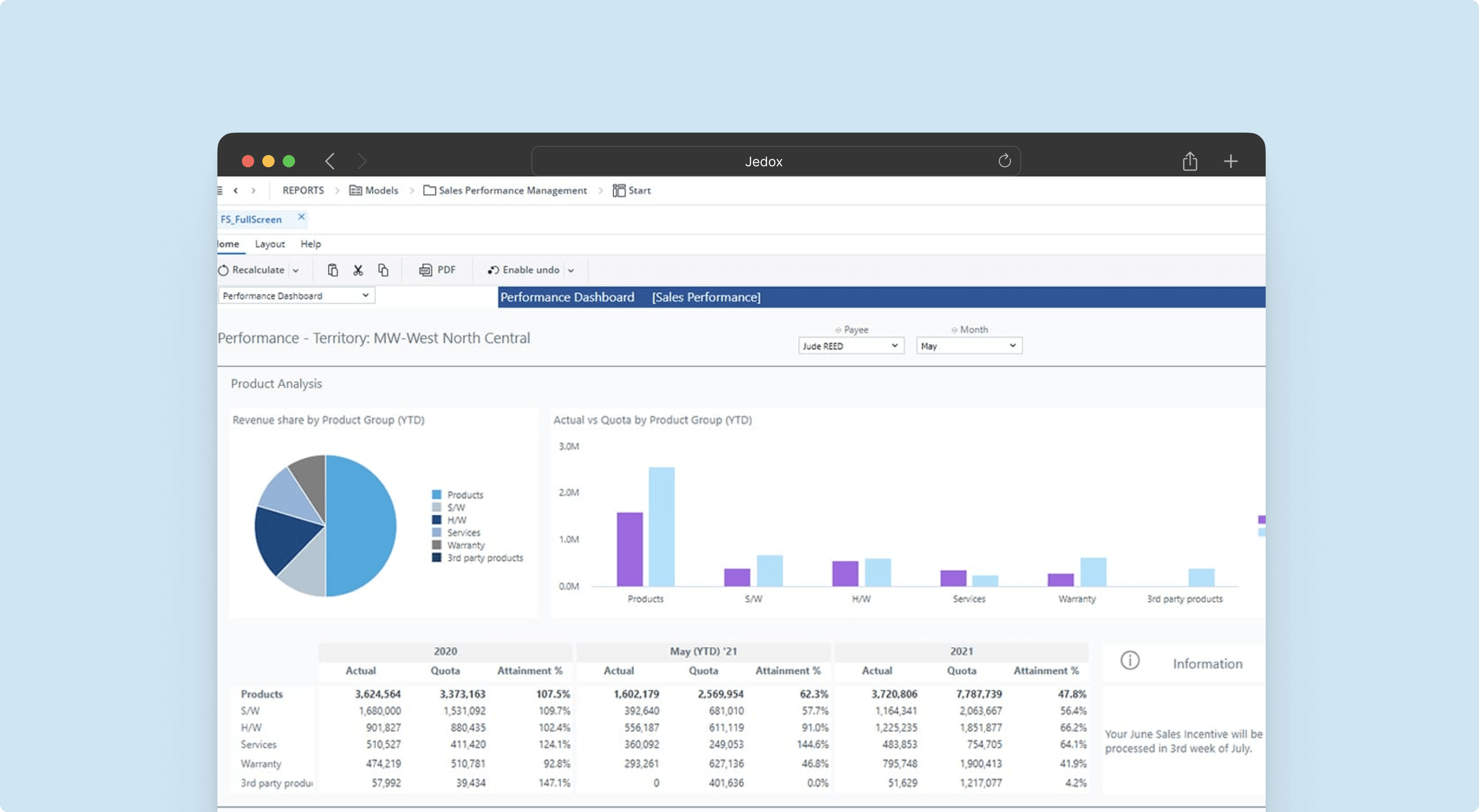

Why it stands out: Jedox stands out due to its dynamic planning and performance management platform, which empowers organizations to surpass expectations with their plans

Key features: Key features of Jedox include customizable permissions for different users, a robust ETL (Extract, Transform, Load) process, the capability to automate tasks through code execution, and an Excel add-in.

What to look out for: It is essential to note that its target customers are typically finance departments, planning teams, and decision-makers within enterprises who require a flexible and comprehensive planning and performance management solution.

Customer support: Jedox ensures customer success by offering a wide range of support options, including an academy, training videos, training calendars, and training centers, in addition to the standard support function.

G2 Rating: 4.3/5

Why it stands out: Planful is a comprehensive financial performance management platform that empowers organizations to make highly impactful business decisions and act as a single source of truth for its financial and operational data.

Key features: Some of its key features are interactive dashboards, its integration with Microsoft Office, and its feature to push reporting directly to stakeholders are among Planful’s features to highlight.

What to look out for: It is essential to note that its target customers are typically finance departments, planning teams, and decision-makers within enterprises who require a flexible and comprehensive planning and performance management solution.

Customer support: Its customers rave about Planful’s customer support and all the resources they provide.

G2 Rating: 4.3/5

Website: Planful

After a thorough comparison of FP&A software solutions, several key insights emerge, guiding businesses of all sizes towards a selection of great choices. Abacum stands out due to its robust scenario analysis, streamlined workflows, and dedicated support, ideal for mid-market startups and scaleups. Anaplan stands out for large enterprises, offering dynamic planning and real-time collaboration, albeit with a steep learning curve. Microsoft Excel and Google Sheets provide versatile options, suitable for businesses of all sizes, with Excel particularly entrenched in finance operations.

Vena Solutions bridges Excel-dependency with advanced financial management, targeting established organizations. NetsSuite Planning and Budgeting streamlines finance operations, albeit with higher pricing and longer implementation times. Cube Software offers centralized FP&A solutions, more tailored to scaling startups but may lack flexibility. Prophix and Planful cater to comprehensive performance management, appealing to organizations prioritizing profitability and risk reduction.

Workday Adaptive Planning excels in handling extensive datasets, ideal for large enterprises, while Jedox offers dynamic planning with customizable features.

To navigate the selection process effectively, readers are advised to:

FP&A is a critical process that combines financial principles with strategic planning to empower businesses to make informed decisions and achieve long-term success. Key principles for effective financial management include scenario planning, identifying business success inputs, measuring progress, and analyzing budget variances.

Top FP&A software tools like Abacum, Anaplan, Excel, Google Sheets, Vena Solutions, and others offer various features to support financial analysis and planning. Businesses can choose the best planning software based on their specific needs and requirements.

Abacum is the leading FP&A software tailored specifically for mid-sized companies, offering a suite of powerful tools designed to automate workflows, provide real-time insights, and transform the way you plan, forecast, and strategize.

When it comes to financial planning solutions for mid-market companies, Abacum stands out as the ultimate choice, driving efficiency, accuracy, and strategic planning like never before. Join us on this transformative journey and unlock your business’s true potential.

FP&A, short for Financial Planning and Analysis, constitutes a subset of the broader field of Finance. Its primary focus lies in analyzing and planning an organization’s financial data. This entails forecasting future performance, evaluating current performance in comparison to budgeted targets, crafting strategic plans, and monitoring cash flow. Additionally, FP&A involves devising strategies to ensure optimal utilization of resources and capital in pursuit of long-term objectives.

On the other hand, Finance encompasses a broader spectrum of an organization’s financial matters, encompassing accounting, financial reporting and control, tax planning and compliance, investments, and risk management. While FP&A narrows its scope to specific financial analysis and planning, understanding financial performance remains of utmost importance for businesses to make well-informed decisions.

Below we have provided some of the best practices in Financial Planning and Analysis for effective financial management within an organization.

By adhering to these FP&A best practices, organizations can make informed financial decisions, anticipate challenges, and optimize their financial performance for sustainable growth.