Integrate your workforce planning into budget planning seamlessly with the top 2023 WFM tools

Learn more ->

, Co-Founder & COO, Abacum

11 min read · Published: October 4, 2023

🎯 Highlights from the article

Stay ahead of the game in 2023: As a CFO, you need a robust tech stack to navigate the challenges of slow business growth and layoffs. This list of cutting-edge software will help to accelerate your business’s scale-up and thrive in any economy.

Over the past decade, the role and responsibilities of the CFO in SaaS organizations have evolved significantly, moving away from transactional to becoming a more strategic finance leader and business partner.

As time passed, the technological environment continued to expand and core systems became more advanced. As a result, executive leadership teams have been updating their tech stacks to keep up with the constant digital transformation and shifting demands of an increasingly complicated market, while also meeting the needs of their business.

SaaS finance leaders have great expectations for the future of technology and have made it a top priority as

“54% of them will increase their spending on Finance”

According to BDO Middle Market CFO Outlook Survey

Their need for comprehensive solutions that address a wide range of requirements has shaped the landscape, and today’s specialized tools enable them to pick and choose the greatest fit for their business.

A best-of-breed approach that customizes each solution to meet a specific requirement is an excellent method to optimize the leadership tech stack and deliver greater value throughout the organization. For a SaaS CFO to effectively scale up their business, they must have expertise in the following areas:

To help you along the way, we will provide a breakdown of what reliable technologies you can use to build your CFO software stack and help your organization move through each stage of growth.

Building a finance tech stack is essential for any business looking to grow and scale. Choosing the correct financial planning tools and software can mean the difference between the success and failure of your business model.

The first step in building an effective finance tech stack is to identify the core needs of your business.

Which growth stage your business is in? What financial processes do you need to automate?

What data do you need to track?

Once you have identified your needs, you can start researching and selecting the right tools for your business.

Depending on your business growth stage, your needs will require you to prioritize one set of tools or another.

After identifying the software that best fit your corporate demands, it is time to start implementing every solution in your toolkit. This process can be daunting, but with the right guidance and support, you can make sure that your finance tech stack is up and running in no time.

At this stage, your company is still fighting to prove if it can be successful in the long term. So, to make things less complicated you probably only use Excel or Google Sheets to keep track of everything, and because you are going to spend a lot of time analyzing data here are some tips.

However, if you want to improve the process and reduce the time it takes to find data-driven insights, you need to invest in the right software for your accounting team and get rid of the crazy mess of spreadsheets.

Unsurprisingly, a large number of accountants and financial advisors are still reliant on the old-fashioned spreadsheets of the past. Admittedly, these can still be useful, but with more advanced tools to streamline financial data and reconciliation, there is no reason not to stay up-to-date.

Accounting platforms allow you to manage your books from anywhere and reduce the amount of manual data entering you do. This software is designed for small-medium businesses, and for those organizations that will later require greater capabilities.

Biggest benefits for SaaS CFOs:

Some examples of good accounting software are:

FreshBooks is cloud-based accounting software that is designed to simplify and automate all of your most crucial accounting procedures. You can simply create, change, and manage ledger entries, and you may export this data without having to put in a lot of time and effort.

FreshBooks, like the other programs on this list, is cloud-based, which means you will be able to access your files from any location as they are stored in cloud servers. FreshBooks reports are simple to create and comprehend, which is consistent with the rest of the FreshBooks experience.

Xero is one of the fastest-growing and most well-known cloud accounting systems on the market. It is specifically designed to make accounting simple and accessible by eliminating as many superfluous stages as possible.

When compared to many of the other accounting tools available, Xero is straightforward and user-friendly. As a result, more skilled financial teams may find this to be a constraining factor.

But, if you can handle your accounts seamlessly and straightforwardly, why not?

As your company begins to grow and show potential, you will need to add some kind of payroll and HR management software to your technology stack.

Payroll may be considered to be more of an HR function rather than a matter for CFOs, yet both responsibilities are closely related. Everything from salary to sick leave has an impact on the efficiency of a firm and the amount of money it makes. So, what are your best options for streamlining payroll while also staying on top of critical employee issues?

Key components all SaaS CFOs can benefit from:

Some of these solutions include:

ADP, or Automatic Data Processing, is one of the biggest providers of Human Resources (HR) software solutions and outsourced services in the world.

It offers effective payroll and Human Capital Management (HCM) services to aid in the running of compensation, attendance, compliance, and more.

BrightPay is a fantastic cloud payroll solution that was developed exclusively for the United Kingdom market. Users can be certain that their payroll operations are HMRC-compliant, and the auto-enrollment option makes it simple for firms to set up employee pensions without the need for additional staff.

The platform’s ease of use is the platform’s second most important selling element.

Gusto, like the other two services mentioned above, assists businesses in automating payroll. Among the tasks are everything from payslips and federal and state tax filings to time-consuming calculations and compliance with healthcare standards (including the ACA).

Gusto works seamlessly with accounting software, ensuring that all of your most crucial (and time-consuming) operations are taken care of without you having to lift a finger. In a nutshell, it simplifies the complicated process of payroll administration.

Now that you moved out of the survival stage and your company has proven to be financially sustainable, it can be good to change accounting software to an ERP system and financial planning software to help make decisions easily that are supported by data.

Numerous ERPs can manage a specific subset of capabilities required by finance leaders to allow them to reach a specific goal. Depending on your organization’s structure and aim will heavily influence what ERP you should use.

Technical components all SaaS CFOs can benefit from:

Two useful tools are:

NetSuite is one of the most well-known and widely used cloud Enterprise Resource Planning tools today. For many finance leaders, this is the gold standard when it comes to financial reporting. NetSuite is an all-in-one solution that serves as an ERP, CRM, business process development tool, and eCommerce platform. One of the advantages of using a comprehensive platform such as this is the ability to have all of your vital data in one place at all times.

Another essential element that can be quite beneficial to your business is if your CRM software and ERP systems can communicate with one another, something that is possible with NetSuite.

Unit4 is a very powerful ERP system with a slick interface. What distinguishes this platform from others is that it is mostly a do-it-yourself platform. You have a great deal of latitude in constructing the system in the manner of your choosing.

This is excellent if you have the time to do so and are clear on what you want to achieve. Nevertheless, some startup CFOs may choose an easier and deeper tool that is ready to use right out of the box.

Financial Planning and Analysis (FP&A) solutions support the finance functions’ budgeting, planning, and forecasting efforts. It increases a company’s ability to manage performance by linking corporate strategy and execution with modeling, collaboration analytics, and performance-reporting capabilities. The FP&A market is accelerating its shift to a more tech-driven landscape, so including these solutions in your CFO software stack will help your company grow at a faster rate.

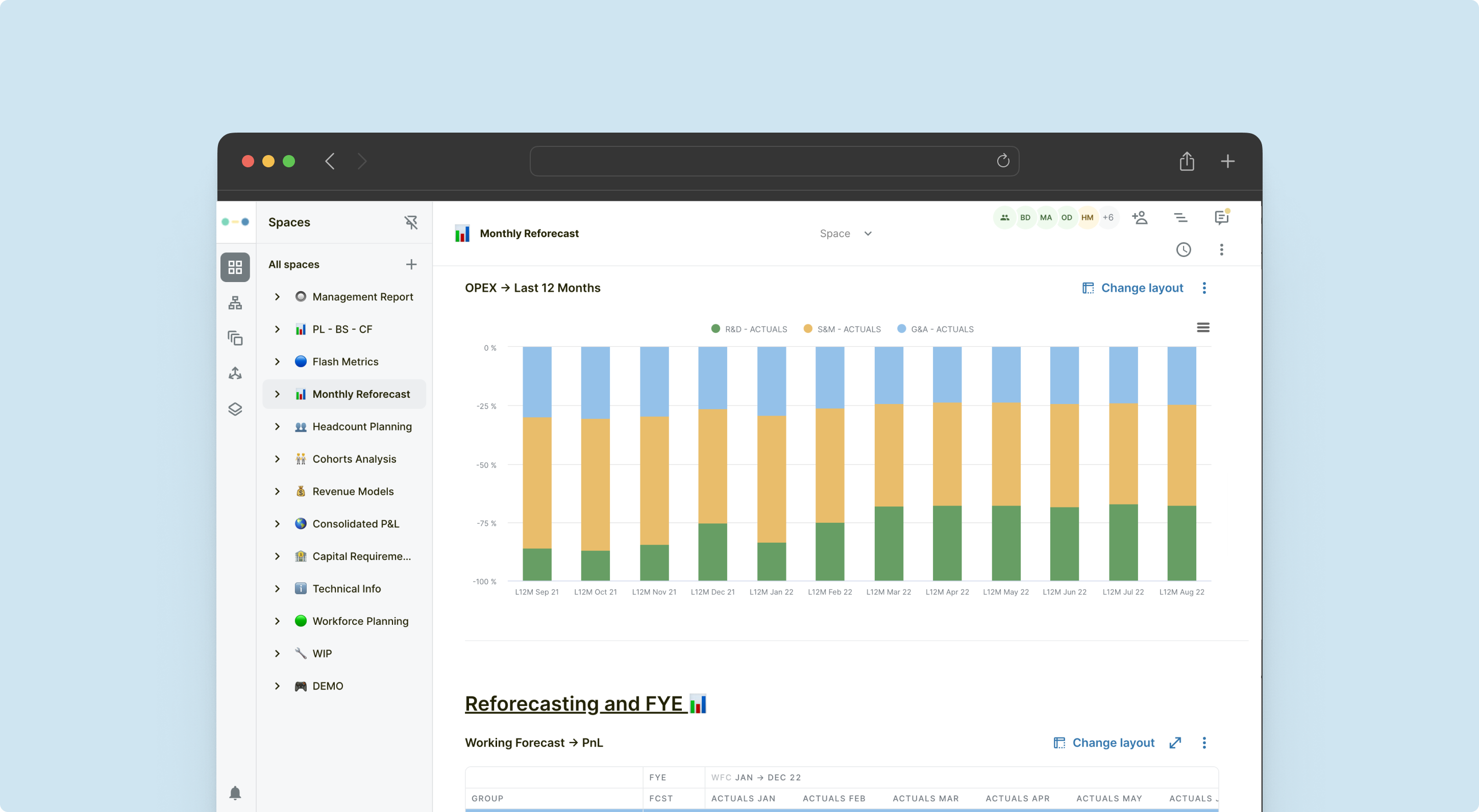

Abacum is a collaborative financial planning and analysis software that helps you streamline your finances by automating manual tasks, sharing findings, and driving decision-making faster than ever before. Cash flow, key financial metrics, and data-driven insights are just a few of the items that can be monitored and optimized with Abacum.

Advanced headcount management is critical to business health, and Abacum transforms the headcount planning process with real-time reporting, automated planning capabilities, and what-is analysis to help you find the perfect headcount planning approach.

It takes Strategic Finance to the next level through an automated performance analysis tool, so you can deliver answers and set up a plan accordingly.

Learn more:

Running a business requires precise customer relationship management; CRM tools need to do more than track email lists and account for recent purchases, they should connect to marketing campaigns, sales outreach initiatives, and more. With the right CRM tools, your business can optimize the relationship it has with its customers. Luckily, there are two CRM tools that have been around for a long time and have grown and changed with the needs of businesses and their clients.

Salesforce has paved the way for CRM tools; with it, business leaders can better connect with customers, track detailed customer interactions, seamlessly manage the sales pipeline, and update product pricing with the click of a button. On average, it reduces customer support costs by 27% and improves sales productivity by 29%.

With features that enable automation and in-platform approval flows, your business operations will find an unstoppable rhythm.

While looking to expand your business, you will need to focus on financial planning, spending, and payments.

To run a successful firm, it is usually necessary to ensure your customers can pay for your SaaS products or services. There are excellent payment tools available to make this process as straightforward as possible.

Biggest benefits for SaaS CFOs:

If your customers want to pay with a credit card online, Stripe is almost the de facto industry standard. It allows you to issue invoices and collect credit payments through your app or website, without having to invest a lot of time and money in the technological development process.

Since every consumer can pay in the same manner, Stripe greatly streamlines the money collection process.

GoCardless assists clients in making payments quickly and conveniently. However, rather than accepting credit card payments, it operates on a direct debit basis. Customers can authorize your firm to collect direct payments from them on an ongoing basis with just a few clicks.

One-time invoices are also supported, and your customers will have an easier time setting them up with the help of the service.

As your revenue grows, Chargebee makes getting your receivables easier than ever. Not only does it streamline all workflows for your accounts receivable team, but it also automates revenue recognition and provides full-service insight dashboards to help you manage your business. Chargebee is used by more than 6,000 subscription businesses, making it on the shortlist for fintech tools your organization needs today.

It is important to choose the right spend management solution within the SaaS tech stack to help CFOs keep track of corporate expenditures.

Key components all SaaS CFOs can benefit from:

Most businesses find it difficult to keep track of their spending. A spend management solution like Spendesk eliminates all of this by providing you with intelligent, trackable spend management. Your employees have access to their cards with adjustable limitations, which eliminates the need for them to pay with their own money altogether.

Meanwhile, as a SaaS CFO, you will have complete visibility into the spending of the company, thanks to thorough records of every purchase.

By implementing these financial planning tools to your financial tech stack, your scale-up will improve not only results but also the finance department’s performance. However, keep in mind that this software will require research to adapt to your own organization’s needs and budget.

Now that you know what key systems exist out there for your finance team to build its CFO tech stack, it is time to begin making that investment.

With Abacum, we empower finance teams of high-growth tech companies to become true strategic partners in their organization by driving time-to-insight with powerful automation and seamless collaboration.

Request a demo now to see our product live and start your finance transformation journey.

A CFO tech stack is the set of tools and technologies used by a Chief Financial Officer (CFO) to manage the financial operations of a business. It includes software such as accounting, budgeting, forecasting, and analytics tools.

Businesses should modernize their CFO tech stack in order to keep up with the ever-evolving technology landscape and stay competitive. By leveraging the latest software-as-a-service (SaaS) solutions, businesses can gain access to powerful tools that enable them to make more informed decisions and drive growth. Modernizing the CFO tech stack can help businesses streamline processes, reduce costs, and improve visibility into their financial operations.

A modern CFO tech stack can provide numerous benefits, including:

In addition to the benefits listed above, a modern CFO tech stack can also help you stay compliant with industry regulations and standards. This is especially important for businesses operating in highly regulated industries such as finance, healthcare, and government.

By investing in the right technology, you can ensure that your business remains compliant while also taking advantage of the latest advancements in financial management. This will help you maximize your profits and stay competitive in the market.

When selecting a tech stack for a startup, there are several factors to consider. The most important factor is the company’s goals and objectives. For a SaaS finance leader, the tech stack should be tailored to support the growth of the business. A well-chosen tech stack can help streamline processes, reduce costs, and increase efficiency.

Another factor that should be taken into account is the budget. Startups often have limited resources and need to be careful when selecting a tech stack. This is why it is important to choose technologies that are cost-effective and can scale with the company as it grows.

Finally, startups should also consider the technical expertise of their team when selecting a tech stack. If the team lacks experience in certain areas, they may need to invest in training or hire additional personnel so they can get the most out of the new technology.

Discover how finance automation drives better decision making