FP&A software for efficient budgeting & forecasting

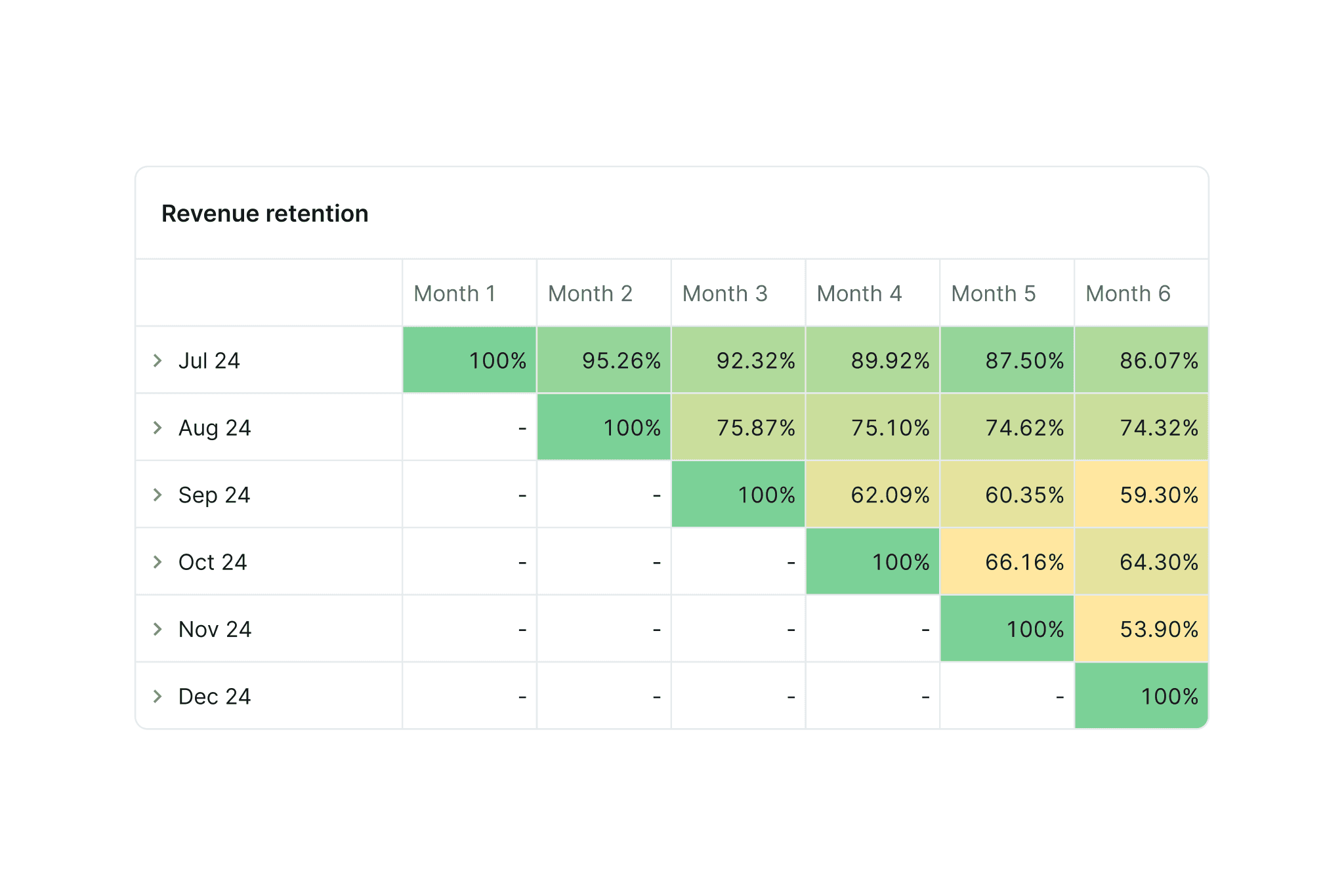

Achieve financial granularity and model accurately

It is no longer a matter of choosing between the two; you must deliver relevant data with a high level of detail on time. Achieving this is challenging with spreadsheets because updating information requires more manual effort.

Make confident business predictions

Luckily, Abacum enables you to gather all of your business inputs in real-time, update your actuals in one-click, and obtain outputs at a dimensional level of granularity. Which allows you to confidently predict your company’s financial future in a fraction of the time.

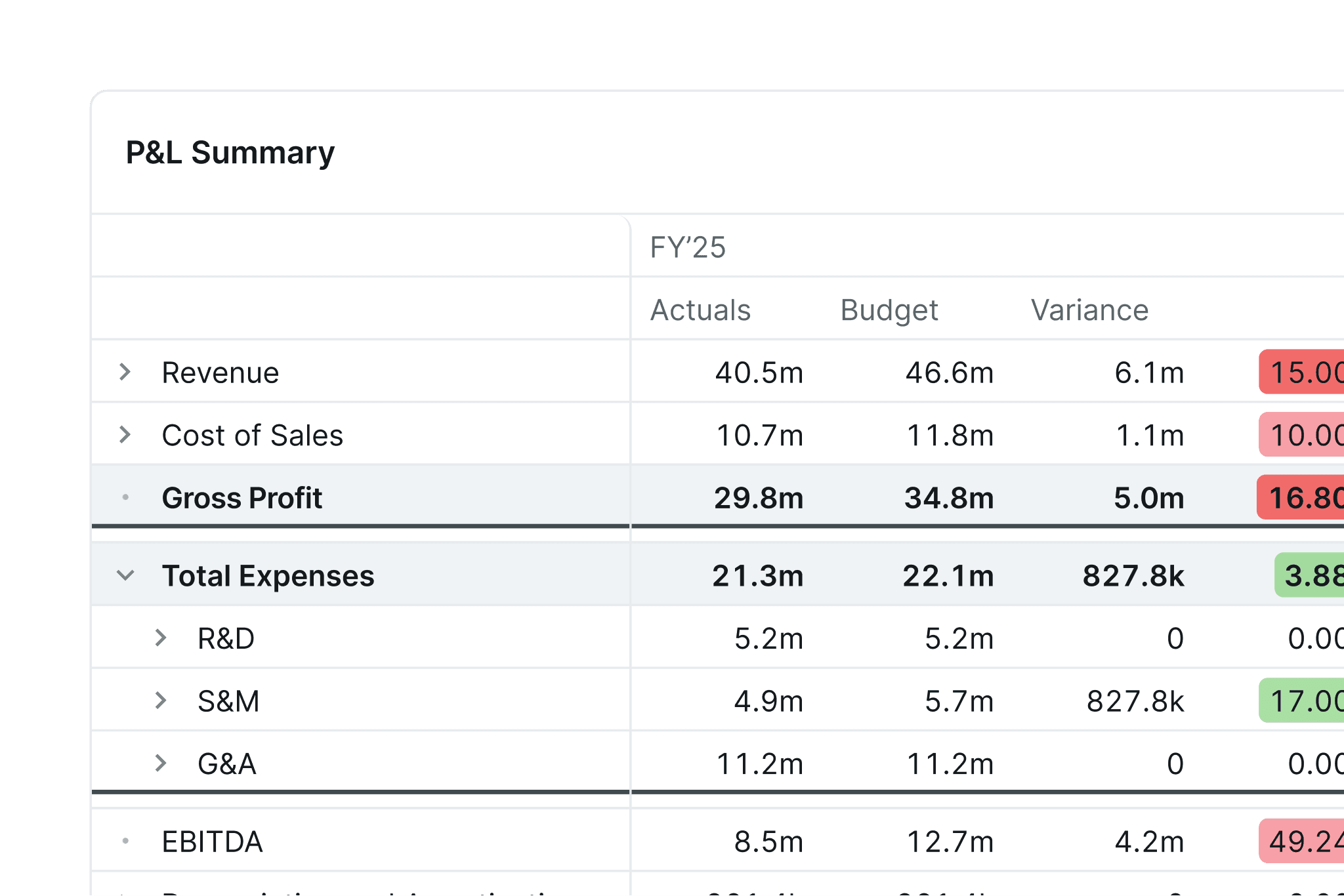

Communicate through stories, not spreadsheets

Today, FP&A software solutions allows for financial analysis to be conducted in one common space, providing all the necessary context to make sound strategic business decisions.

Automation to reduce complexity

With Abacum, you and your finance department can save time by automating the financial consolidation process, gain confidence in the accuracy of your data, and deliver stories to decision-makers in an easily digestible format, allowing them to identify potential challenges and opportunities faster.

What sets Abacum apart from other FP&A software solutions?

Easier set up

Keep all your business data in a single platform

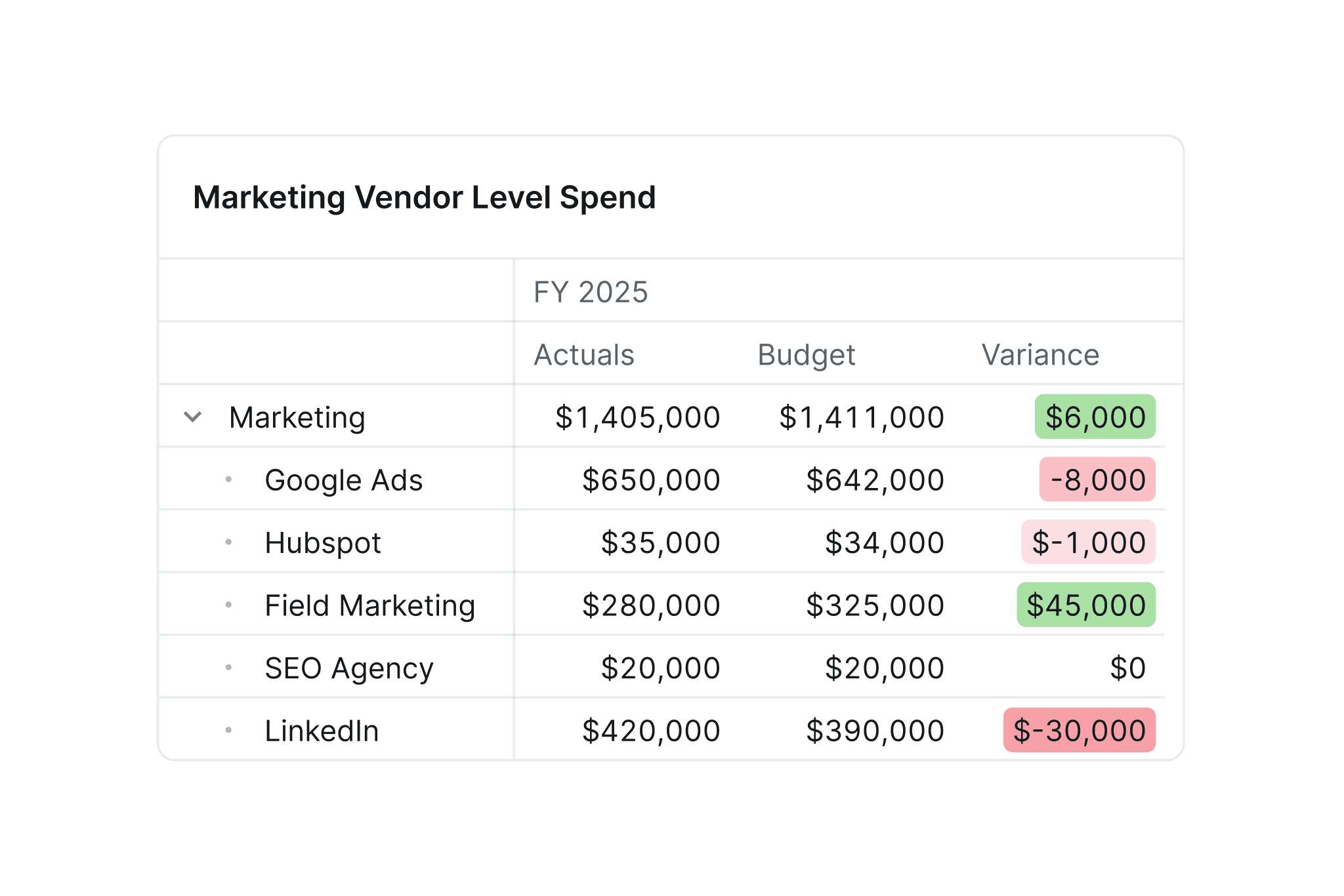

Dimensional granularity

Adjust the level of granularity to meet your needs

Intuitive user interface

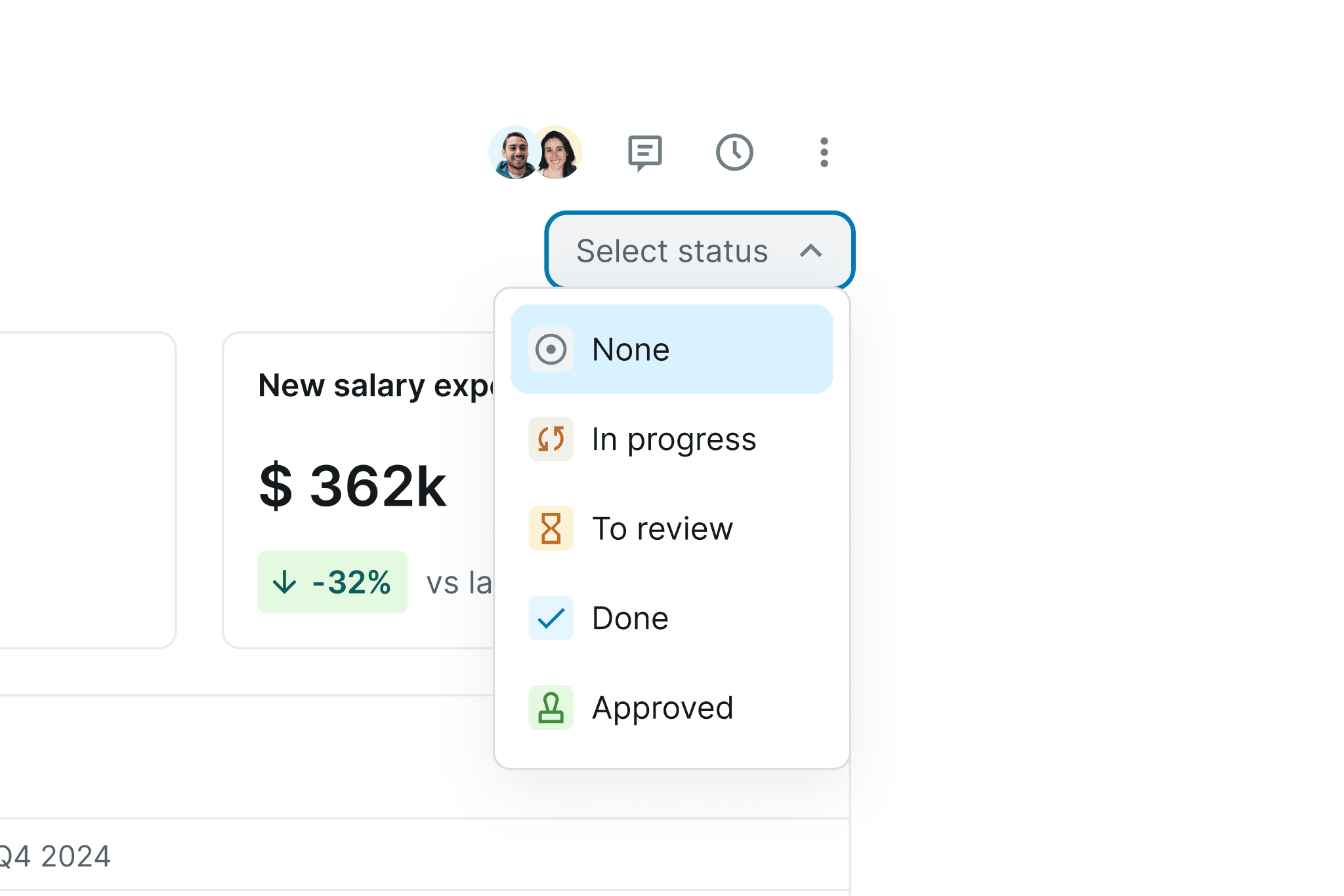

Engage stakeholders through a user-friendly tool

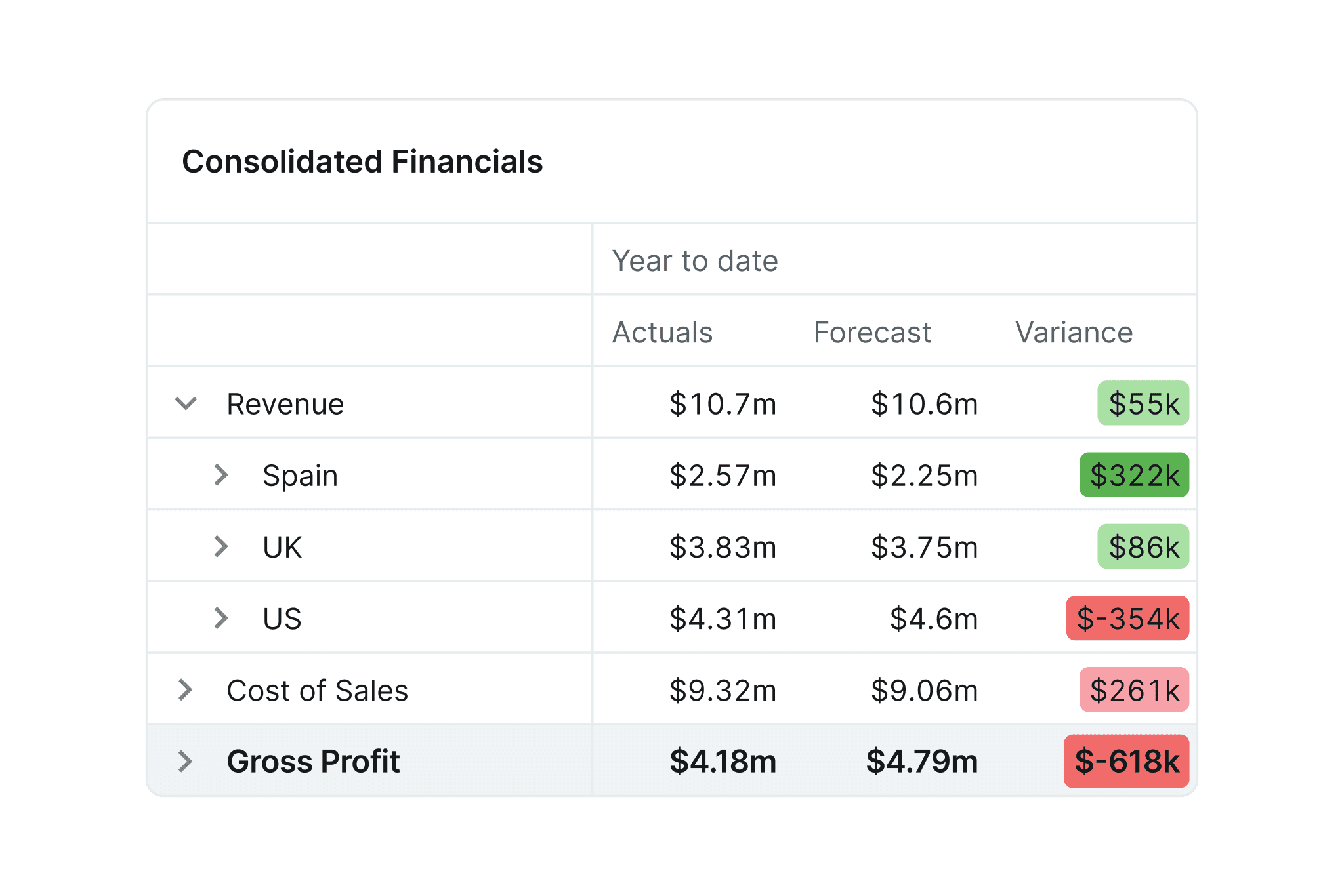

Easily manage and sync your data with one click

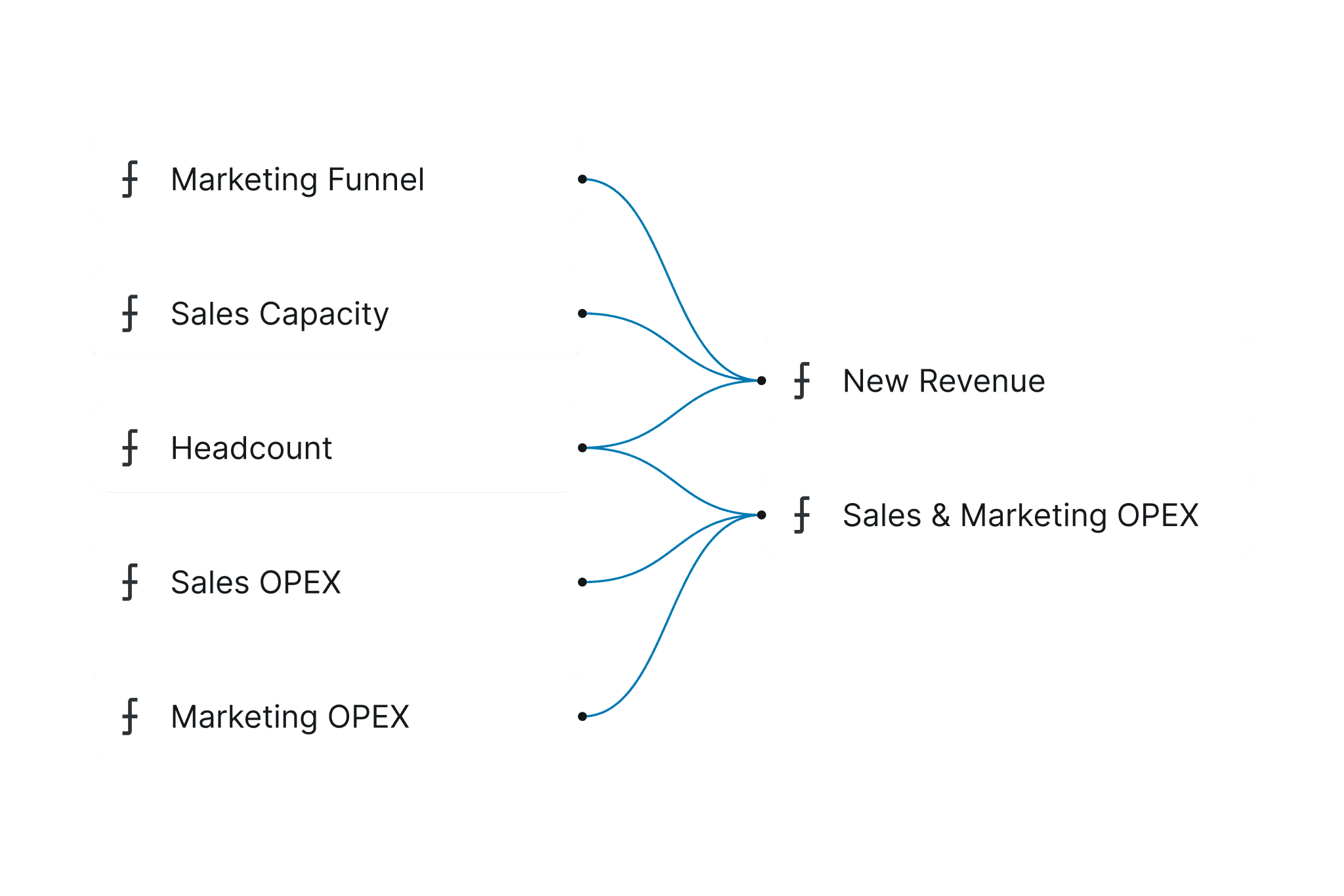

Do you have too many data source systems, making it difficult to establish a single source of truth? With Abacum’s financial planning and analysis platform, you can automatically integrate all of your business systems in a centralized location with just a few clicks. Your entire company’s information will be available for you to define variables across the whole platform, enabling you to build efficient connections between the business drivers that impact your bottom line.

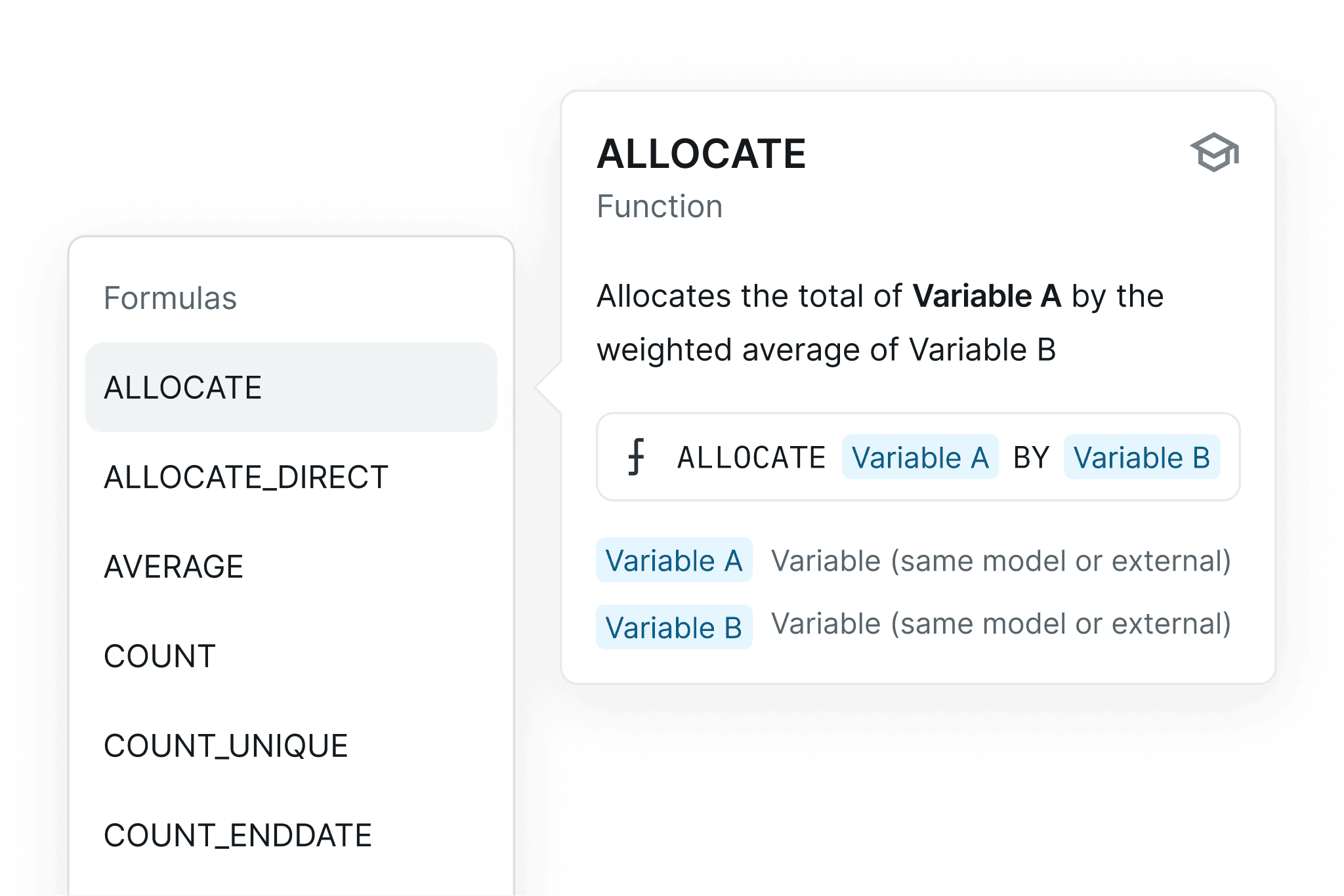

No more questions about the syntax of your model

Enhance your financial planning process by adopting Abacum, the advanced financial planning software that provides a user-friendly, unified solution that all of your business’s budget owners will love to use. By adopting Abacum, stakeholders can easily understand your company’s financial forecasts, and you will be able to prepare and share actionable insights with other department Heads, making the process more intuitive, quick, and effective than ever before.

FP&A software that makes efficiency a priority

Single source of truth

Finance leaders can optimize their operations faster than with traditional spreadsheets and keep all their business data in a single source of truth.

Attention to detail

Seamless comunication

Integrate your

|

Tableau

Stripe

Snowflake

SFTP

Salesforce

Looker

Amazon S3

BigQuery

Chargebee

Google Drive

Google Sheets

Hubspot

Get the most out of your data with Abacum

Abacum’s streamlined workflows enabled us to identify cost savings of up to 25% in key departments, driving tangible business value.

Alexander Moll

Head of FP&A at DCI

The ability to manage multiple scenarios simultaneously is a game-changer. We can save historical versions, analyze assumptions, and learn from them to make better decisions.

Márton Bódis

FP&A Manager at Antavo

The forecasting period was reduced from 2 months to 3 weeks thanks to Abacum. Helping us save time but also reduce our OPEX spend.

Geoffroy de Bouvier

Head of Finance at Kenjo

FAQ

What is Financial Planning and Analysis (FP&A)?

What is an FP&A software?

FP&A and Finance: What is the difference between them?

What are the advantages of FP&A software?

Can you use spreadsheets for FP&A?

How to choose the best FP&A platform?

Why is extended planning and analysis a necessity for SMBs organizations?

How does financial planning software automate processes?

For all the decisions you need to make.

Use cases