Unlock the power of connected planning

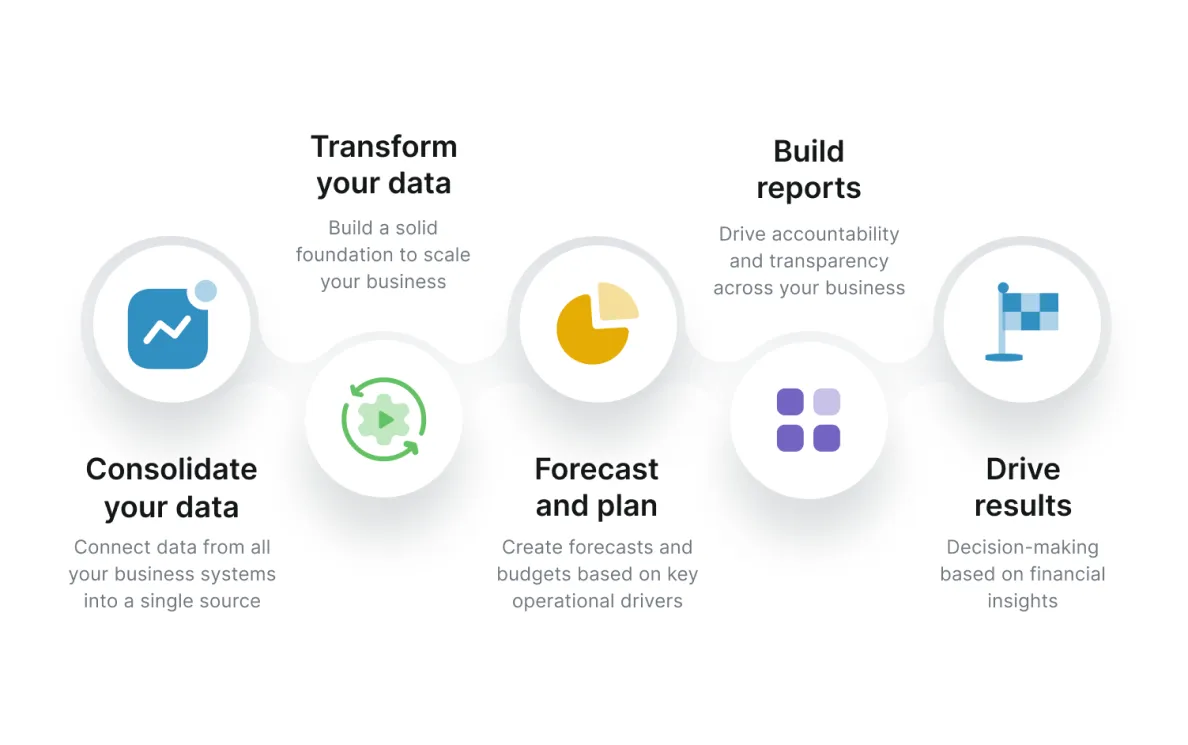

Revolutionize your financial planning and analysis software Say goodbye to tedious tasks and hello to actionable insights that drive your business forward. Our advanced integration and collaboration capabilities empower you and your team to take a proactive approach to budgeting, forecasting, and business execution.

FINANCE DEPARTMENTS THAT MAKE BETTER STRATEGIC DECISIONS WITH ABACUM

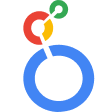

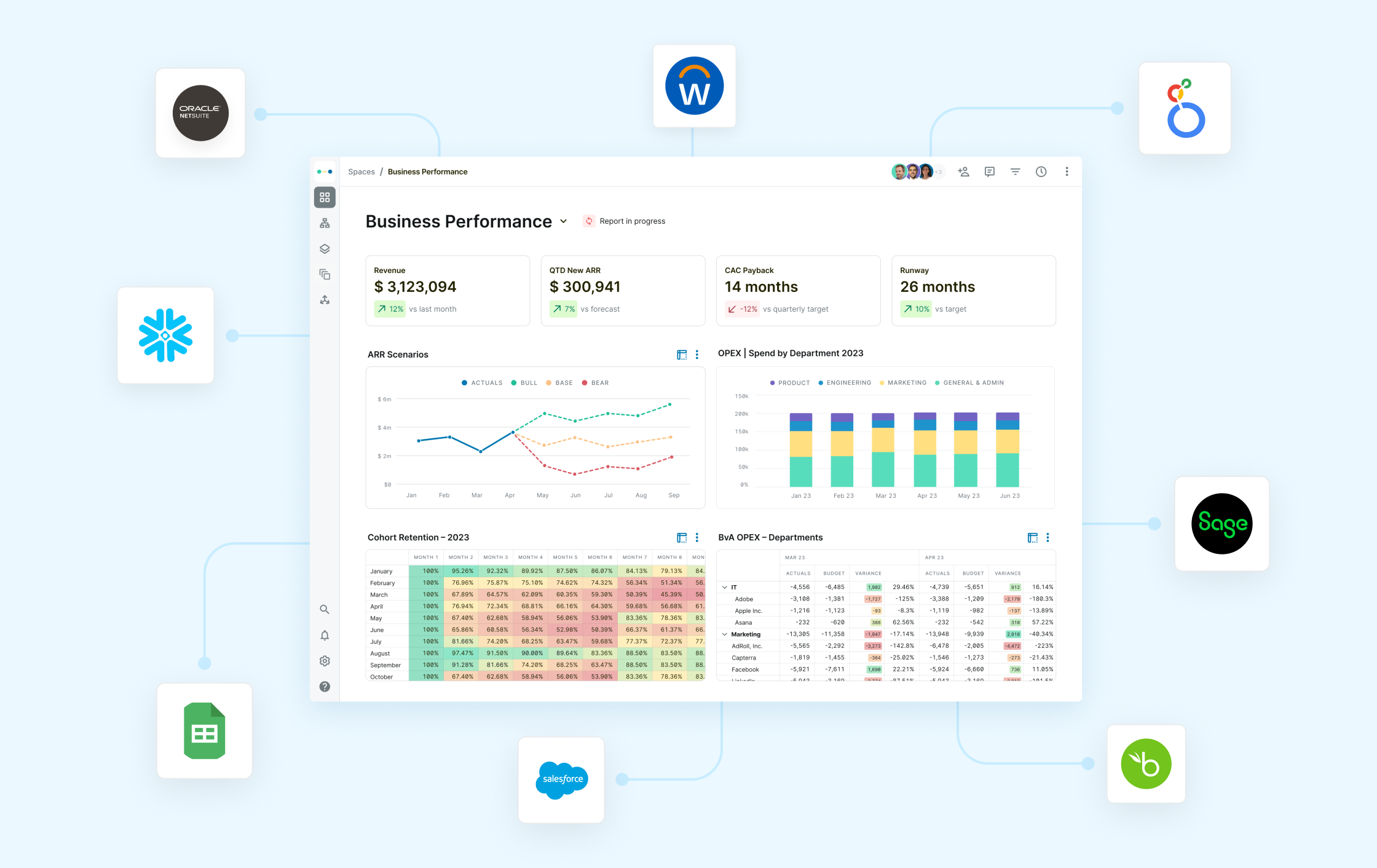

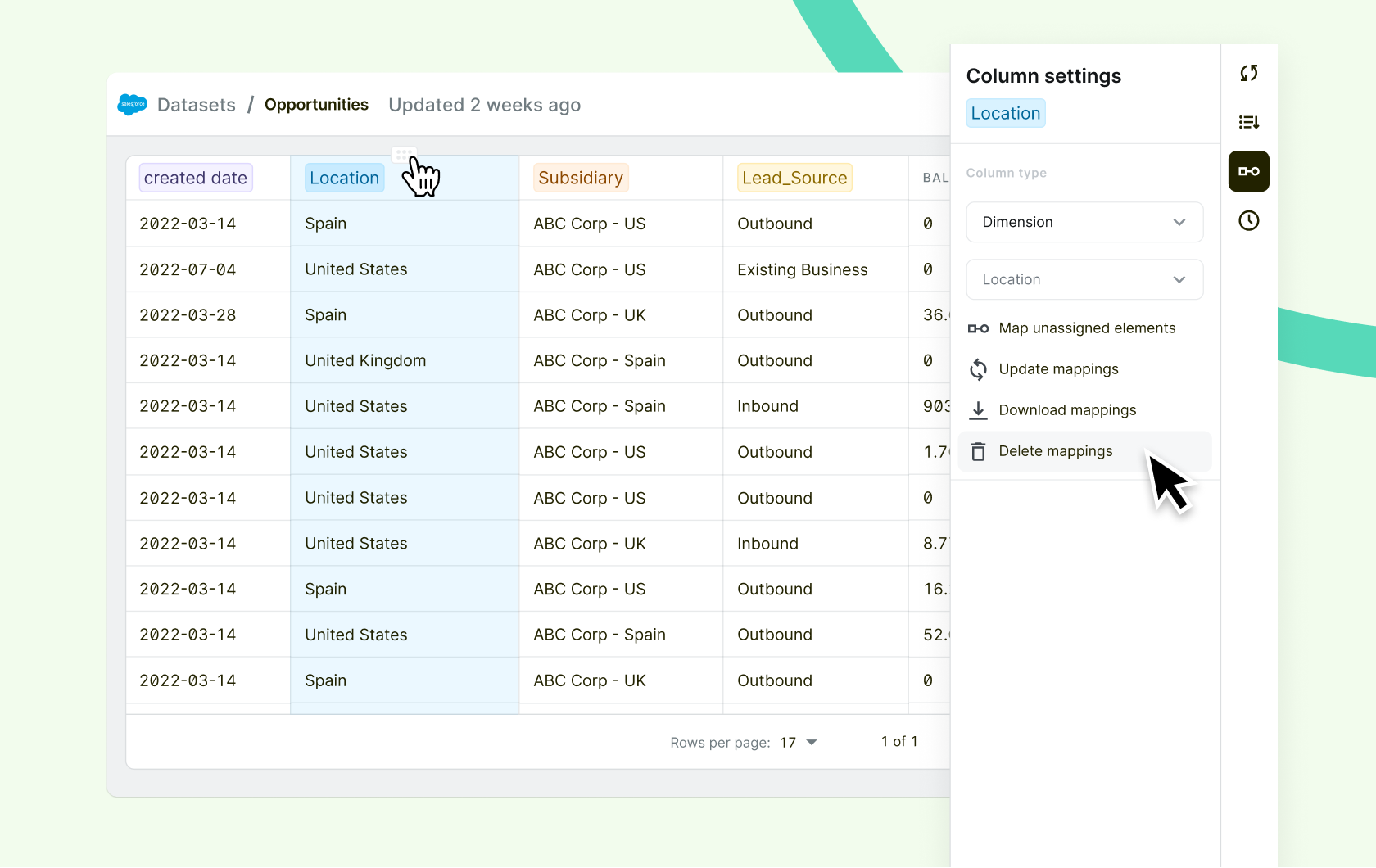

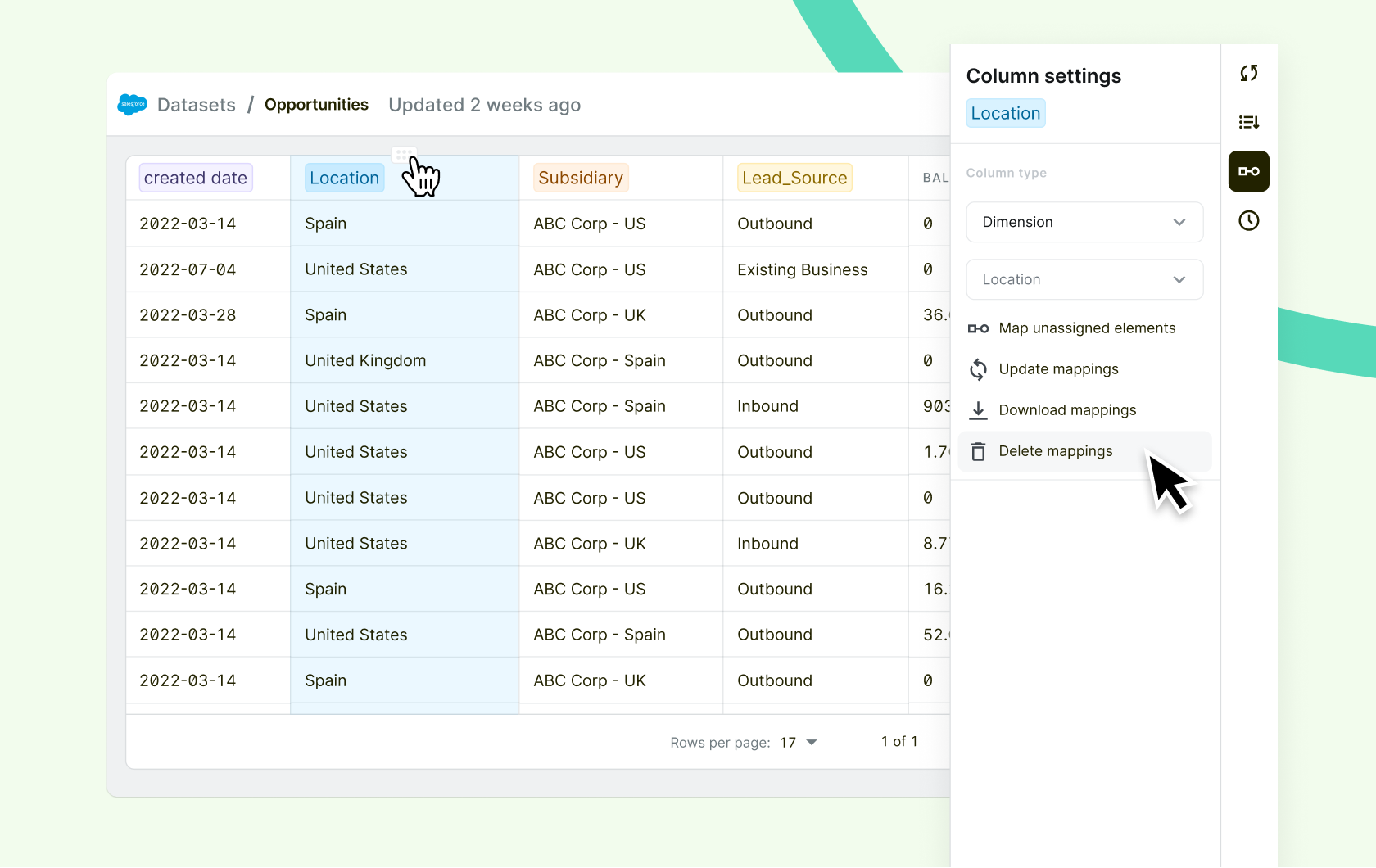

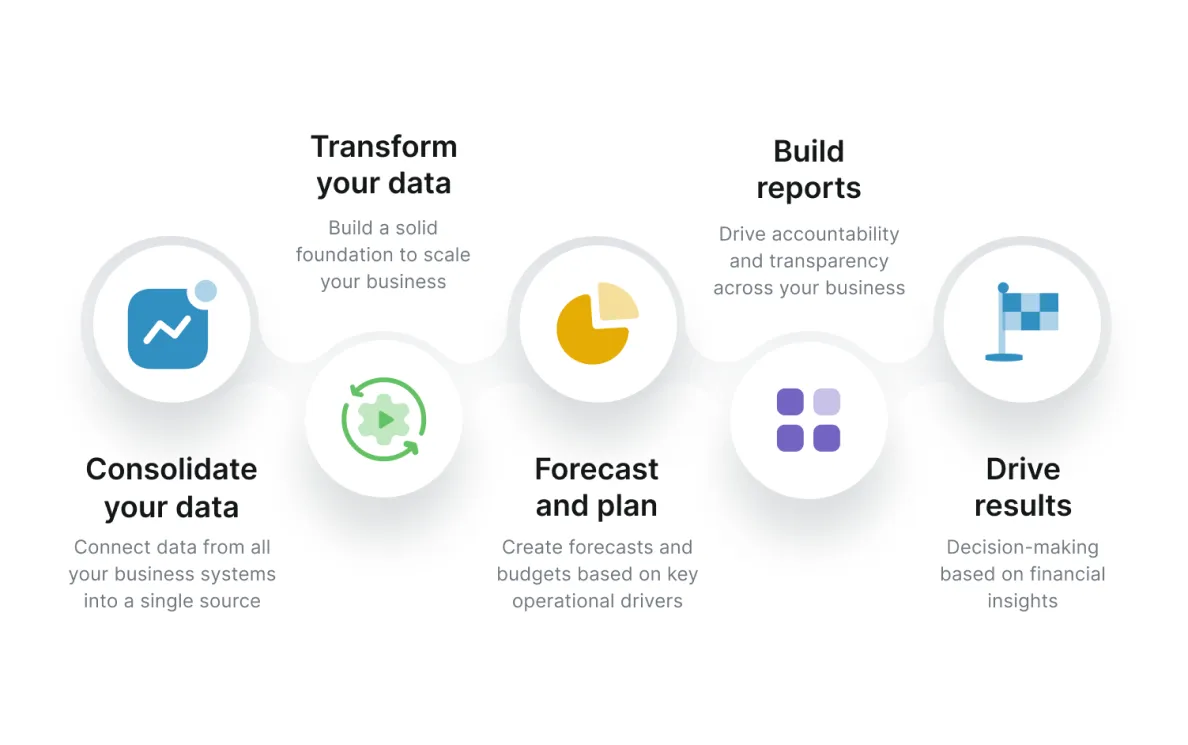

Easily manage and sync your data with one click

Are you struggling to keep all of your business data clean and finding it burdensome to manually copy and paste during your consolidation process? Abacum’s seamless integrations centralize all your business’s data sources in a single location, setting your entire company up for success. With Abacum, you can easily define global variables to optimize key driver connections and boost corporate performance. By having a central place where the definitions are clearly defined, you will ensure that all functional leaders have access to the same information.

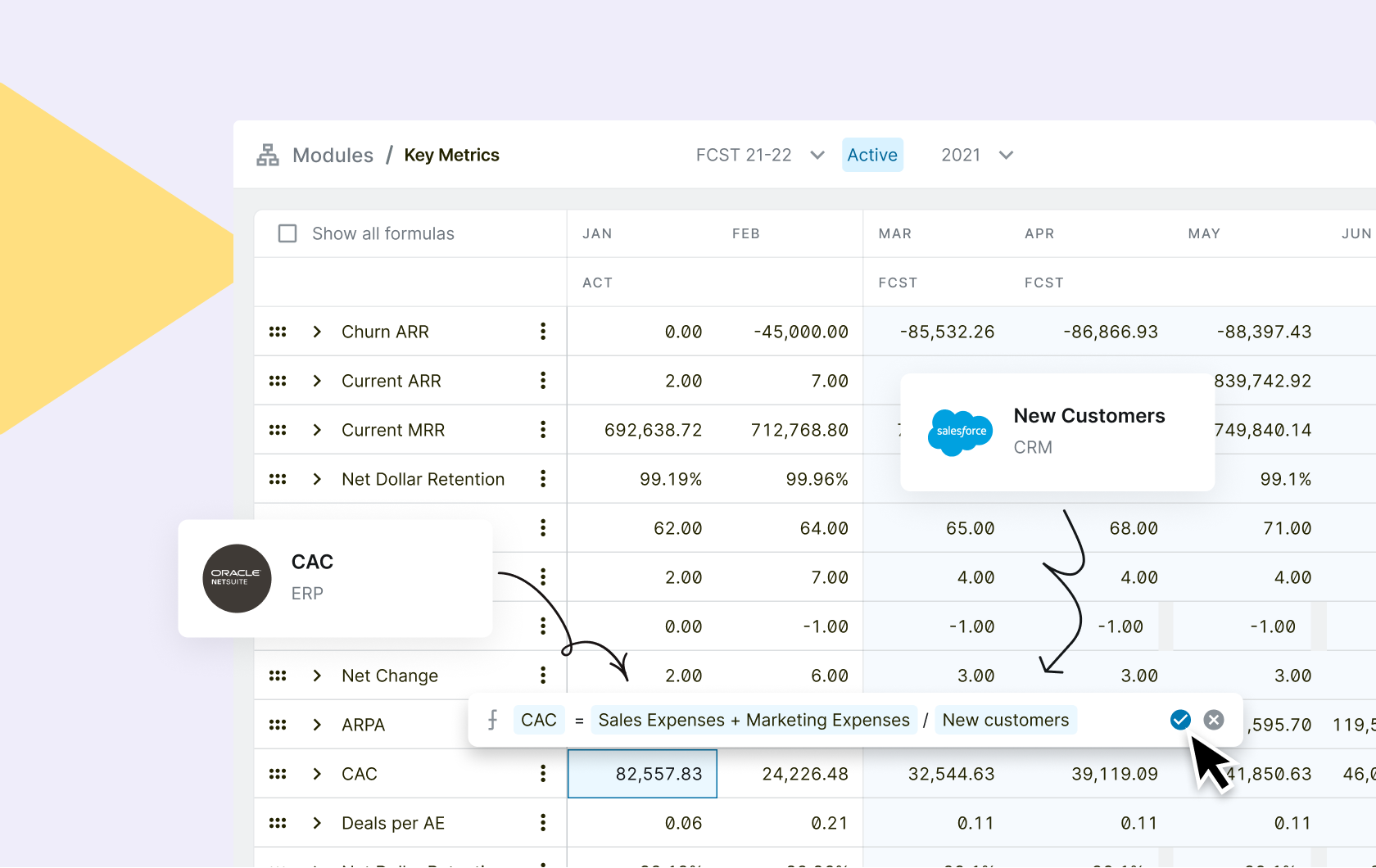

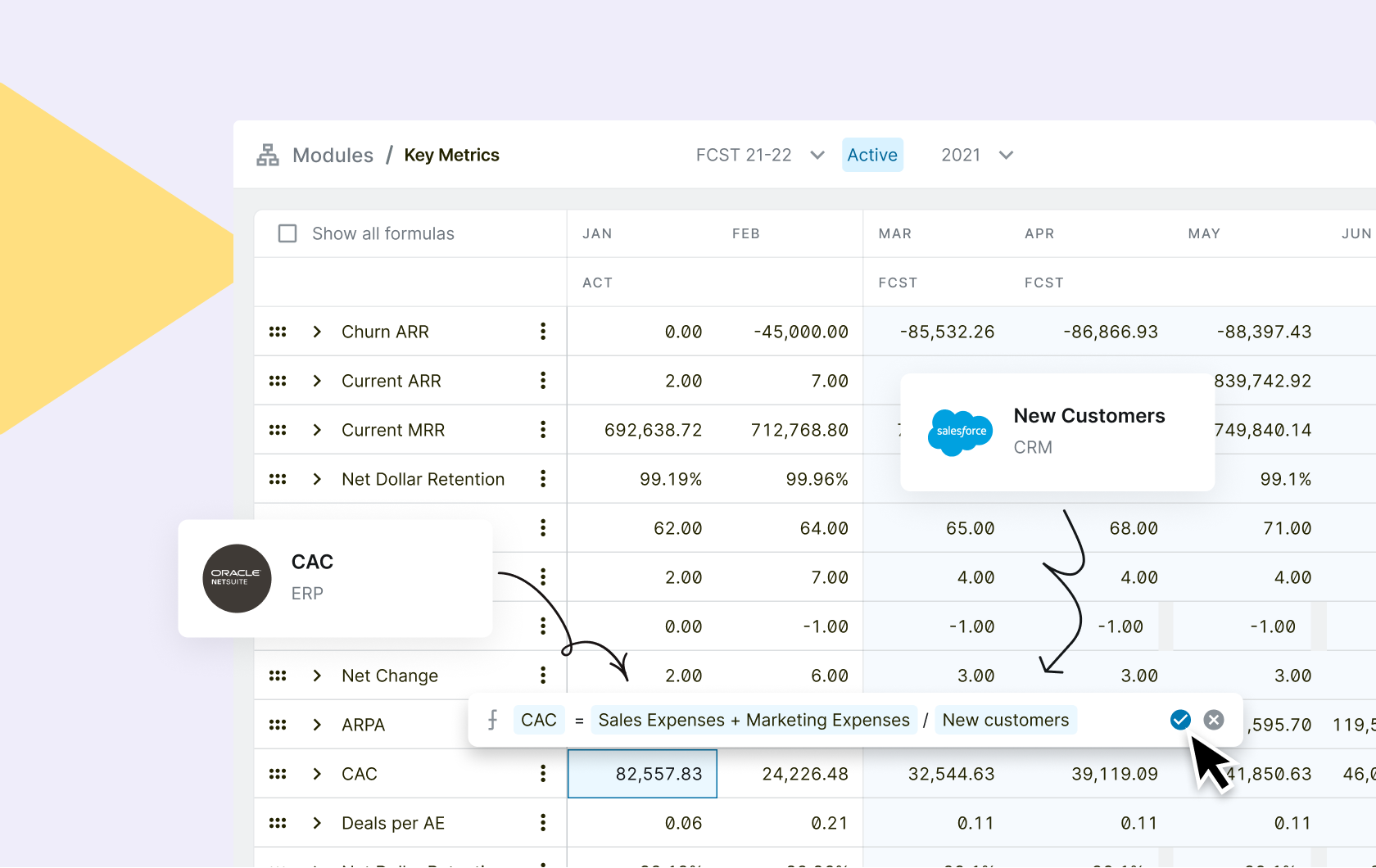

Aim for both, precision and accuracy in financial modeling

When it comes to effectively analyzing a business’s financial future, spreadsheets are no longer the preferred choice. While they are still a valid option, they are not dynamic enough for today’s fast-paced environment. Fortunately, financial planning and analysis software like Abacum enable precise and accurate projections by allowing dimensional level modeling. By consolidating and cleaning all your business data in a centralized location, Abacum can help you streamline the forecasting process, obtain detailed results in no time and plan ahead based on reliable numbers.

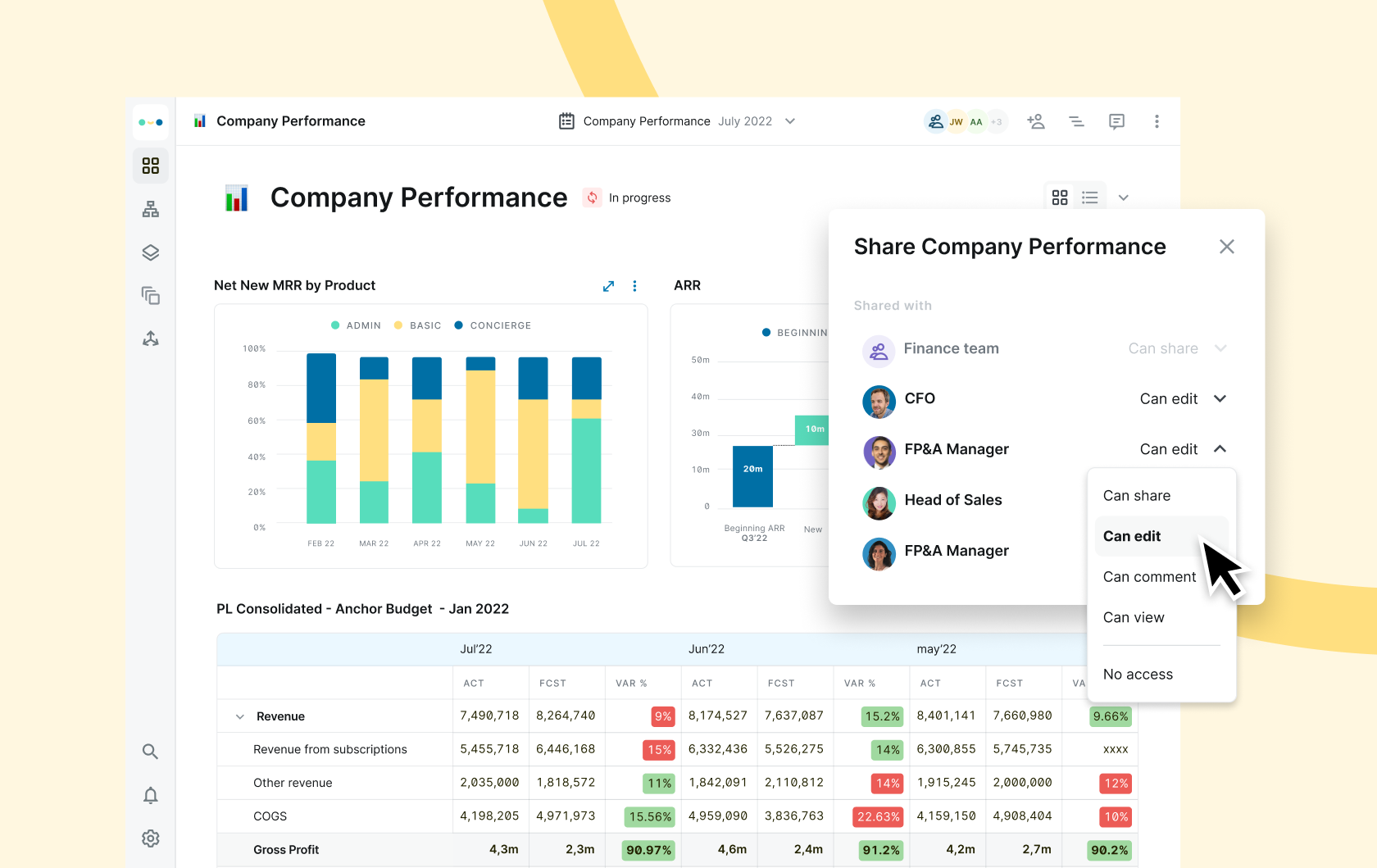

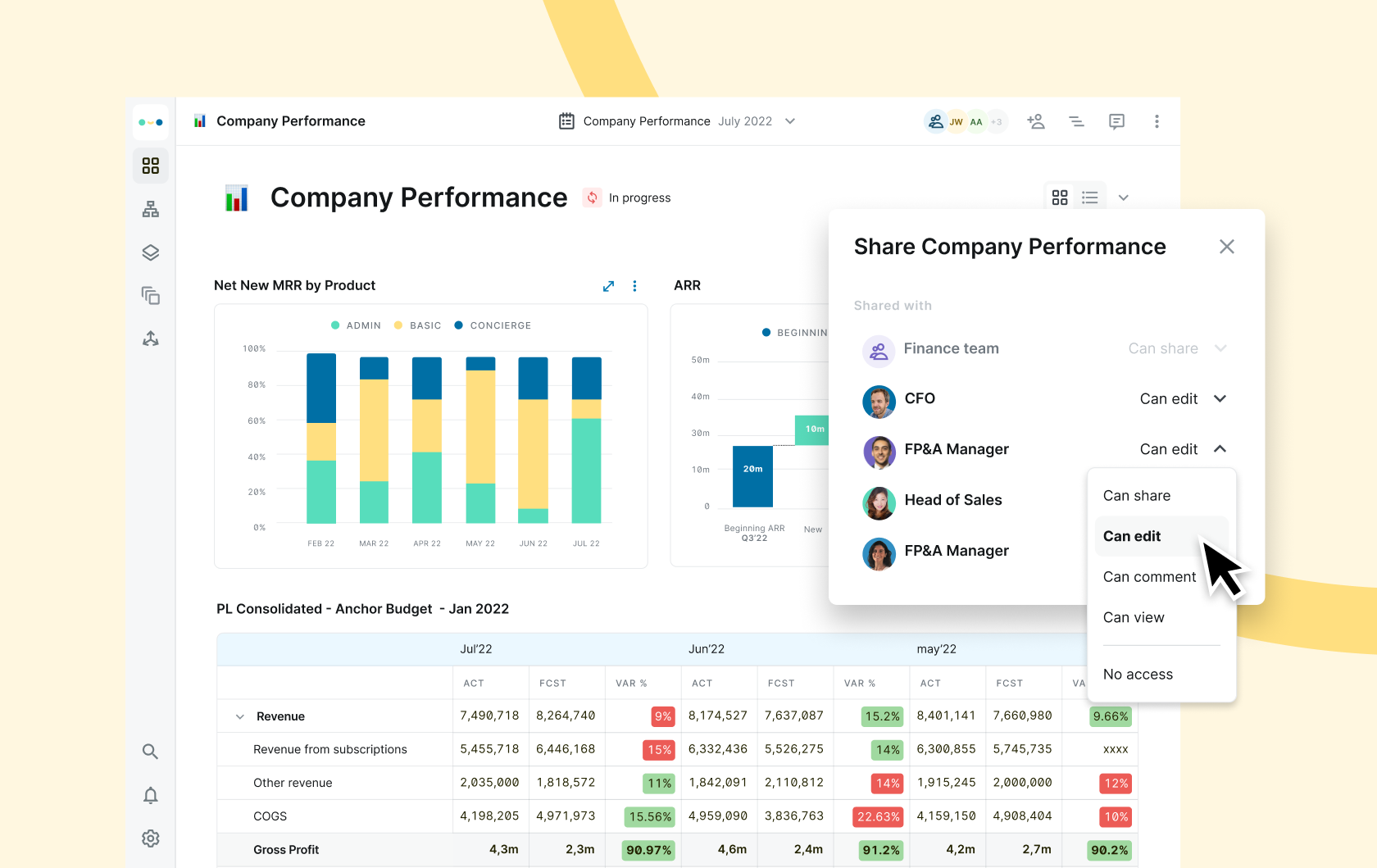

Harmonize financial collaboration: Get everyone on the same page

Abacum is a comprehensive and powerful business planning software that caters to all your financial planning and analysis needs. With its intuitive user interface and features for collaboration and visualization, Abacum enables all your budget owners to easily understand and interpret complex financial data. It offers a finance workspace that is easy to use for everyone, promoting transparency and collaboration, and empowering senior management to have meaningful and informed conversations.

Financial reports now skip spreadsheets

FP&A software has transformed financial analysis by providing a centralized platform for more accurate and efficient financial consolidation. Abacum’s automation and data validation features can help you save time to focus on what really matters and improve accuracy. With Abacum, you can deliver actionable insights in a visually engaging format that all stakeholders can understand. Don’t get left behind in the spreadsheet dark ages!

As many integrations as your business needs

Abacum breaks down data barriers and empowers businesses to analyze and consolidate information from any source system with ease.

Xero

Tableau

Salesforce

Faster implementation

Consolidate all your business data in one source of truth

Accurate level of data detail

Dimensional level of granularity to make informed decisions

User-friendly interface

Your stakeholders will have a clear and comprehensive view of the numbers

Ready to take your business to the next level?

Tired of working through spreadsheets to keep your finance team up to speed? Abacum is here to save your day! Our FP&A software increases efficiency in real-time, turning your finance leaders into the ultimate optimization heroes. It provides a single source of truth for all the details you need to make accurate and precise financial decisions. Plus, its easy-to-use interface and syntax make cross-departmental collaboration easy, even for non-financial stakeholders. Get everyone on the same page and working towards the same goals with Abacum, and unleash the potential of your team.

Stay ahead of the future with Abacum

Join our finance heroes community and share your story.

Pablo L.

CFO

“Abacum is very helpful if you are looking for a collaborative financial planning and analysis tool that helps you with your budget preparation, variance analysis and reporting processes.”

Mid-Market (51-1000)

Juan Carlos R.

VP of Finance

“The tool does not replace a FP&A person but it complements really well with their responsibilities. It has helped us automate a lot of the financial reports and reduce the preparation time.”

Mid-Market (51-1000)

Francesc M.

CFO

“Abacum has allowed us to reduce the time it took to report to our management team and do easy modeling and forecasting, using all the information that is automatically updated into the platform.”

Mid-Market (51-1000)

Still have questions? We’ve got answers.

What is financial planning and analysis?

Financial planning and analysis is a business practice used by organizations to analyze the financial performance of their operations and develop accurate plans to ensure future profitability. It serves as a critical tool for strategic planning and decision-making.

Typically, FP&A includes activities such as financial budgeting, accurate forecasting, trend analysis, sensitivity analysis, cost control, benchmarking, and business modeling. These activities inform business decisions regarding investments, strategic partnerships, and other financial initiatives.

What is the difference between FP&A and Finance?

Financial Planning and Analysis is the process of developing financial plans, budgets, and forecasts to guide the direction of an organization. It involves gathering and analyzing data on past performance and trends as well as forecasting future business performance. FP&A’s main role is to provide the necessary information and insights to allow senior management, investors, and other stakeholders to make sound financial decisions.

Finance, on the other hand, is a broad term used to describe activities related to managing money. It includes activities such as budgeting, forecasting, financial reporting and analysis, taxation, debt management, investments, and acquisitions. It is responsible for ensuring that the organization has sufficient funds to meet its obligations and reach its financial goals.

How can you do financial planning and analysis?

Financial planning and analysis is the process of preparing accurate, timely financial projections and analyzing business performance to make sound financial decisions. FP&A includes forecasting, budgeting, analyzing current-period results, and assessing the impact of business drivers on future performance. It also involves developing key performance indicators (KPIs) to measure progress against business goals.

The first step in FP&A is to develop an understanding of the current financial situation. This involves analyzing past performance, developing financial projections, and assessing trends. Once the current situation has been understood, strategic plans can be developed to achieve the desired results. These plans typically include budgeting, forecasting, and business modeling, and these should be used in combination with KPIs to help track progress toward financial goals. Finally, financial performance should be regularly monitored and analyzed to identify potential problems and opportunities.

How can ERP systems be utilized for effective financial planning?

Effective financial planning and analysis can be achieved with the help of ERP systems – such as Netsuite Oracle, Quickbooks, Sage Intacct, or Xero -, which offer significant value to organizations. Through the integration of financial data from various departments and functions, these systems create a centralized database that enables the identification of trends and informed decision-making.

In addition to this, automation of financial processes can reduce errors and save time, allowing finance professionals to concentrate on more strategic activities like financial analysis and planning. When integrated with FP&A tools such as Abacum, ERP systems enable organizations to plan and manage their finances more effectively. Customizable financial reports generated by these systems help analyze performance, identify improvement areas, and track progress towards financial goals.

Why is extended planning and analysis a necessity for SMBs organizations?

Small and medium-sized businesses (SMBs) rely on making decisions based on data to remain competitive and sustain growth. This implies that they must not only concentrate on short-term results, but also consider long-term planning and analysis of their business. The process of extended planning and analysis helps SMBs assess their current situation, anticipate future events, identify opportunities and threats, set objectives, and establish strategies.

To guarantee success, SMBs should evaluate the efficiency of their existing financial planning and analysis (FP&A) processes. This may involve reviewing and auditing the current financial plans, budgets, and forecasts to pinpoint areas where improvements can be made. Additionally, SMBs should review their key performance indicators (KPIs) to ensure that they are measuring the appropriate information that can provide meaningful insights into their performance. SMBs should also consider investing in financial planning and analysis software to gain more profound insights into their operations and create more precise forecasts.

How does financial planning software automate processes?

Financial planning software automates processes by streamlining data entry, tracking financial information, and providing insights into an organization’s current financial status. It automates the process of entering income, expenses, and other related data into a business system for review and analysis. This allows users to quickly compile financial records and generate financial reports in real-time, as well as track changes in data over time.

Financial planning and analysis software also automates the process of budgeting, allowing users to easily set up plans and track progress toward goals. It can also be used to quickly generate forecasts and projections based on current data. This helps organizations identify opportunities and create strategies for future success.