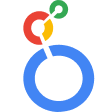

Prepare for the unexpected with scenario planning software

Anticipate the future and take proactive action with scenario planning software. Let Abacum help you and your Finance team forecast the impact of your strategic decisions by defining clear objectives, assigning business drivers, and setting global variables in a customizable data model.

Finance teams staying ahead with scenario planning

Stop limiting yourself. Eliminate Excel from the equation

Tired of managing large amounts of data in Excel? Worried about maintaining confidentiality within your spreadsheets? With scenario planning software, you and your team can model multiple scenarios, no matter how complex or technical the circumstances may be. With Abacum, you can eliminate time-consuming and error-prone processes, build precise and easy-to-understand scenarios, and allow all business owners to provide their input through permission-based collaboration features.

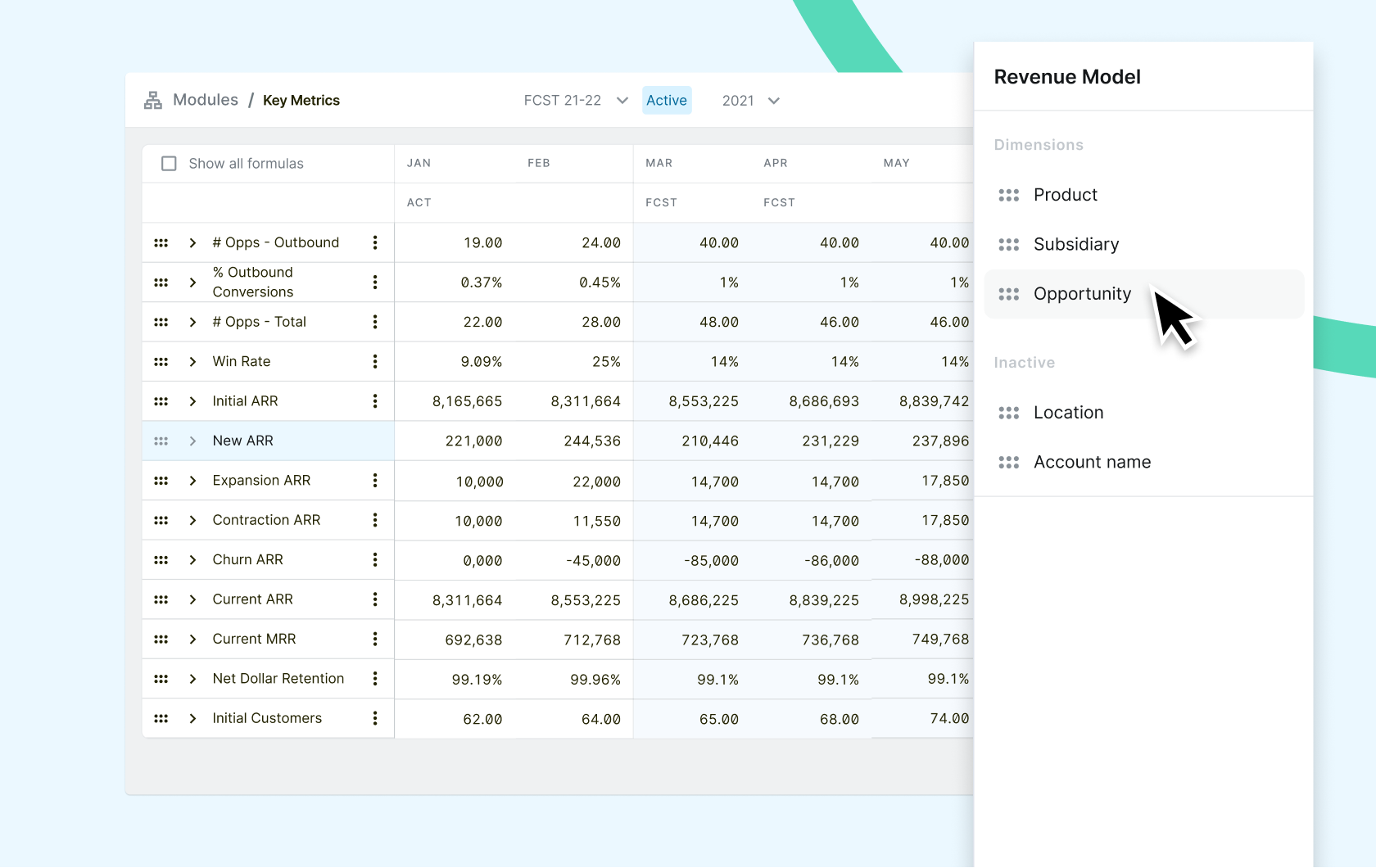

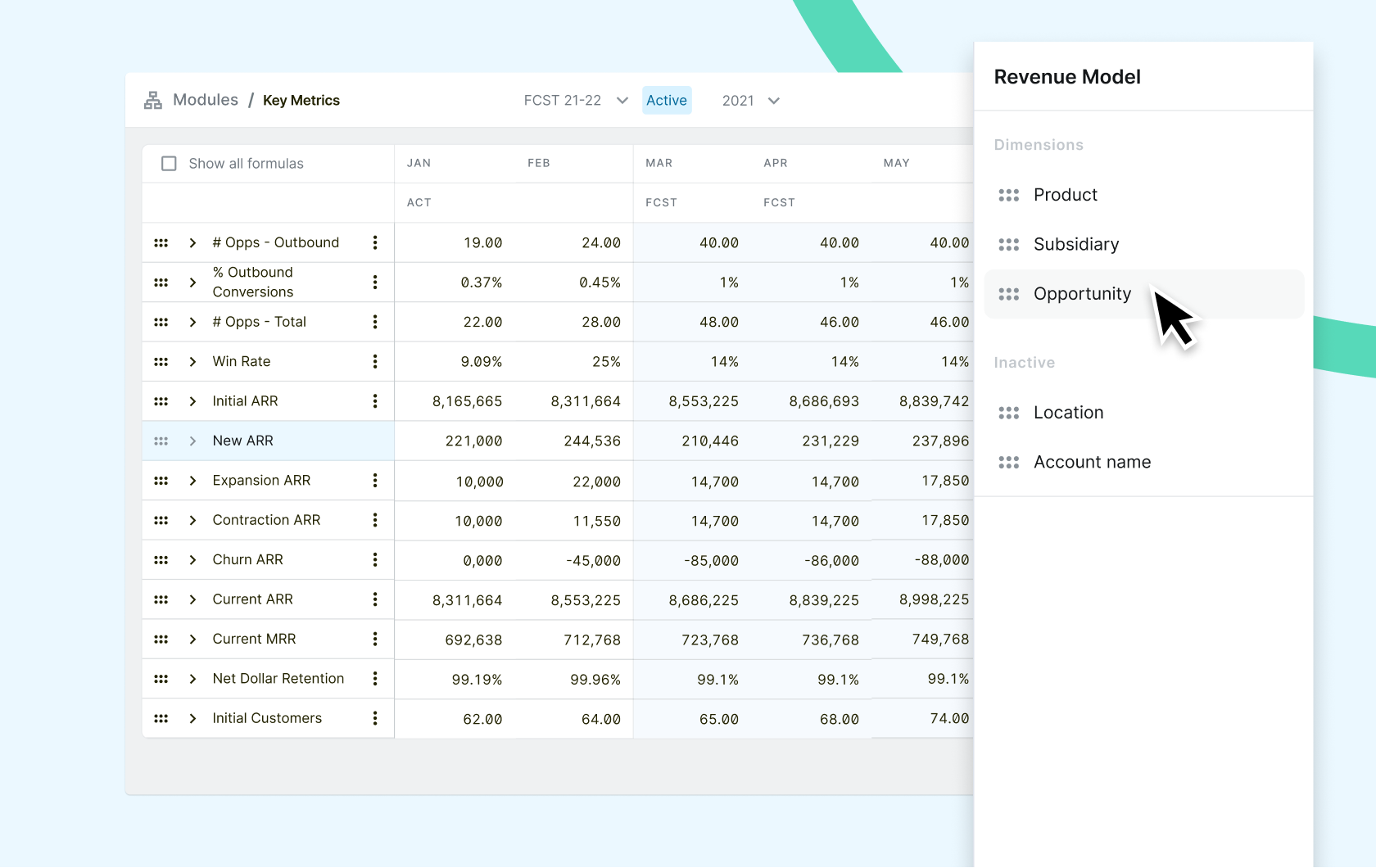

Stop making trade-offs, model with precision and accuracy

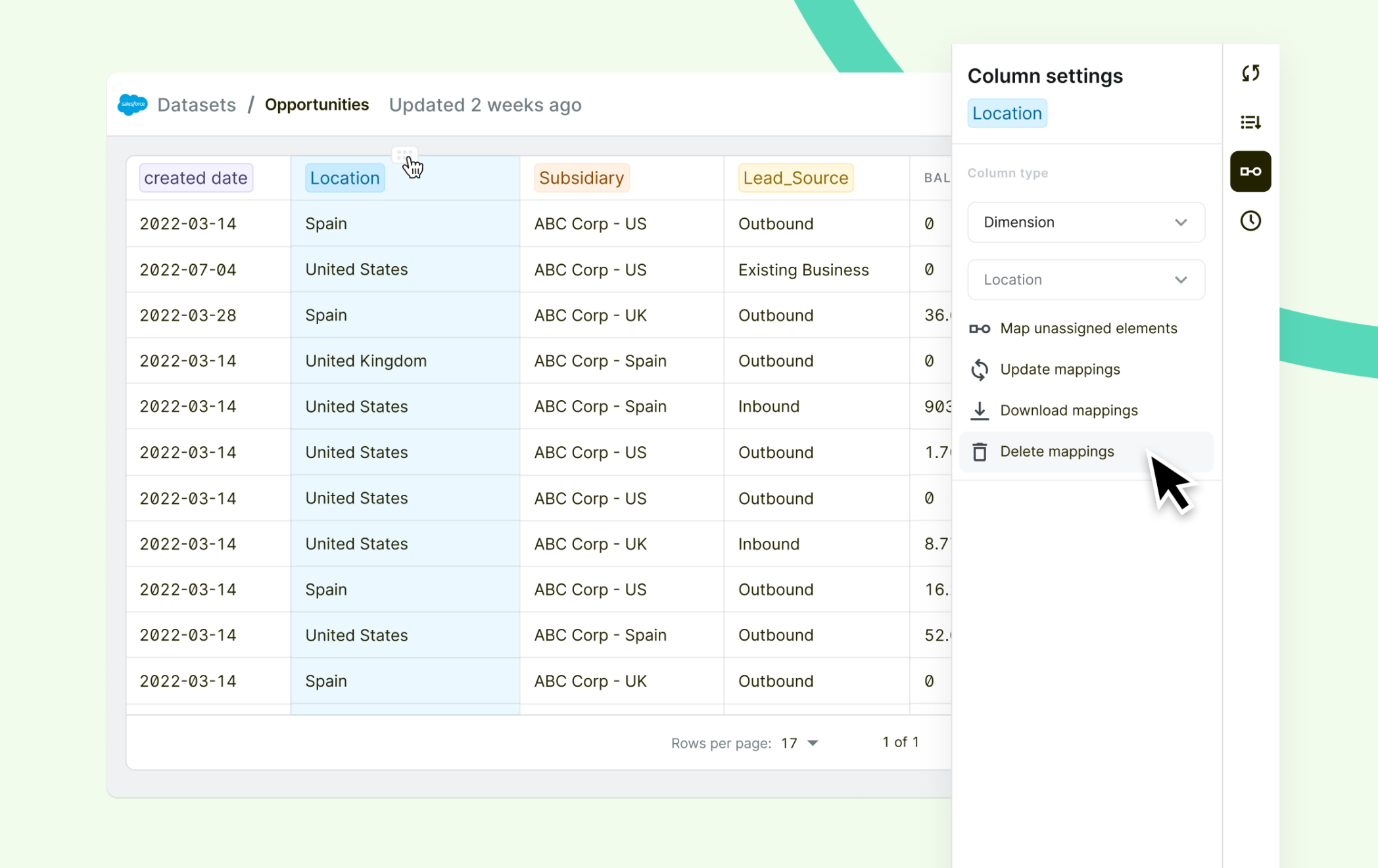

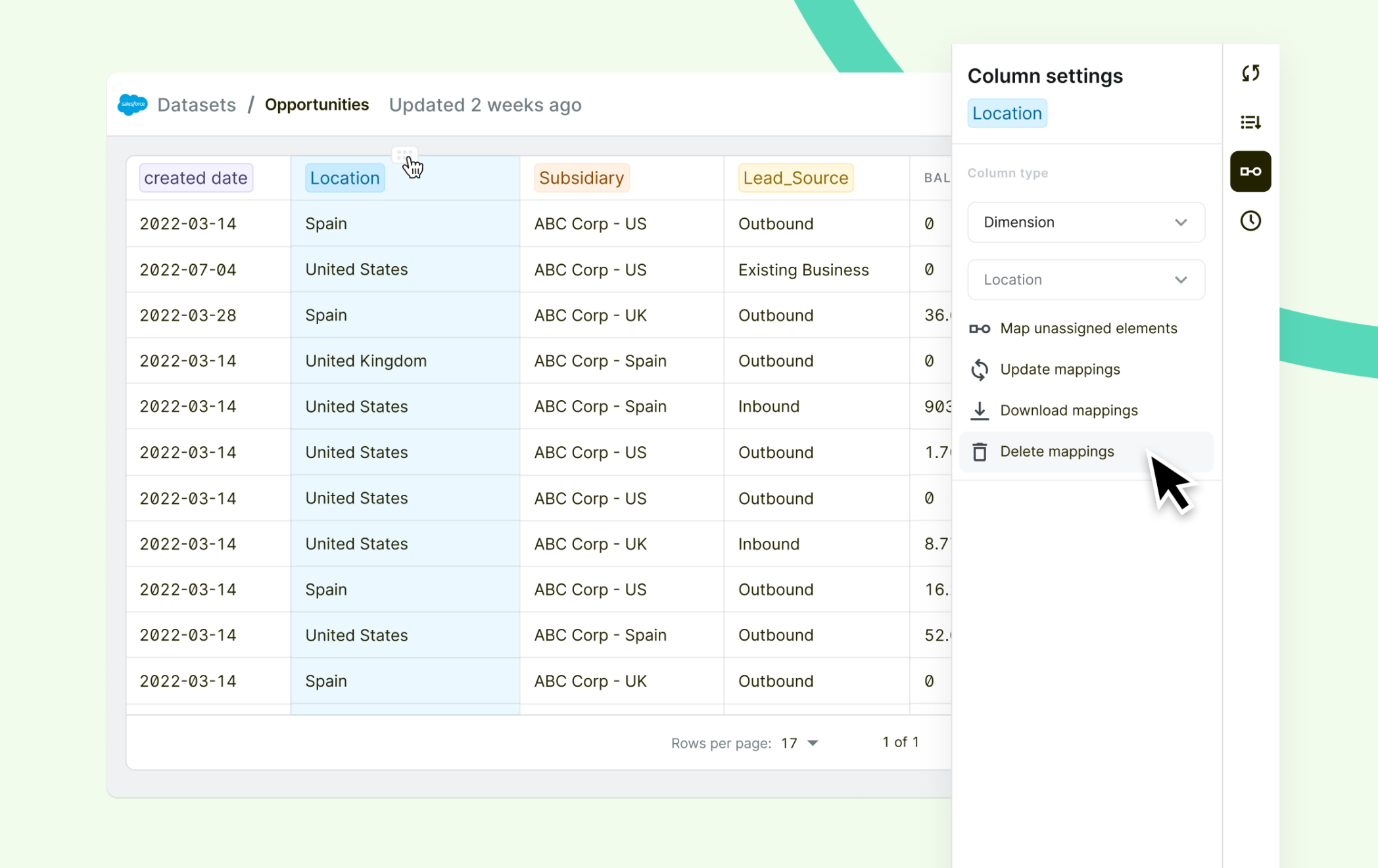

When conducting scenario planning in spreadsheets, precision and accuracy are not always compatible. The more precise you want your financial model to be, the more data you must input manually, which not only takes more time but also makes the information less up-to-date by the time you get your results. Abacum solves this issue by automatically consolidating large amounts of data into a single source of truth, allowing for precise and up-to-date scenario forecasts that take into account all available information. Leverage dimensional granularity to forecast revenues by product or expenses by vendor, unlocking more detailed and accurate visibility of your company’s future.

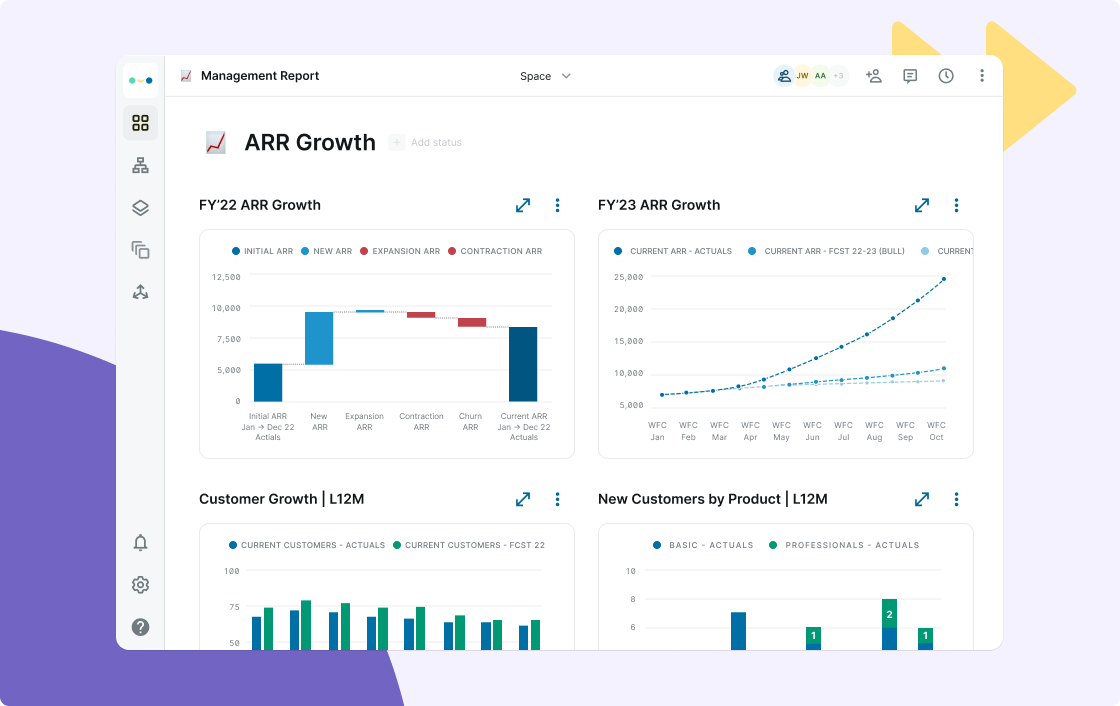

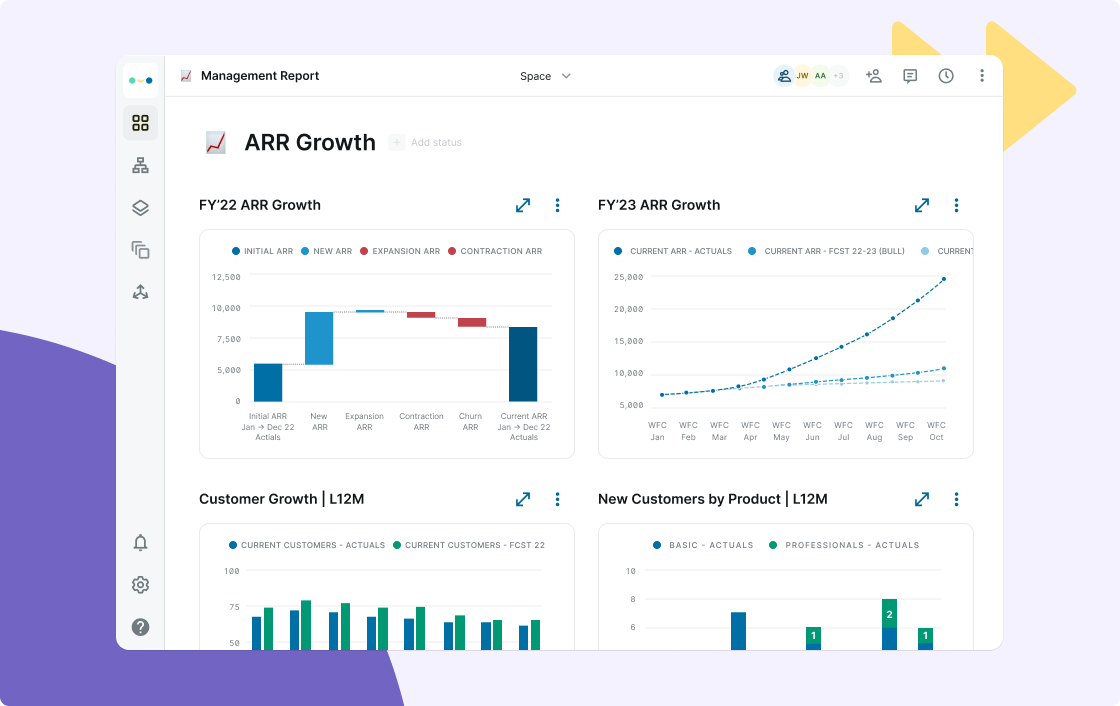

Align everyone with Abacum’s intuitive interface

You don’t have to worry about whether your strategy leaders will understand your financial forecasts. By incorporating Abacum into your tech stack, you can ensure that your scenarios are easy-to-read, thanks to its intuitive visualizations. With our scenario planning software, you can filter relevant information and leverage user-friendly visualization options to share your analyses with stakeholders from any department.

Take a holistic approach toward the uncertain future

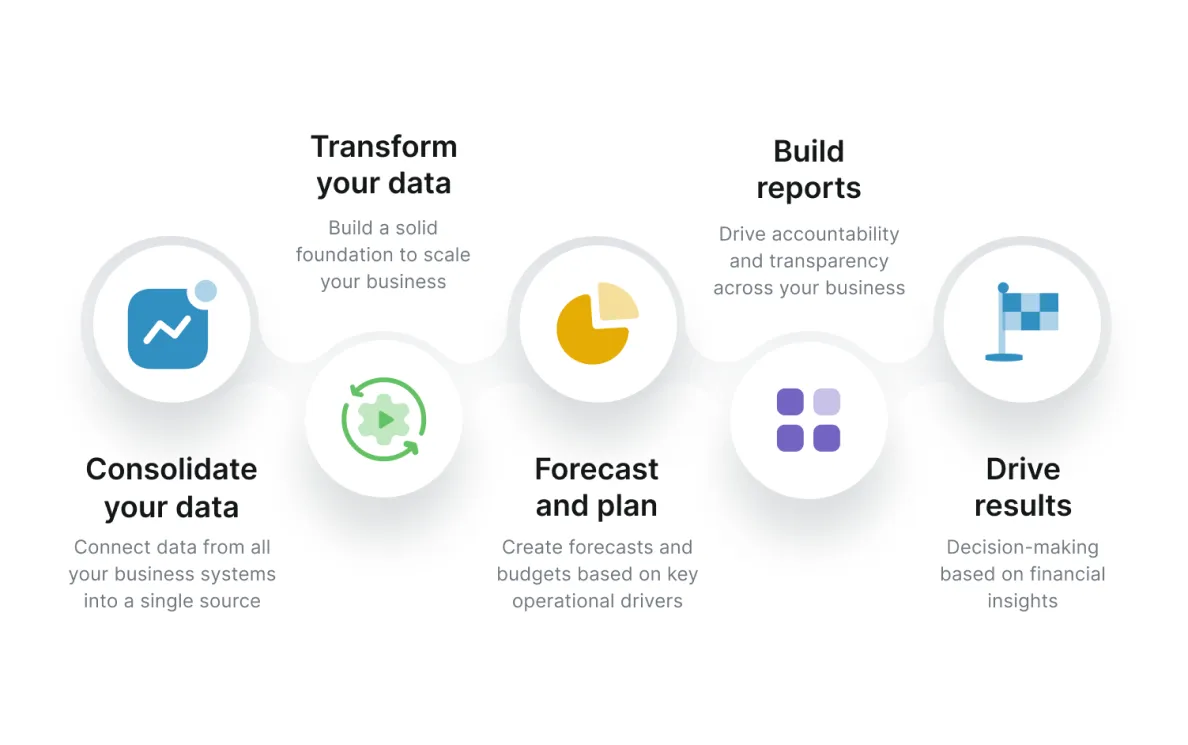

Integrating scenario planning software into your daily processes can provide detailed information on your financial health, and help you better prepare for an uncertain future. Modern technologies enable automated data gathering, input categorization from all sources, and analysis of information from all business units. The ability to quickly access relevant data will allow you to take greater ownership of your actions from a holistic perspective and make more impactful business decisions.

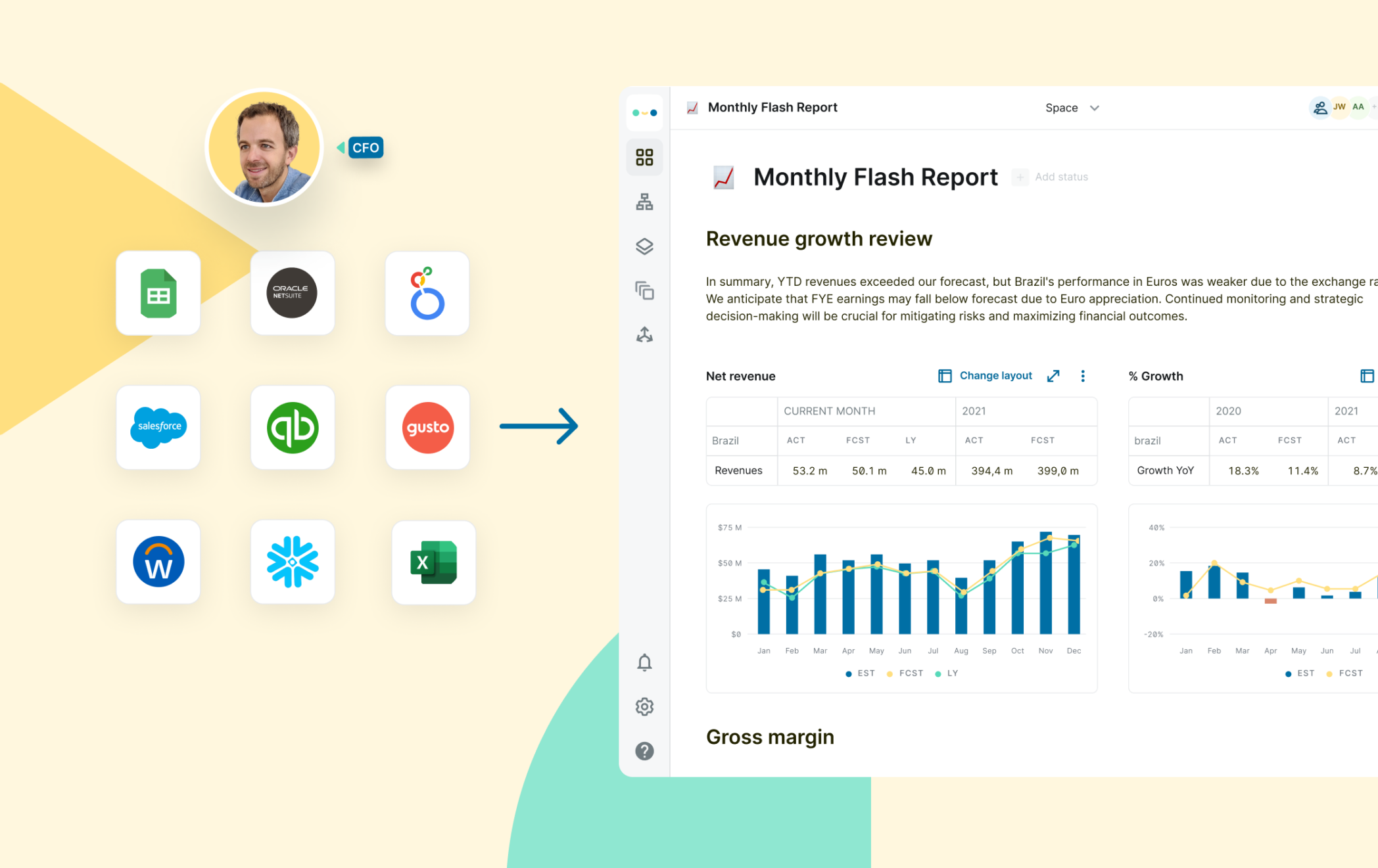

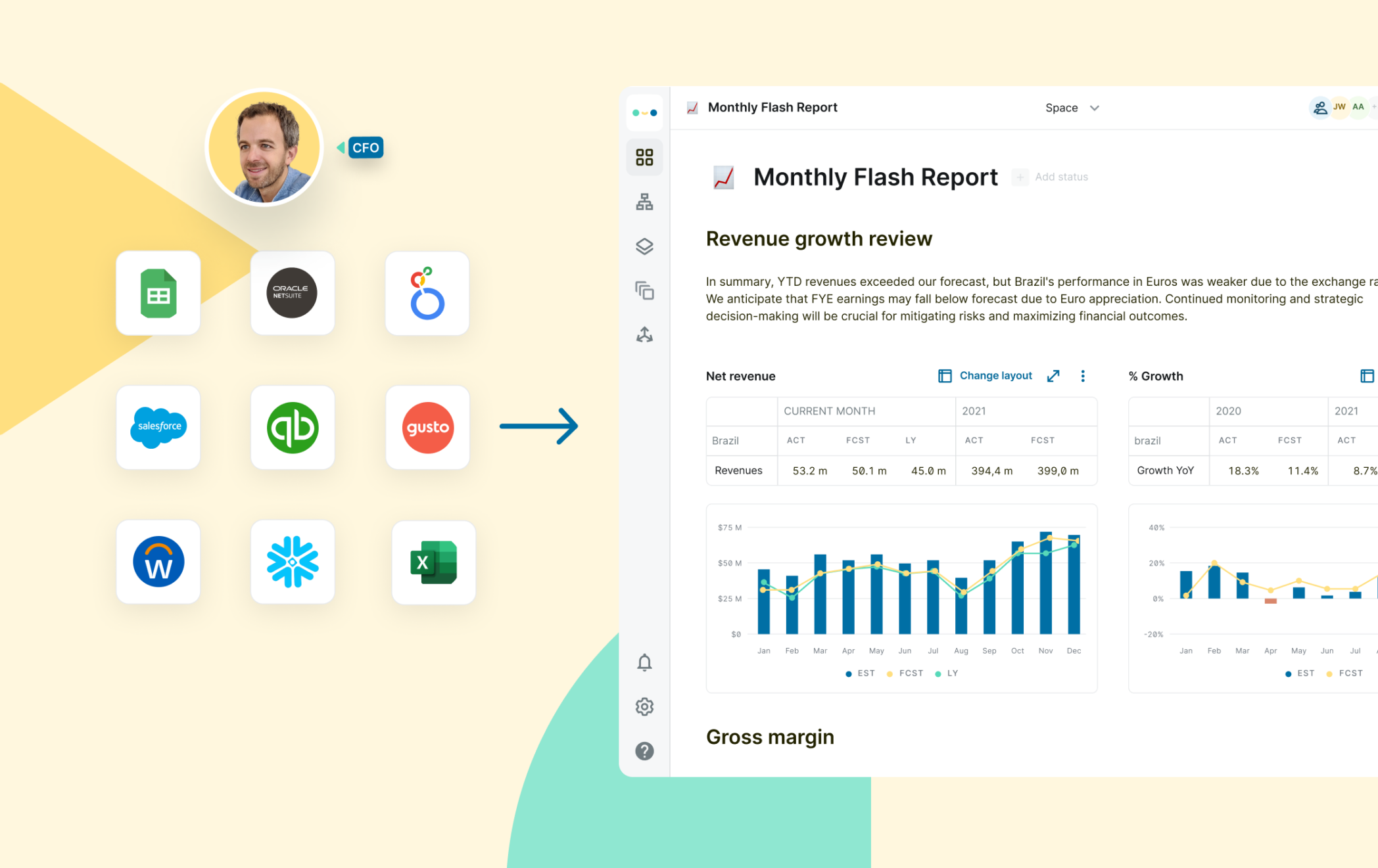

Customizable integrations to fit your unique needs

Don’t worry about software compatibility. Abacum integrates with all sources, providing real-time forecasting with a seamless experience.

Xero

Tableau

Salesforce

What sets Abacum apart from other scenario planning tools?

Integration with all sources

All of your business’s data in one SSOT

Global variables

Consistent data across the entire company

Dimensional granularity

Dimensional granularity

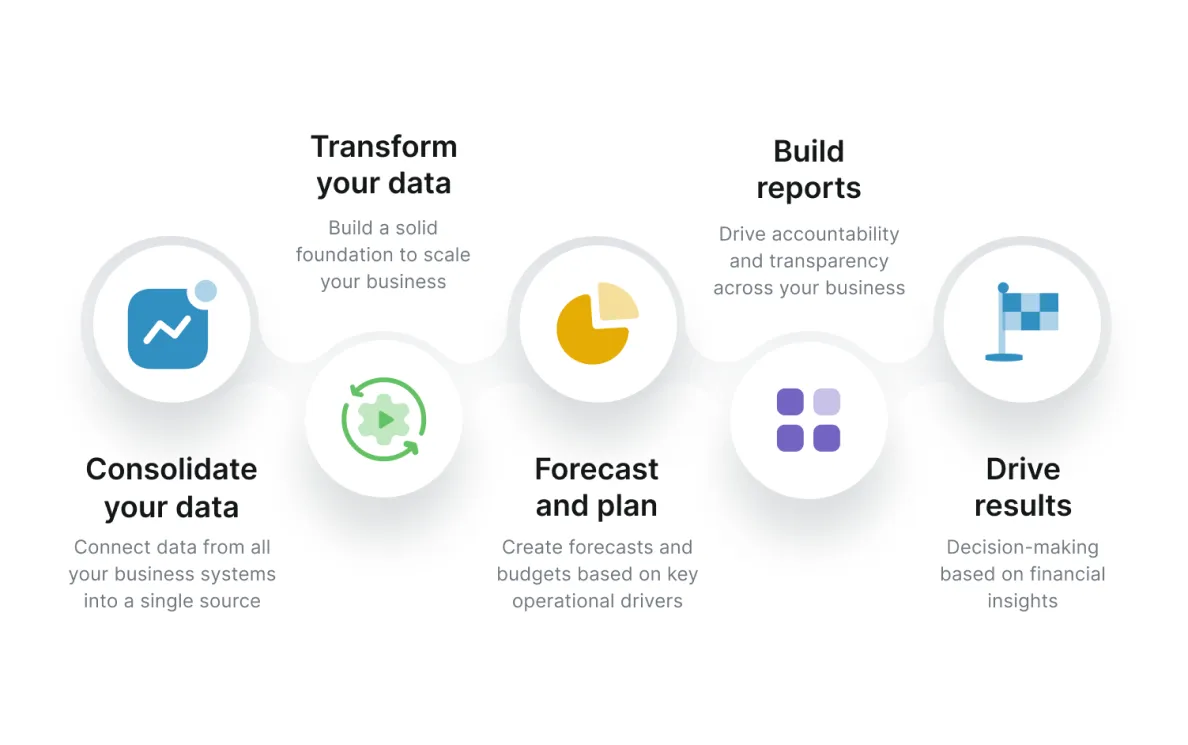

Using Abacum for scenario planning

Abacum is the business planning software for Strategic Finance leaders to drive operational performance and make informed decisions in real-time. With Abacum, you can define global variables and integrate large amounts of data from various locations into one source of truth. This enables you to model with consistent definitions and compare financial scenarios based on different key drivers and assumptions. Compared to spreadsheets, Abacum can provide you with greater granularity, enabling you to identify new growth opportunities early on, anticipate potential challenges in the coming months, and adjust your strategy to safeguard your company’s future financial position.

Ready to join our community?

Centralize all your business data and get the most out of it with Abacum.

Frederikke Norborg

Strategic Finance

“We went from budgeting in spreadsheets, to unlocking collaboration and better decisions with 30+ budget owners.”

FinTech

Javier Delgago

VP of Finance

“Communication and working cooperatively with other teams has been pivotal for us, and we do that really easily in Abacum.”

Mobility

Nerea de la Fuente

Finance Controller

“This is the future of reporting, no more Excels!”

FinTech

Still have questions? We’ve got answers.

What is scenario planning?

As a Finance leader, preparing for the future can be challenging, especially when faced with uncertainty and risk. It is for that reason that scenario planning is the go-to tool for finance teams to minimize uncertainty, by expanding the scope of their forecasts to include a variety of potential outcomes.

Scenario planning is key for businesses to make data-driven decisions. It simulates possible scenarios by considering financial assumptions, operational drivers, and external factors, which are particularly relevant forces in today’s volatile market. By predicting the impact of different variables on financial efficiency and growth, Finance can better manage risk, model operations, and streamline sales forecasts.

Depending on their business setup, companies use various types of scenario planning to prepare for different circumstances and develop agile strategies. These types include strategic management, operational, quantitative, and normative scenario planning.

What is scenario planning software?

Scenario planning software is a type of computer program used to help organizations anticipate and prepare for potential changes in the future. It is designed to enable users to identify, evaluate, and simulate a range of scenarios that could potentially affect their business or industry.

The software typically includes tools for analyzing data, visualizing information, creating simulations, and presenting results. This enables users to explore multiple outcomes based on different factors and develop strategies to respond effectively.

How do I create a scenario in Excel?

Creating a scenario in Excel is relatively simple, but can be time-consuming depending on the complexity of the project.

You must first enter the data necessary to create a realistic scenario. This includes all relevant information about your company’s current and future financial and strategic goals, as well as any external factors that may have an impact on future outcomes. Once this is done, you can use various tools within Excel to forecast outcomes based on different scenarios or variables. These tools include pivot tables, data tables, and goal seek.

While spreadsheets are certainly a valid tool for scenario planning, it is important to be aware of their limitations. This is especially true as companies scale and their needs and complexity increase. One such limitation is the potential for errors due to manual data entry. Because spreadsheets rely heavily on human input, they are prone to mistakes, which can lead to incorrect assumptions and projections.

Spreadsheets in complex scenarios can be challenging. When dealing with large datasets spread across numerous tabs, it can be difficult to keep track of all variables and ensure that everything is working as intended. Plus, they can be somewhat limited in terms of collaboration capabilities.

How do I use scenario planning?

Scenario planning involves creating multiple scenarios that describe possible futures, taking into account various factors such as economic trends, consumer preferences, and technological developments. By considering a wide range of possibilities, businesses can be better prepared for any obstacles that may arise.

Here is how to use scenario planning:

- Identify the drivers: Identify the key drivers that could affect your business in the future, such as social trends, economic conditions, or technological advances.

- Create scenarios: Develop multiple scenarios that outline different possible futures based on these drivers.

- Analyze outcomes: Evaluate the potential outcomes of each scenario and identify any potential risks or opportunities for your business.

- Plan for the future: Develop a plan to prepare your business for any potential scenarios.

Monitor trends: Keep track of changes in the factors that could affect your scenarios and adjust your plans accordingly.

What are the different types of case scenarios?

Case scenarios are hypothetical situations that allow for the exploration of potential outcomes, allowing decision-makers to plan for a variety of possibilities.

Several types of case scenarios can be explored using scenario planning software:

- Best-case scenario: This is the most favorable outcome for a decision or event. It assumes all variables will work in your favor and present the best possible outcome.

- Worst-case scenario: This is the least favorable outcome for a decision or event. It assumes all variables will work against you and present the worst possible outcome.

- Base-case scenario: This scenario is the most likely to occur, based on all available data and information. It does not assume either the best or worst outcome but rather provides a realistic picture of what could happen.

What are the benefits of using scenario planning software?

There are several benefits to using a scenario planning software system:

- Improved efficiency: Scenario planning software streamlines the process by allowing users to automate the process of creating and analyzing scenarios. This saves time and resources, resulting in greater efficiency.

- Improved accuracy: By using effective scenario planning processes, users can access up-to-date data in a few clicks and create more accurate simulations. This reduces the risk of manual errors and allows users to make better-informed financial decisions.

- Permission-based collaboration: Scenario planning tools allow team members to see the impact of different scenarios on their parts of the business specifically, giving them more visibility on how they might need to adjust accordingly.

- Enhanced visualization: Scenario planning software provides a simple way to visualize data through dashboards, improving the understanding of non-finance users or stakeholders and helping them easily identify trends and patterns.