Get an edge with financial modeling software

Create custom financial models with ease. Choose advanced financial modeling software to allow your Finance leaders to make informed business decisions based on real-time insights.

Trusted by scaling businesses worldwide

Build flexible models for a strategic advantage

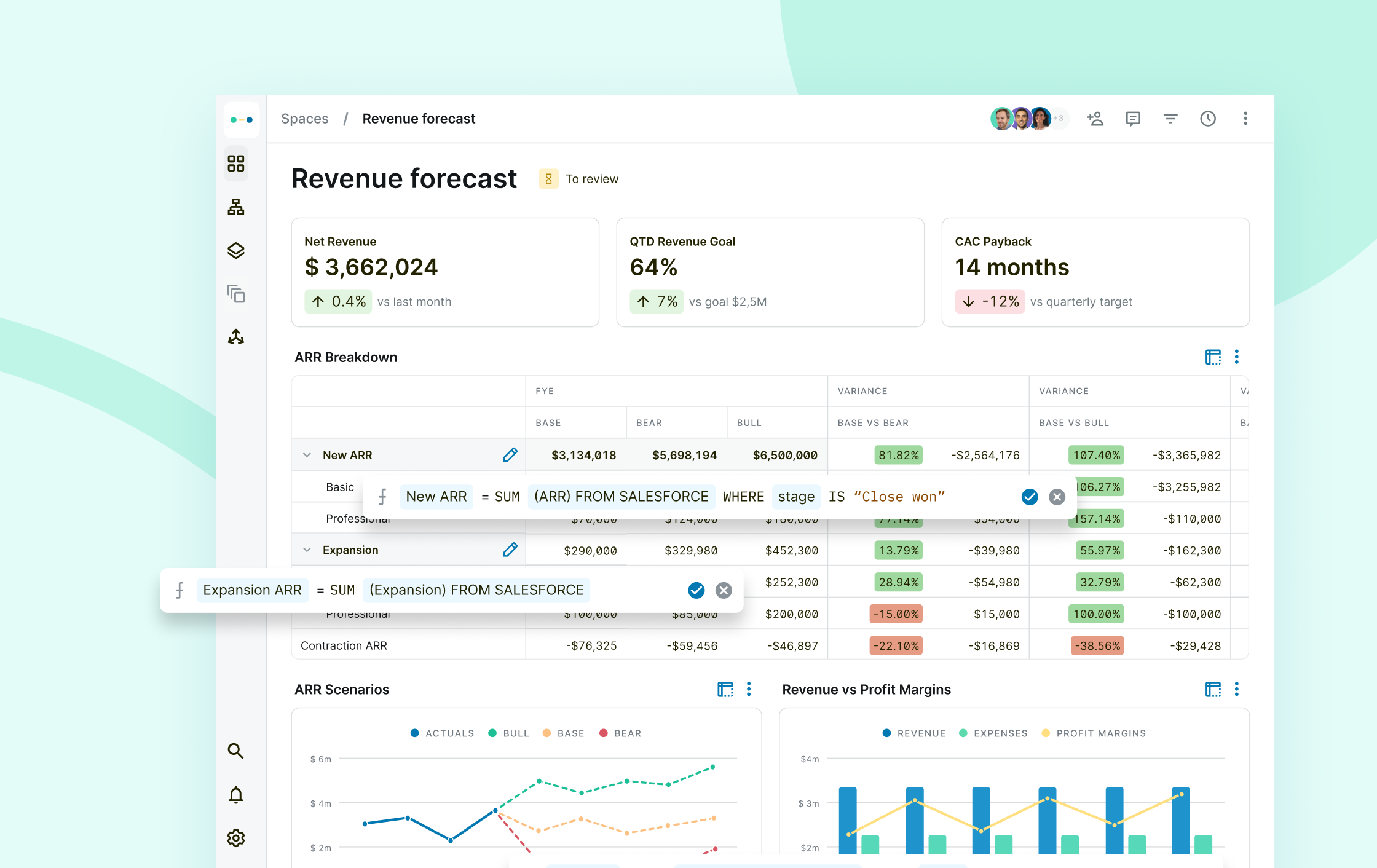

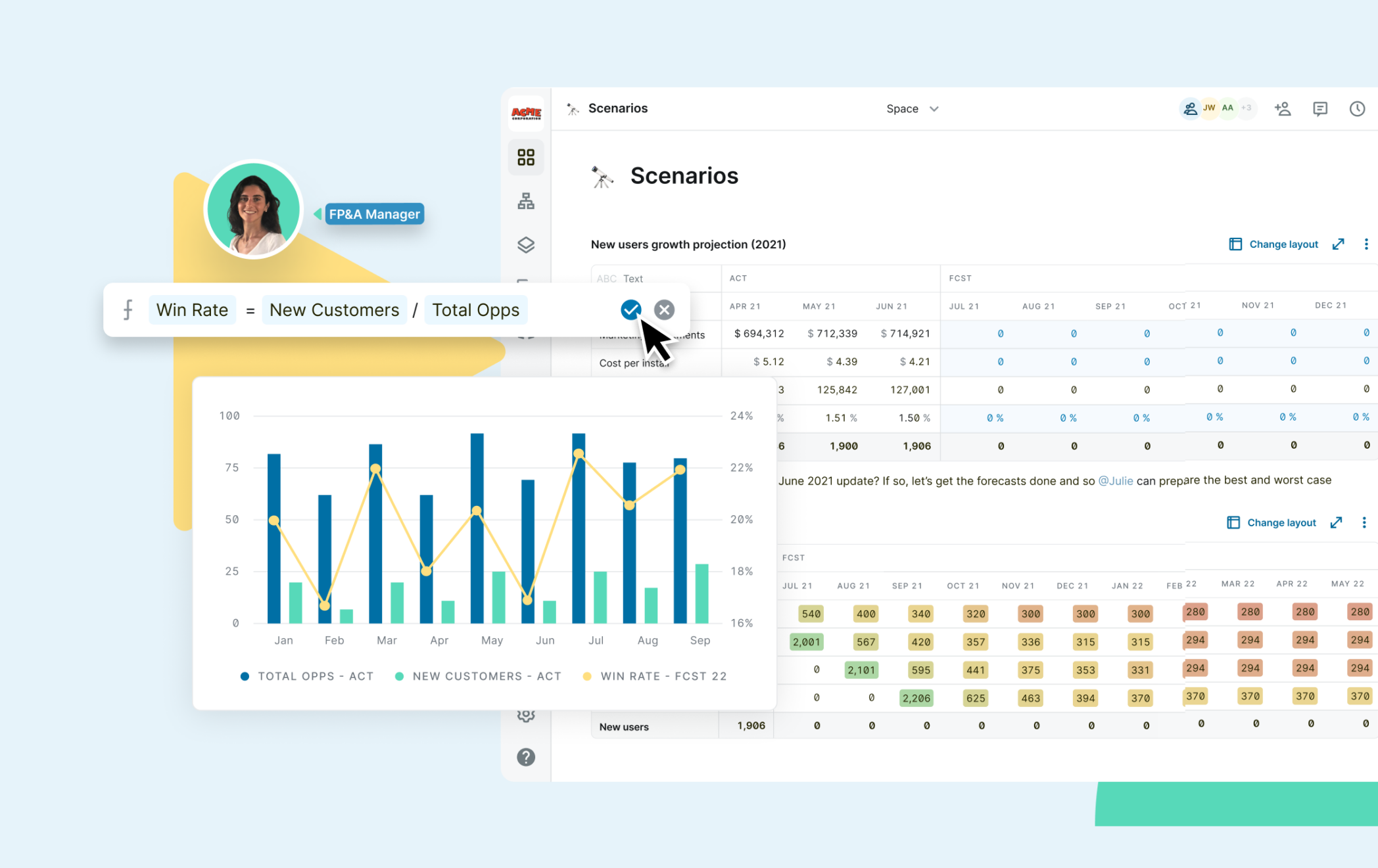

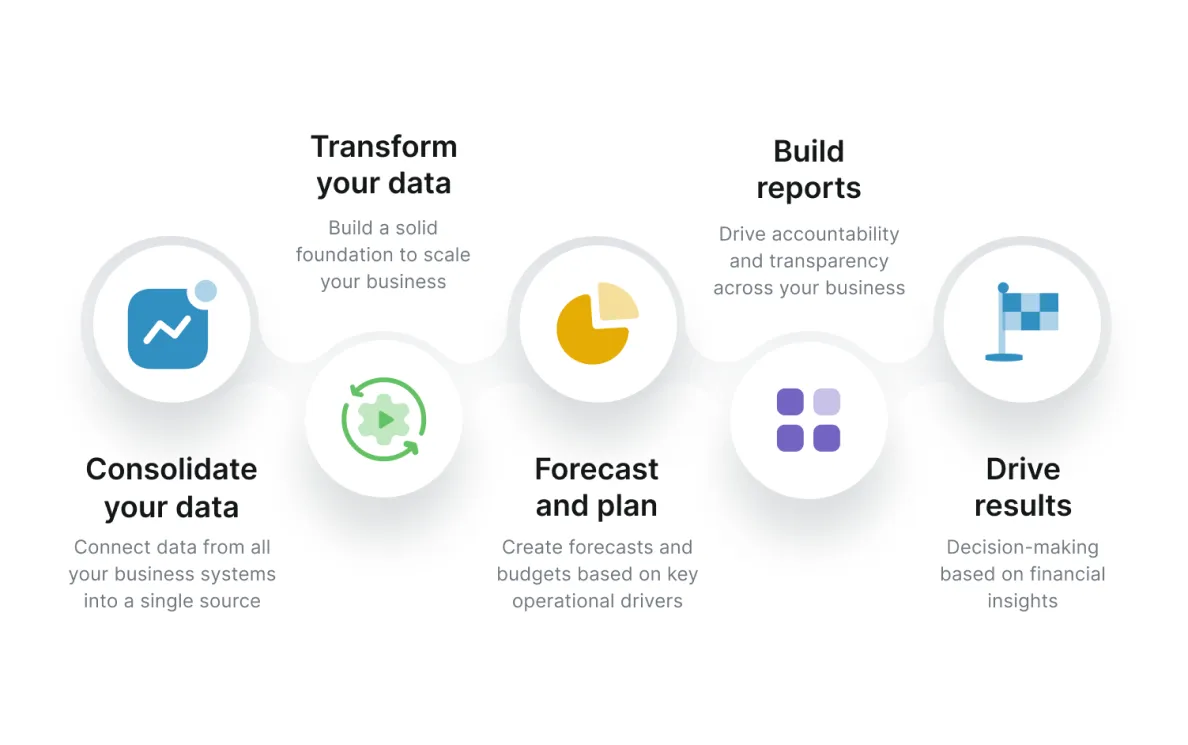

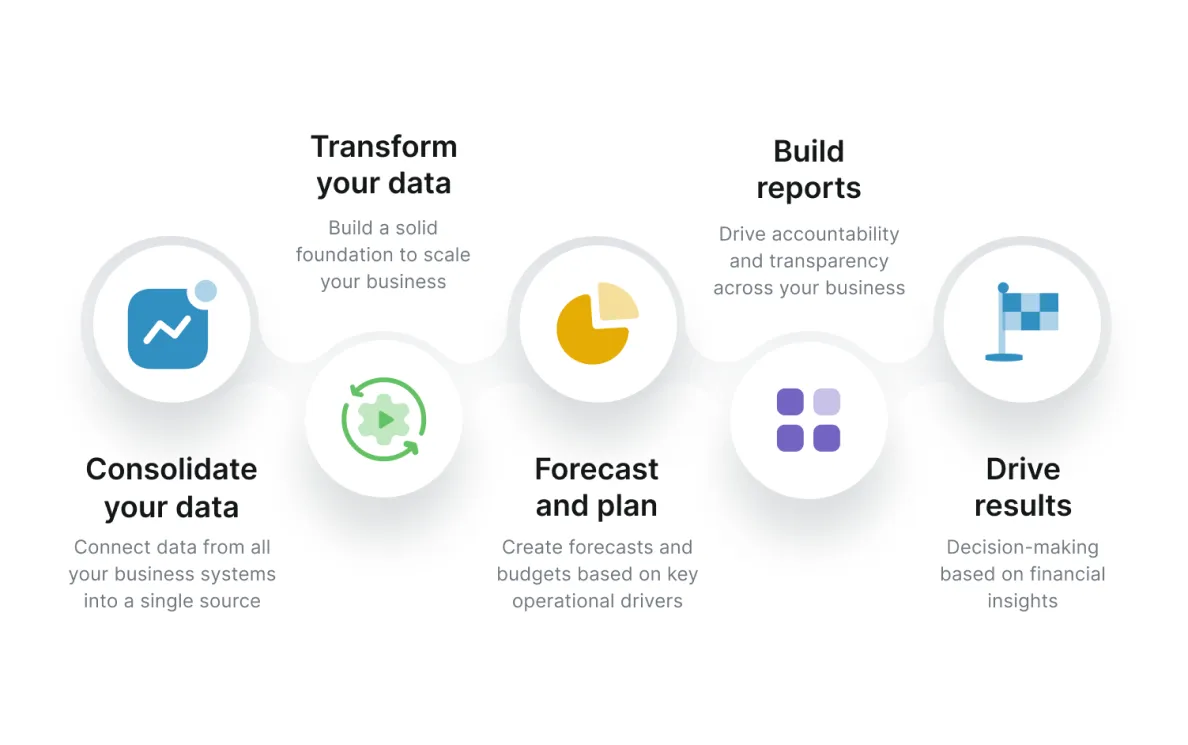

Step up your business game with advanced financial modeling software. With Abacum, you can create flexible models that are tailored to your company’s specific needs and goals, allowing you to make decisions faster based on real-time insights. By adopting financial modeling platforms, your company can improve cross-functional collaboration, streamline business workflows, and save time when assessing its current financial situation. This will allow you to focus on value-added activities instead of investing a considerable amount of time in repetitive tasks, and determine the best course of action every time.

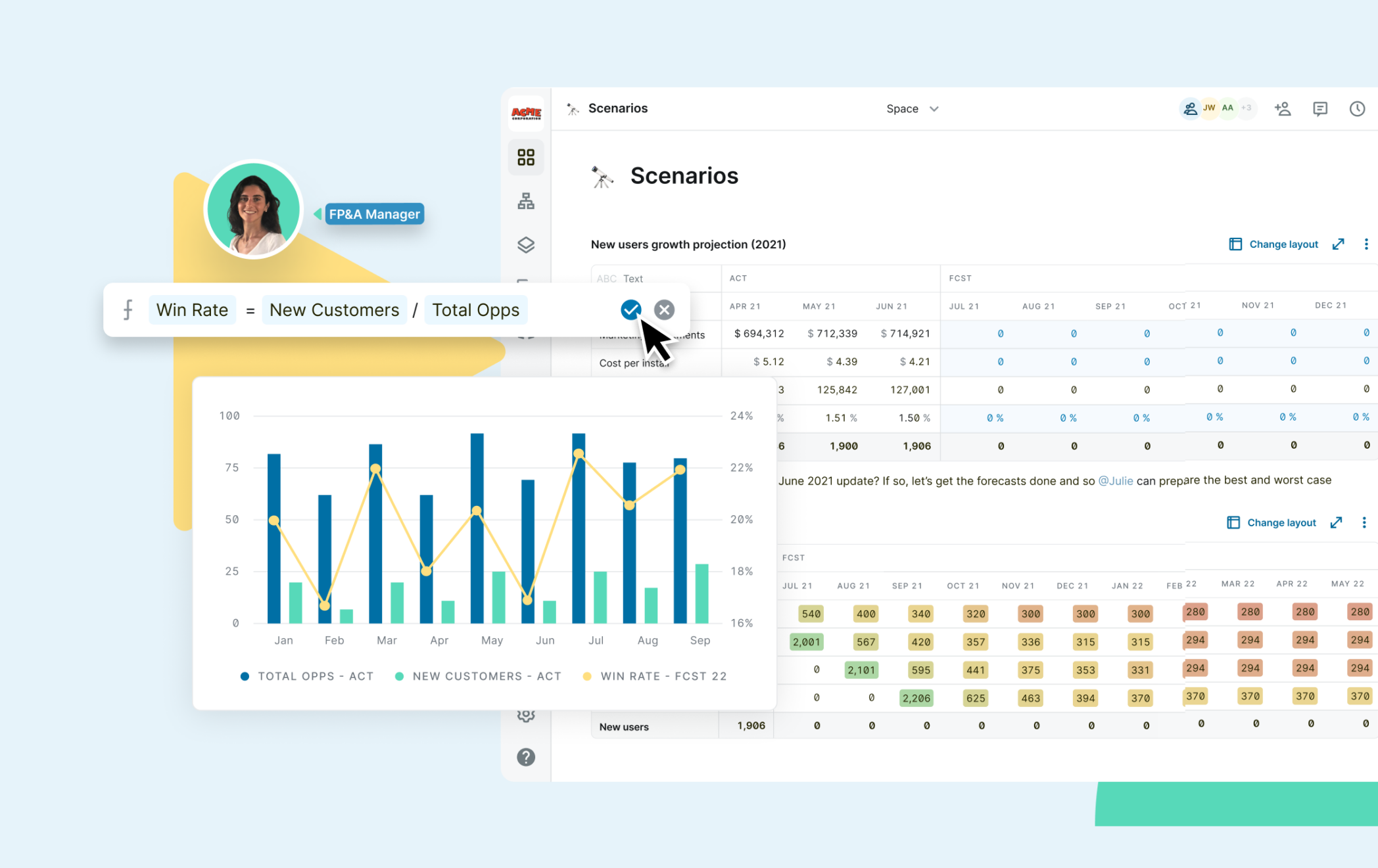

Be the business partner your company needs

Helping your leadership team make sound financial decisions has never been easier. With advanced financial modeling software, your team can now collect inputs from various budget owners, conduct sensitivity analyses, maximize and maintain forecast accuracy with simplified driver creation, and link cause and effect to ease top management decision-making. Instead of wasting time gathering cross-organizational data, keep your financial team focused on driving change through real-time input from a single software, so they can provide the insights your CEO and investors need and care about.

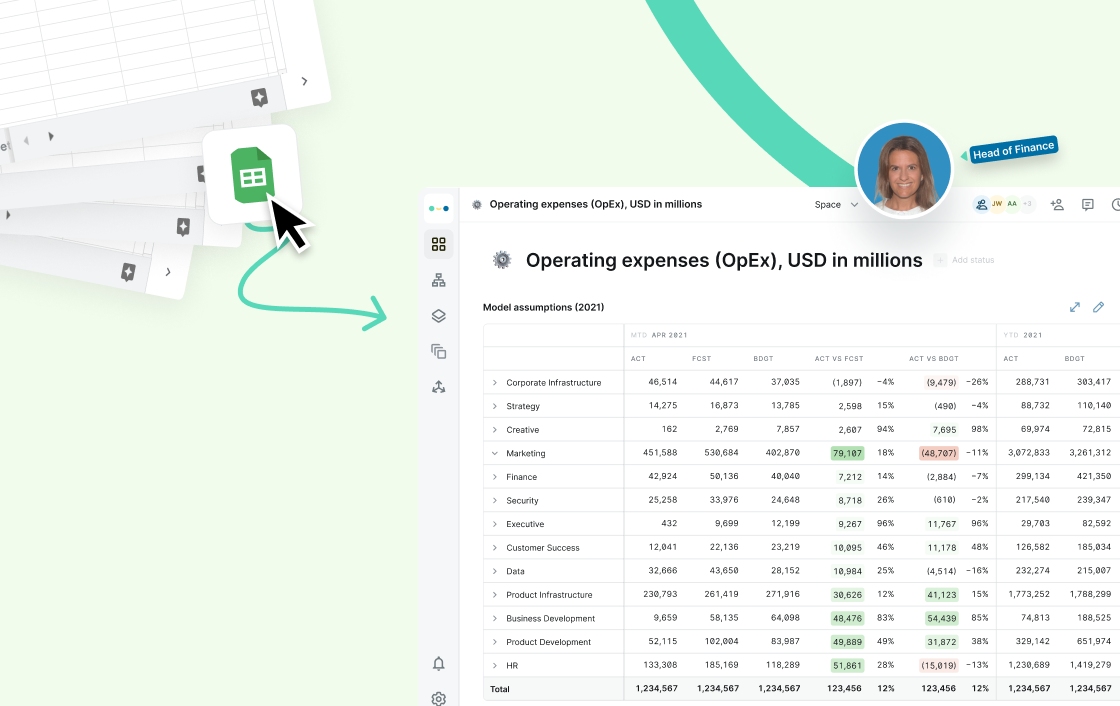

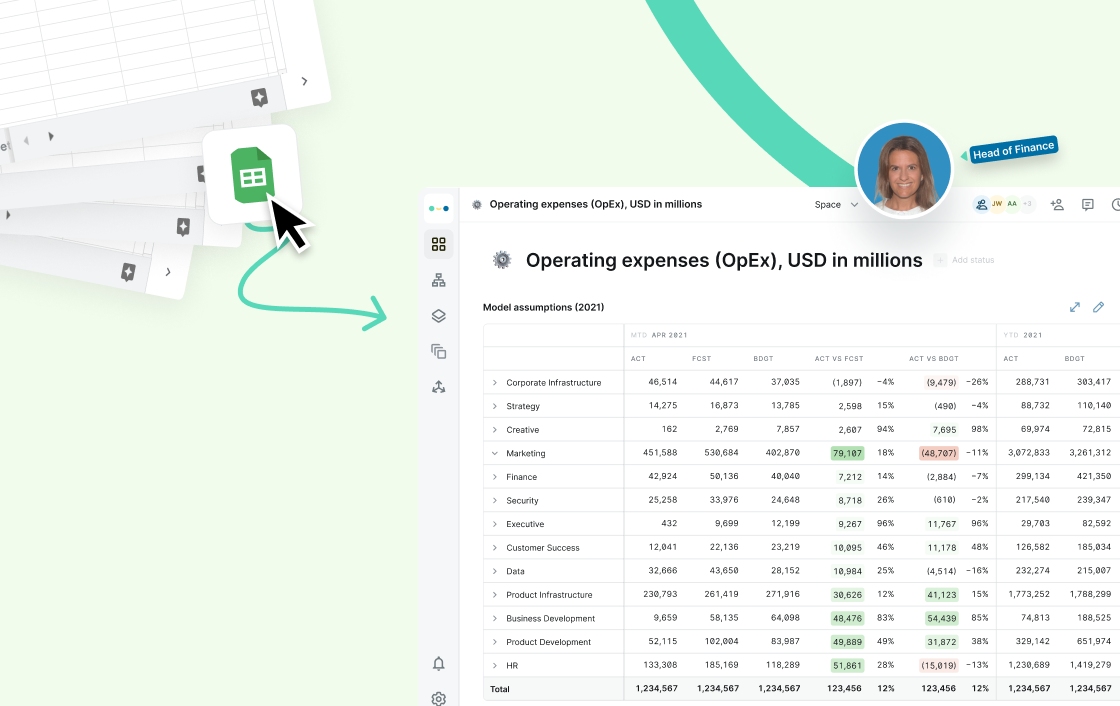

No more human errors on your projections

Spreadsheets fall far behind when it comes to modeling accuracy. Even though they are still popular among early-stage startups, as your model complexity increases, you shouldn’t need to go through countless tabs or endless, unrelated spreadsheets to forecast your business’s future performance. Transitioning from traditional to advanced software enables your Finance team to automate the process of creating financial projections, enhance cross-functional collaboration, and conduct all modeling processes in one place. Its advanced features will help you eliminate any trace of manual error with precision and generate detailed, reliable reports on your financial future.

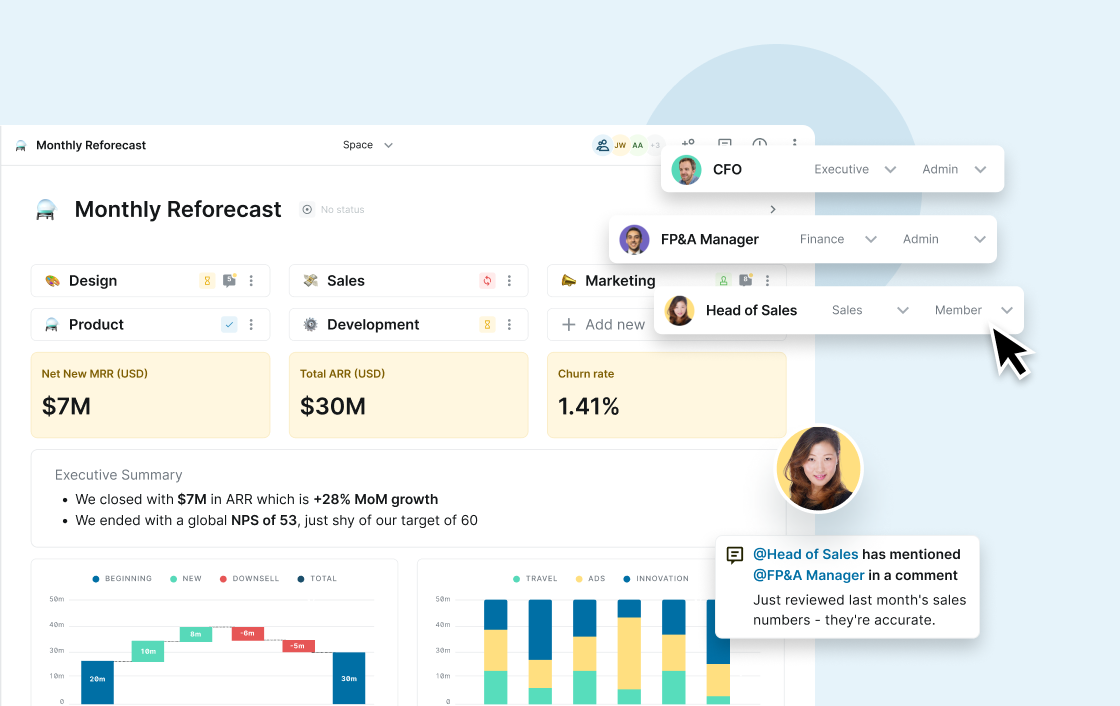

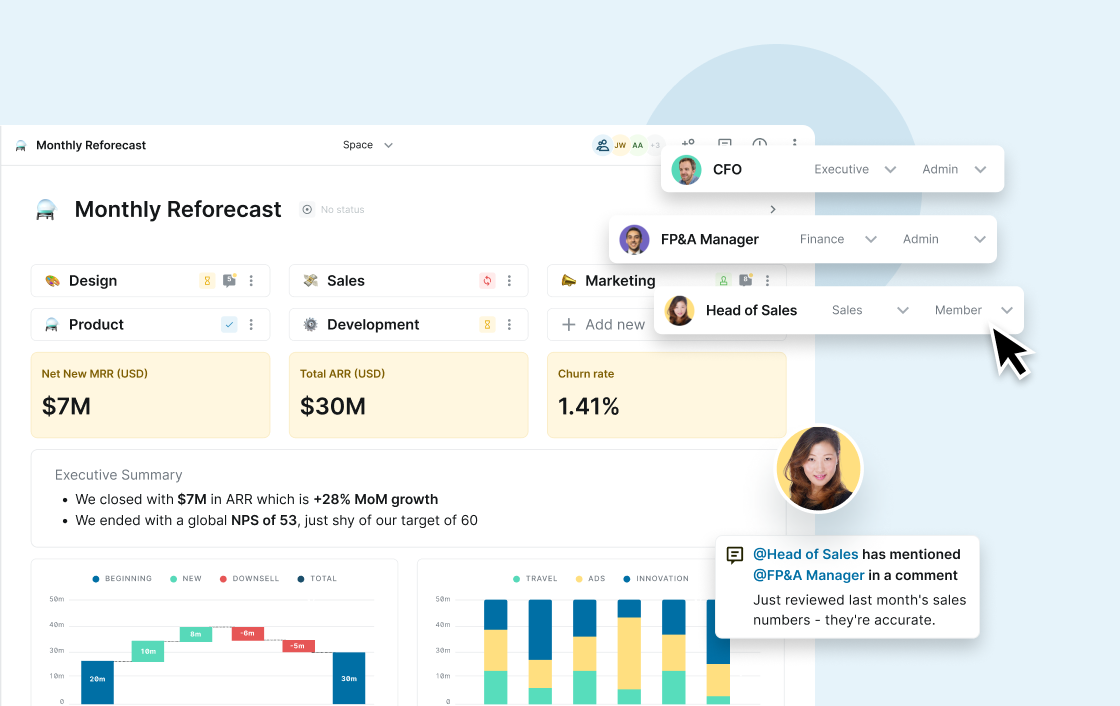

Share progress with only 1-click

With just one click in Abacum, you can have complete visibility into your business’s financials, create interactive dashboards, generate reports in multiple formats, and share your insights with your stakeholders. Abacum’s advanced collaboration features allow you to maintain active communication with your business leaders, so you can ensure that everyone is on the same page and working towards the same goals to drive operational performance like never before.

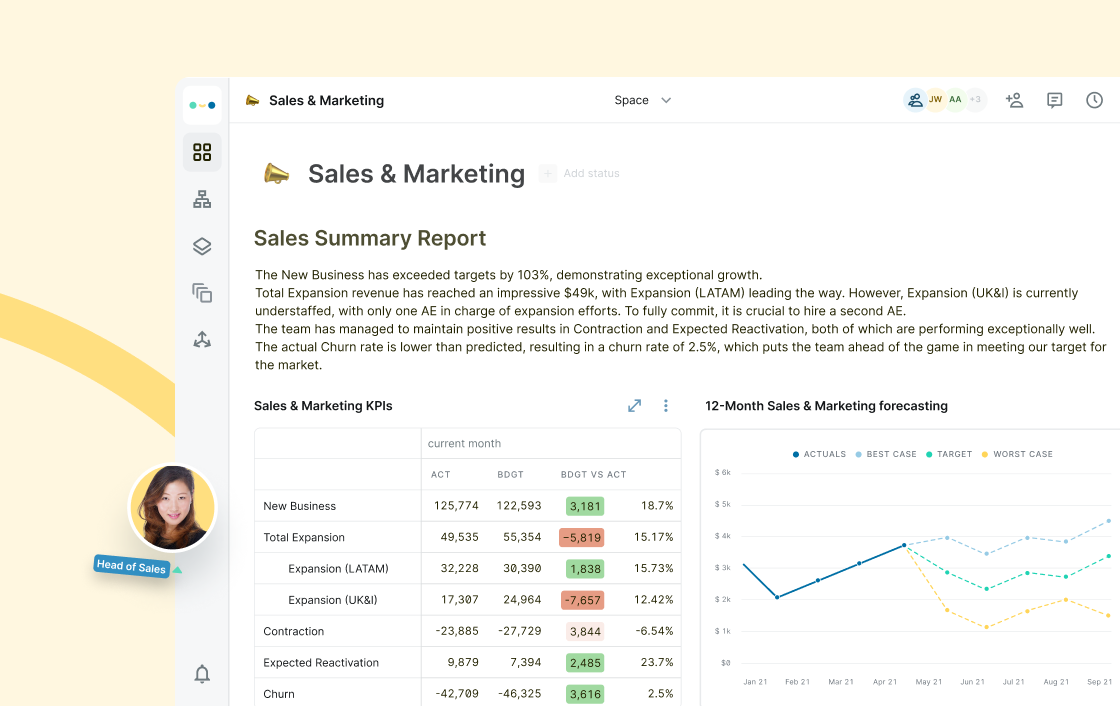

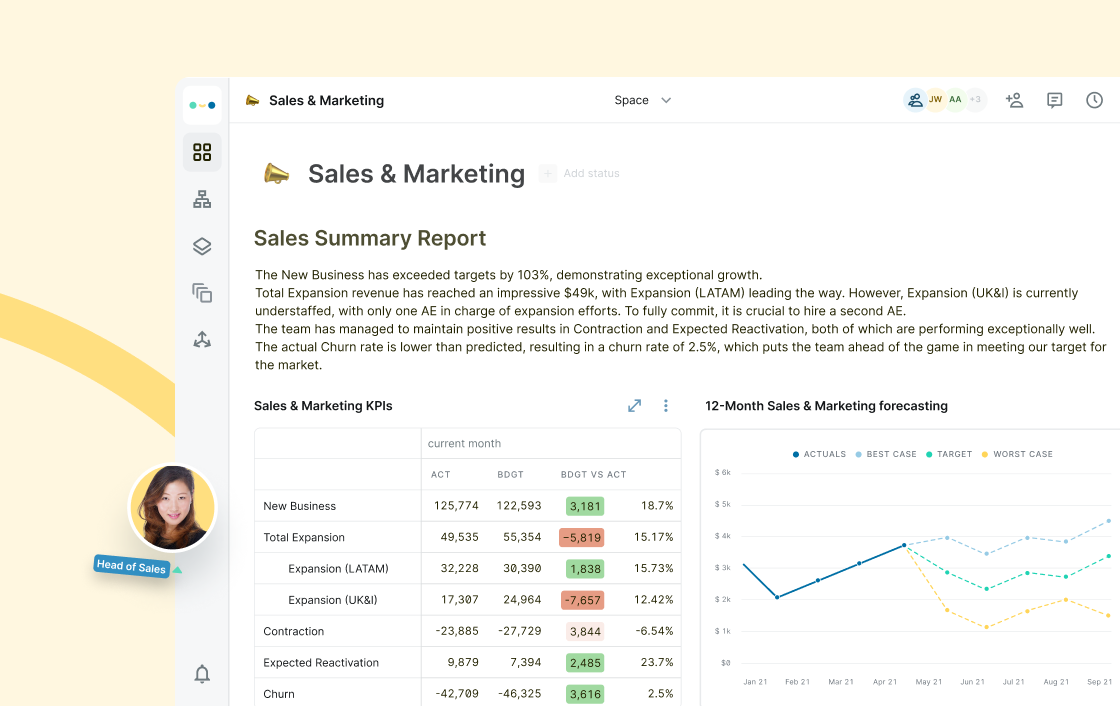

Forecast and manage your sales

Forecasting your company’s future performance doesn’t have to be a tedious task. With the help of financial modeling software, you can make precise financial predictions based on historical performance and current trends. Your team will be able to forecast and manage sales more accurately than ever before by adopting cutting-edge technologies. Advanced software will provide you with valuable information and a greater understanding of how changes in the market will impact your company in real-time. Abacum will serve as your greatest ally, enabling you to measure success against KPIs and making sure your business is always on top of its game.

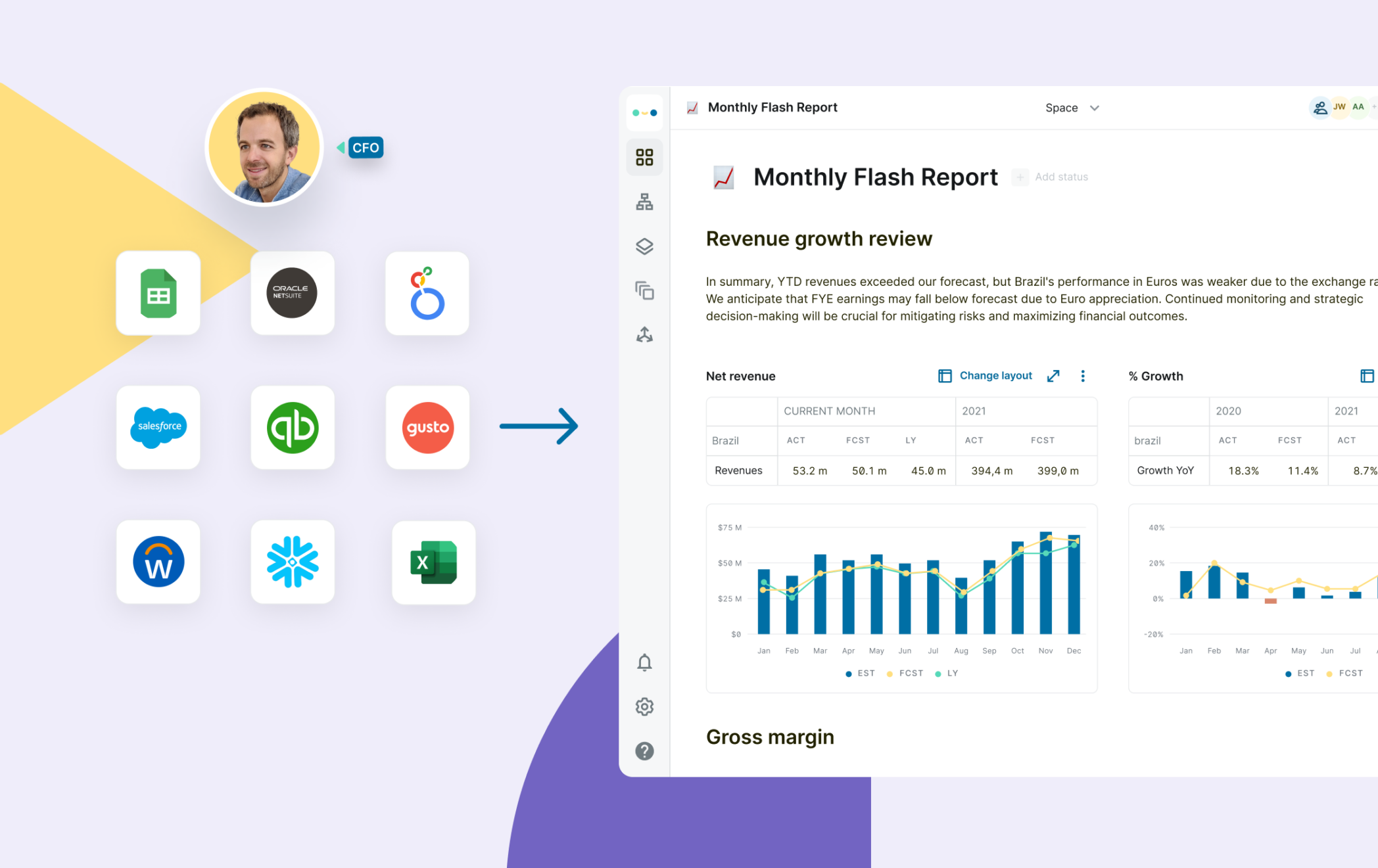

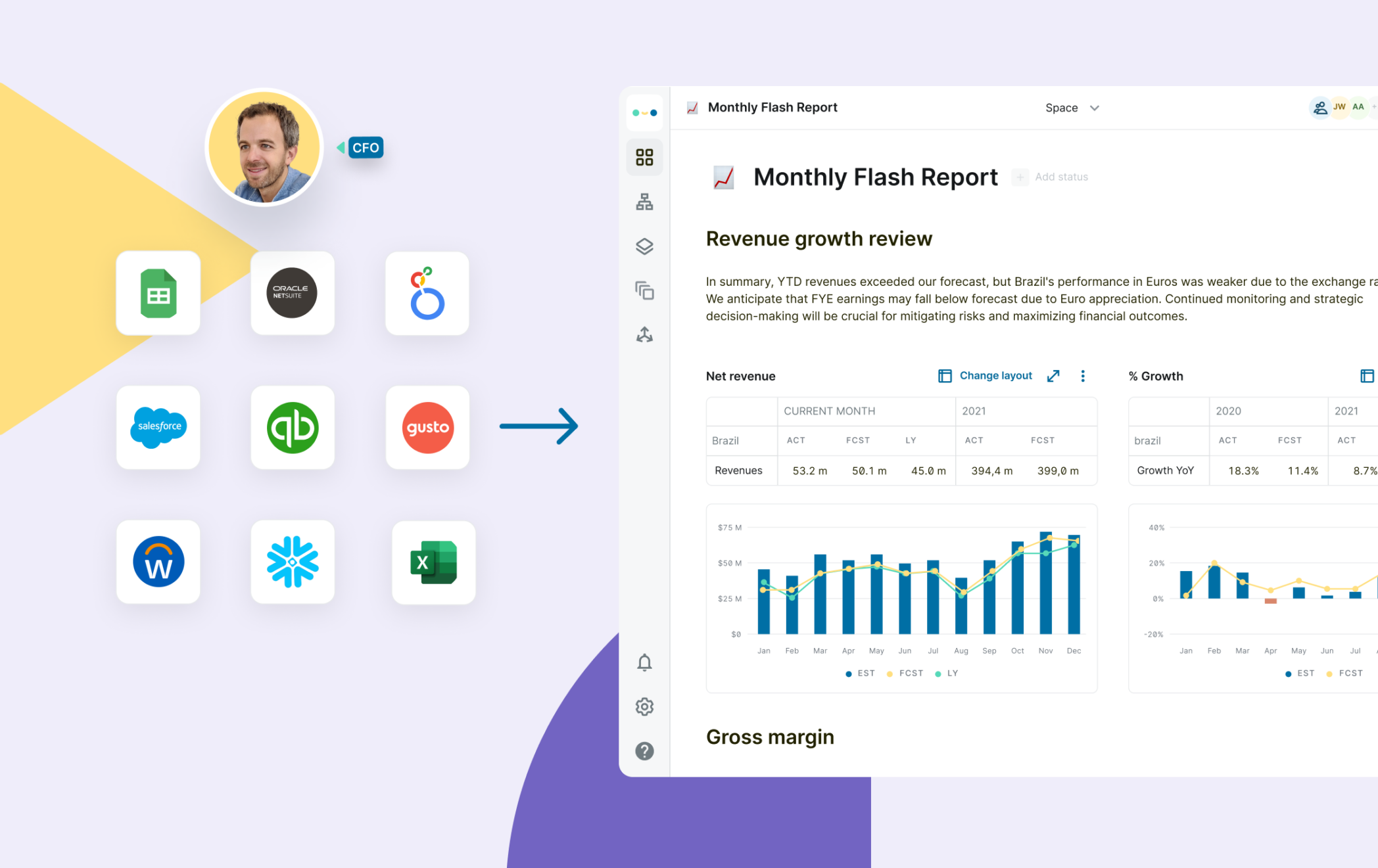

Bringing direct integrations to the forefront

Feeling the pain of a complex integration? Want to know if your ERP will connect with your financial modeling software? Worry no more. With Abacum, all workflows and business systems are welcome.

Xero

Tableau

Salesforce

What sets Abacum apart from other financial planning solutions?

Error prevention

Get the most out of your resources

One single source of truth

No more endless, unrelated spreadsheets

100% data accuracy

Just press a button and get the results

Make your finances work smarter with Abacum

Abacum is a powerful financial modeling software that helps you make better decisions faster. It enables you to create custom models based on informed premises, calculations, and data from reality, making your analysis easier to interpret and visualize. Its suite of features includes advanced integrations, real-time collaboration, record-keeping capabilities, and the ability to export data for further reporting. Abacum’s intuitive user interface makes it easy for Finance leaders and business analysts to build complex financial scenarios with just a few clicks.

Keeping Finance teams in sync at all times

Join our community and unleash the potential of your business with modern business planning software.

Javier Delgago

VP of Finance

“We went from budgeting in spreadsheets, to unlocking collaboration and better decisions with 30+ budget owners.”

Mobility

Pierina Nuques

Head of FP&A

“The onboarding process with Abacum was fast and efficient. We have now automated 20 hours of manual work.”

MedTech

Maria Lapucci

Senior FP&A Analyst

“With Abacum, we stopped budgeting by emailing spreadsheets. Our 30+ Budget Owners became collaborators, understood their performance, and gave us the visibility to plan with clarity.”

FinTech

Still have questions? We’ve got answers.

What is financial modeling?

Financial modeling is the process of creating a mathematical representation of a financial situation or system. It is used to analyze and forecast potential outcomes, such as future profits, cash flows, and other financial metrics.

Financial models are typically created using software programs such as Microsoft Excel or specialized financial modeling software. They can be used to evaluate the performance of a company, assess the risks associated with an investment decision, or project future cash flows.

What are the benefits of using financial modeling software?

Financial modeling software offers precise and current information about a company’s financial position in real-time, enabling firms and investors to make well-informed decisions in a fraction of the time.

You may integrate financial modeling solutions to eliminate time-consuming processes, generate reports that can be used for financial planning, automate operations that would otherwise be done manually, and analyze data from a variety of data sets. Financial modeling tools may also be used to build financial statements, including income statements, balance sheets, and cash flow statements, as well as to help you identify opportunities and risks that might not be obvious to the human eye.

Which software is used for financial modeling?

Microsoft Excel is the most widely used financial modeling software. Excel-based models allow users to create models with formulas, charts, and graphs. However, for more advanced and detailed predictions, larger businesses are increasingly adopting specialized financial modeling software, such as FP&A or business planning software.

Financial modeling software allows you to build more complex models and provides an in-depth view in real-time of a company’s financial situation. This allows SaaS businesses and investors to make decisions about investments, budgeting, and financial forecasting more accurately and faster.

What does a financial model show?

A financial model is a tool used to project the future performance of a company or investment. It typically includes detailed assumptions about revenue, expenses, capital investments, and other factors that affect the company’s financial performance.

A model can be used to perform scenario analysis and make decisions about how to best allocate resources. Financial models are often used by investors and analysts to assess the potential return on investment of a project or initiative.

Can you use Excel for financial modeling?

Yes, Excel is the most popular tool used by financial analysts and other corporate finance professionals in the industry for financial modeling. It is a versatile spreadsheet program that has a wide range of features that allow users to store and analyze large amounts of data, build business models, create charts and graphs, and perform complex calculations. However, while Excel is certainly a useful tool, integrating it with powerful financial modelling software can take your business planning to the next level.

By using such software, you can unlock even more advanced features and capabilities that Excel alone cannot provide. For instance, you can use historical performance and market data to improve the accuracy of your financial forecasts or use advanced analytics tools to uncover hidden insights in the data from various functions of your business. Additionally, financial modeling software can help you automate tedious tasks, such as data entry or report generation, freeing up time for more strategic activities.

In short, while Excel is a great starting point for financial modelling, it is important to consider integrating it with more advanced software to stay ahead of the curve. Doing so can help you unlock new insights, save time, and make more informed decisions.

How can you bring your DCF model into Abacum from Excel?

A Discounted Cash Flow (DCF) model is a valuation method used to estimate the value of an investment by projecting its future cash flows and then discounting them back to their present value. This is a powerful method that takes into account both the timing and size of future cash flows, making it an effective way to analyze investments.

If you have been using Excel to create your DCF model and want to move it to a financial modeling software like Abacum, you are in luck. Abacum is a cloud-based business planning platform that allows you to quickly and easily import your existing Excel-based DCF model, while adjusting and improving it natively. Simply upload your Excel file as a CSV, and Abacum will automatically convert it into an interactive web-based model. With just a few clicks, Abacum will generate visuals, such as graphs and charts, to help you better analyze your business’s insights and move from data to execution faster.