, CFO and author of Mostly Metrics

7 min read · Published: September 22, 2023

Editor’s note:

CJ Gustafson is the author of the popular Mostly Metrics newsletter with over 30,000 subscribers. He recently broke down his guide to annual planning, an important topic for every finance team getting ready for 2024. We’re sharing his article below.

If there’s one thing I know, it’s that both your budget and my budget will both be “wrong” at the end of 2024. Those are just the facts.

It’s really a matter of who’s “less wrong”.

I always tell my teams that budgeting for anything that’s in hyper growth mode is really, really hard. I mean, try to predict anything in your life that’s literally doubling each year – it’s like a bad carnival trick where they spin you around, blind fold you, and ask you to throw a dart at a board that’s also moving.

And planning for 2024 will be even more difficult. Although we might be taking a bit of heat off our fastball when it comes to top line growth next year, you’ve got a lot more to pay attention to. Much like you can’t build a house with expensive windows and no roof, you can’t present an operating plan to your board that isn’t solid at both the top and bottom of the P&L.

Here are five tips for planning your operating plan in an uncertain economic environment. They aren’t for the faint of heart.

Take your bottoms up headcount build seriously

70% of costs at software companies walk on two feet. To hedge the bets you are taking in your operating plan, start by seriously analyzing headcount, as everything else will follow.

Don’t believe me?

- Approximately two thirds of your software tooling is probably expensed on a per head, per license basis (until the usage based revolution comes and changes everything to consumption based… but that’s not next year)

- After tooling, the next biggest expense is office space. These are long term commitments that you don’t want to lock in without knowing how many people will actually show up everyday

📝 Note: there is a direct correlation to both the quality of your snacks and the number of people who show up. I stopped showing up to the office when they replaced Welch’s fruit snacks with costco brand fig newtons.

- And travel should be forecasted by person, by activity and by staffing level (exec vs plebeians)

I bet that covers 90% of your expenses. And if I was a betting man, we’ve eliminated a lot of tail risk by getting headcount right.

So you should begin the process by doing a tops down percentage build of headcount by department (e.g., will Product evolve from 10% of total headcount to 12% next year?), then perform the actual bottoms up build with leaders, and finally sanity check that what dropped out fits within your top down budget envelope.

Spend extra time this year interlocking the engineering and product teams

Few people understand that your Product Roadmap is essentially synonymous with your 5 year Revenue roadmap. You can only sell what’s on the back of the truck.

That means you need to think through which engines you are incubating for growth outside of just this year. Although we are planning for the next 12 months, this should be the first puzzle piece in your 5 year planning model. The two are forever intertwined, like Peanut Butter and Jelly.

2024 is really the first chapter of the 2024 – 2029 plan.

Build a plan that gets your sales people PAID (and your CAC back)

Perhaps the biggest mistake I’ve seen companies make in a downturn is setting the sales goals too high. (I think I just heard a few jaws hit the floor.)

This seems super counterintuitive, but hear me out.

In a downturn, companies want to play catchup on the topline goals they aren’t currently hitting. So they get more aggressive on what they believe sales achievement should look like. And they raise the numbers while also cutting down on the supporting resources the sales teams rely on. The ratios of BDRs per Sales rep go up (2:1 jumps to 3:1 to cut headcount expenses), the marketing program budget is peeled back (no more conferences that used to drive leads), and all new tool purchases are frozen (sorry managers, no Gong this year).

And guess what happens? The sales people get pissed and leave when they inevitably don’t hit their number (and don’t get paid). So now you have a super aggressive goal, not enough quota carrying capacity to come within a hail mary throw of the plan, not to mention serious morale issues. And when the gap between plan and attainment grows even wider next quarter, guess what happens? You guessed it, more cuts.

I call this the Quota Death Spiral (QDS). It’s taken the souls of many great software companies. And yes, I literally just made that up on the spot.

And if sales teams are struggling to make quota, you will likely start closing crappier deals (before everyone well… walks away and QDS sets in)

You’ll be left with maybe an “ok” CaC payback, but a terrible Net Dollar Retention rate (if you are on annual contracts). Why? Your customers will follow your sales people out the door the first chance they get if they were duped into something that isn’t a mutual fit.

It’s a slippery slope. Things will get a lot worse if you don’t take care of your sales people. Don’t cut commission corners.

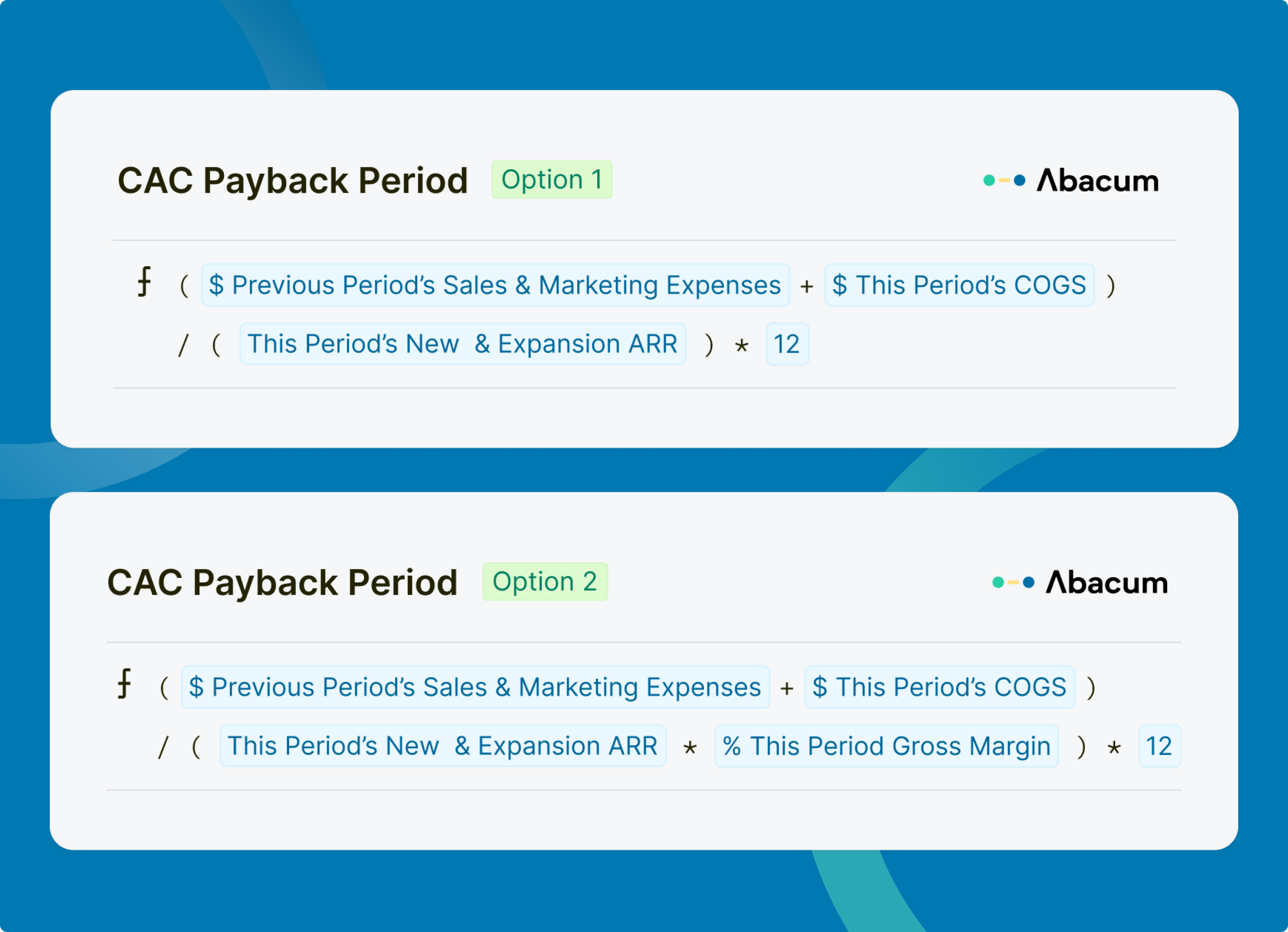

Check and Re Check your Budgeted CAC Payback Period

A quick recap before we get spicy:

How much money do you have to put out into the world to land a customer? Different marketing channels will have different CAC’s.

This represents the number of months it takes to recoup that initial cash outlay.

And in my experience running FP&A teams, companies LOVE to check their CAC Payback period after each period closes. But they hate to check their future CAC Payback period in their budget before the year starts.

Many times they’ll tell their board,

“We want to build a plan to deliver $xM in Net New ARR at a 10 month CAC Payback Period”

but they fail to actually run the calculation on the forecasted numbers in the plan. They’re basically hoping for the right results.

And there’s a 90% chance that whatever you’ve thrown into Marketing Programs is actually higher than what your “aspirational” CAC Payback Period calls for.

2024 is not a good year to get caught in what I call the “CAC Payback Trap” – when you are constantly playing catch up to a budgeted figure that your operating plan doesn’t jive with. So throw your future numbers into the formula and sanity check your stuff.

Ensure you can hit your cash burn budget for the first half of the year (Q1 + Q2)

The best way to make sure you don’t have to make cuts in H2 is to not spend too much in H1. It’s that simple.

Put placeholders in your first half budget for things that might come up. The two most common unforeseen expenses are contractors for short term projects and price increases you forgot would be applied to your software renewals.

What I’ve done in the past is take whatever my first half (or even total year) budget is for contractors, and then put in a placeholder of 10% for projects that we will inevitably need to take on in order to get a new product to market or expand sales in a new geo.

The same goes for software tools. Beat your vendors to the punch and add at least 5% to each tool’s planned spend. And if they don’t jack up the cost on you, put it in your pocket and be the hero at the next board meeting who beat his OPEX and Burn budget.

You should feel great about your first half burn numbers if you paid attention to point #1 above regarding headcount, and also throw in placeholders for contractors and software price increases.

Make the crafty budgeting decisions now so you don’t have to make difficult decisions (using scissors) in H2.

Enjoyed this post? Check out Mostly Metrics to hear more from CJ.

Looking to get ready for annual planning? See how Abacum empowers finance leaders to drive the perfect strategy this FY’24 planning cycle