Financial management strategies for scaling businesses

Learn more ->

, Chief of Staff, Abacum

17 min read · Published: July 11, 2023

🎯 Introduction

Successfully running a mid-market business requires leaders to understand the financial picture of their company at any time. In order to have real-time snapshots of budgets, forecasts, accounts payable transactions, and more, selecting a corporate financial management software is critical.

Often thought of as accounting software because of its functionality in that space, financial management software can do so much more. The right software options will bring together budget vs. actuals variance analysis, give FP&A teams a forum to submit updated budgets, automate the approval flow process for headcount changes, and even offer all-in-one insights for the entire business.

To enable real-time analytics and meet financial goals, your business needs financial management software for business functionality, financial planning, budgeting, cash flow analysis, and everything in between.

We’ve put together a list of the most effective software options for business owners. Implementing one of the financial software tools from our list will transform your business. Now it’s up to you to pick one that aligns with your business needs.

Financial management is the process of aligning business finances with business needs; if a new investment needs to be funded, costs need to be cut, or revenues need to be higher, financial management – including budget creation, actuals monitoring, data analysis, and more – is what’s happening in the background.

The FP&A teams in any organization use financial management for budgeting, forecasting, trend analysis, and reporting.

The insights and information that come from the FP&A function provide critical data points about how to move forward and make beneficial business decisions. In order to enable effective financial management, organizations need strong underlying data sets, powerful analytical capabilities, and well-trained analysts working smoothly together with the rest of the business. With the right enterprise resource planning (ERP) tool and the best FP&A management software, your business can reach new levels of success.

When considering financial management, there are two channels to think about. The ERP and source data channel must flow correctly into the reporting and analytical channel, which is usually an FP&A tool similar to the software we are reviewing in this article.

Some tools offer standalone FP&A functionality such as Abacum, Workday Adaptive Planning, and Causal. Others like Oracle NetSuite, SAP Business One, and Sage Intacct are focused on storing large amounts of data and serving as an ERP. Even further, some options do both. Xero, FreshBooks, and QuickBooks Online are examples of financial management software that offer ERP functionality and analytical capabilities.

Depending on the financial goals of your organization, you’ll need to employ unique financial management tools and systems that work for you. Whether you use zero-based budgeting and need a software that works well with that methodology or you’re looking to implement a new ERP entirely, keep reading to find the best financial management software for your business needs.

Though business accounting and financial management may feel similar to managing your own personal capital, personal financial management and business financial management are very different.

If you need a budget to run your household or want to determine your net worth, you might use a personal finance app or other tools such as:

Targeted for individual use, these tools will link to your personal bank accounts and investment accounts to help empower you to manage your personal finances. Tools meant for business needs will be able to handle more data, work through advanced calculations, and offer customizable functionality. The best financial management software tools we review in this article are intended for business use only, NOT personal use.

Financial management tools today are incredibly robust, equipped with powerful calculation features, and can make data management more seamless than ever.

With the right tools on hand, businesses can have a much greater impact. Investing in a financial management tool now can mean the following for your business:

There are endless reasons to invest in financial management tools, but until you do it, you won’t see all the benefits that are waiting on the other side.

When selecting corporate financial management software for business purposes, you first need to understand your own business needs. Do you need an ERP or are you looking for a solution that will propel your FP&A team to success?

Maybe you need both. Regardless, combing through the features offered by each platform and understanding any drawbacks will help you find the solution you feel most confident in to meet your needs and transform your business.

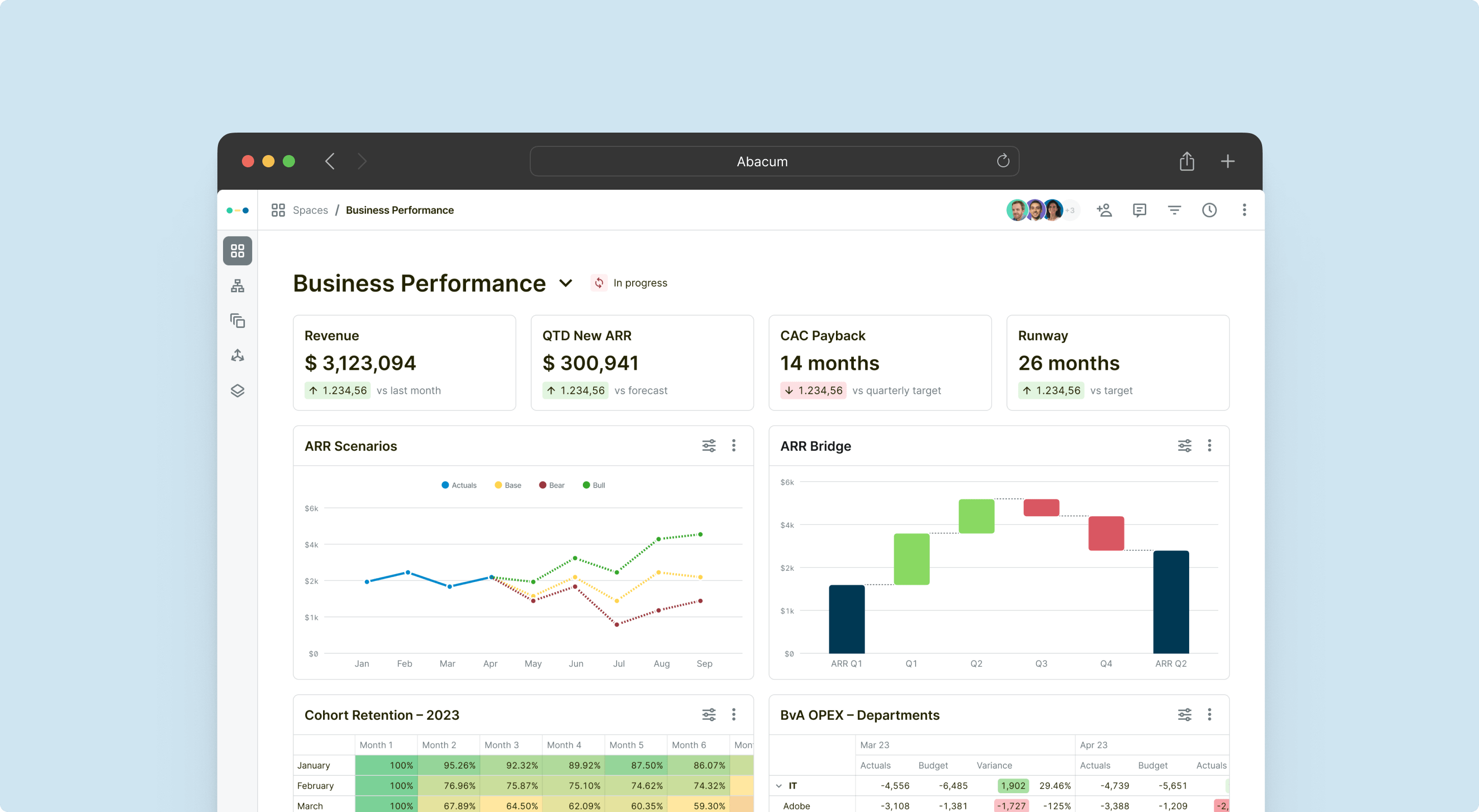

Bringing together financial data and operational data, Abacum provides a holistic financial snapshot, making it easy for FP&A teams to take action, update forecasts, and complete the budget approval process. It integrates well with a multitude of ERPs and source data systems such as NetSuite, QuickBooks, and AWS Redshift, connecting all critical business metrics in one location and creating customizable, interactive dashboards to paint a picture using the metrics that are most valuable to your organization.

Suitable for: Small and medium-sized businesses who want to transform their FP&A function, pivoting from reporting and close activities to predictive analytics and next-generation modeling.

Support Options: All Abacum users get untethered access to the customer support team before, during, and after system implementation.

Key Features: Automated data cleaning functionality and flexible modeling features ensure that everything from basic financial data to what-if scenario analysis is accurate and financially relevant. The interface gives budget owners a chance to update their budgets based on scenario testing outcomes, funneling the approval workflow directly within the platform.

| Pros | Cons |

| For FP&A teams, Abacum is a powerhouse. Its capabilities and offerings are continuously being improved upon and the size of the organization means that it can consider customer feedback and make platform improvements in very little time. | Abacum’s solution is targeted toward data analytics and business insights rather than data storage needs. |

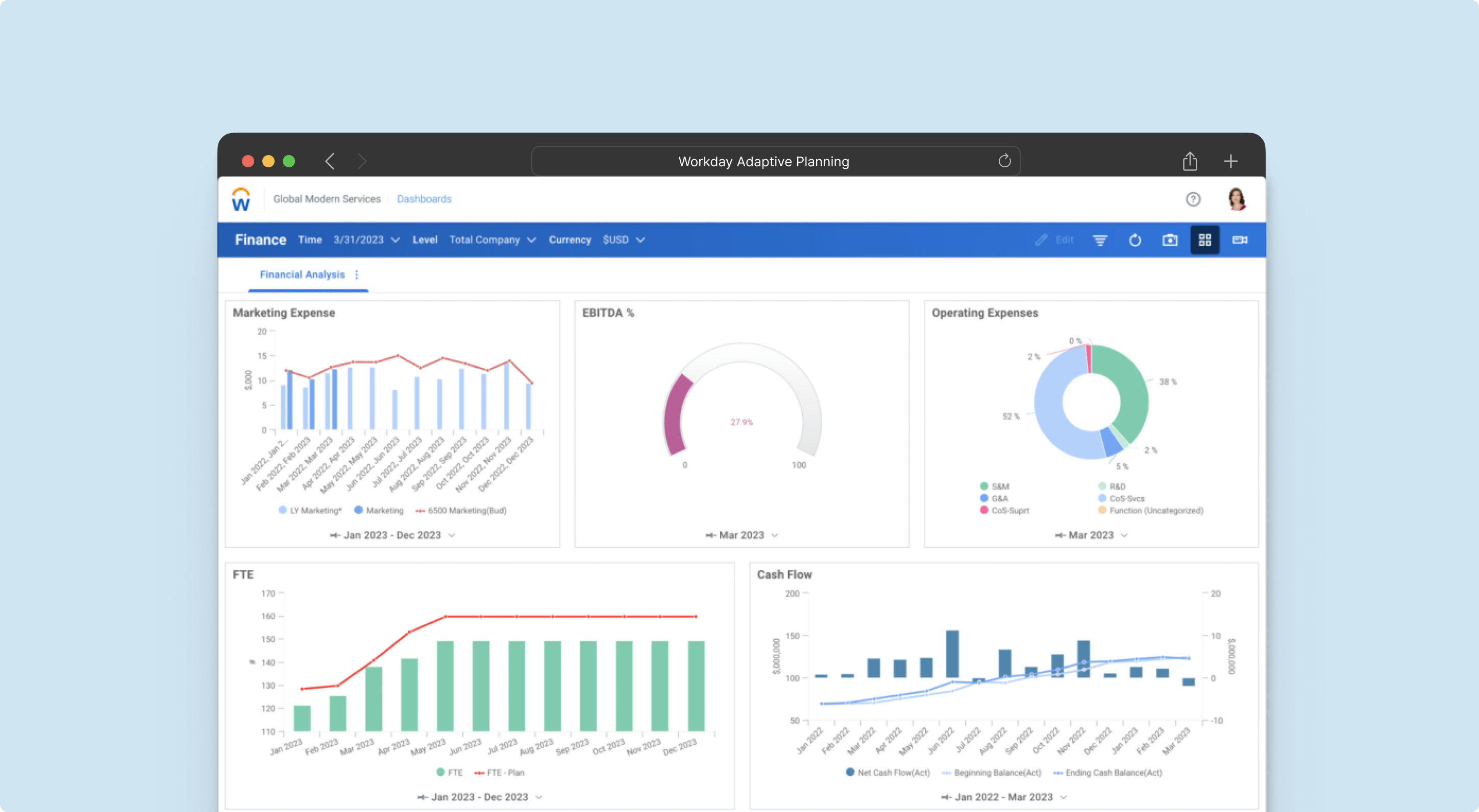

Designed to be a versatile business solution, Workday Adaptive Planning aims to transform your business by partnering with your finance function. With embedded reporting and analytics functions, your FP&A team can serve as the guiding force for sales, marketing, and human resources. When paired with Workday Human Capital Management, this platform provides a complete business picture and allows for planning adjustments at a cost-center level.

Suitable for: Large enterprises that need to reinvigorate their analytical and reporting functions within FP&A and beyond.

Support Options: 24-hour support can be accessed online, via email, or with a quick phone call.

Key Features: Workday’s Elastic Hypercube Technology helps large enterprise companies with complex data sets manage large models, clean massive data sets, and provide end-to-end business snapshots. If your current solution is running out of processing power due to the data demands of your business, Workday Adaptive Planning might be the answer to your problems.

| Pros | Cons |

| All departments and functions can have their own models within this solution; it’s not solely an FP&A tool. | The visualization and reporting capabilities are not as impressive or customizable as they are in other solutions. |

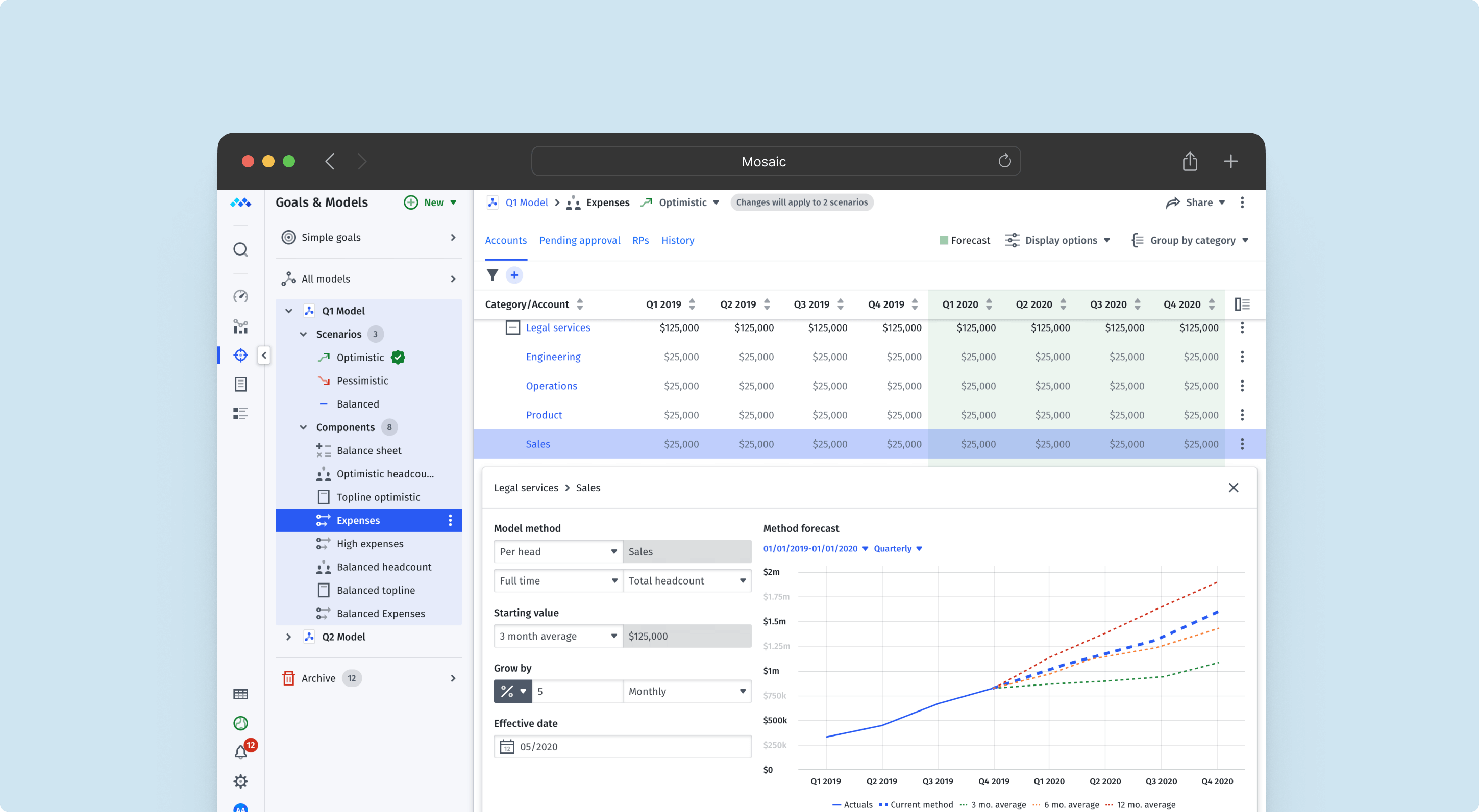

Acting as a command center for your most critical business leaders, Mosaic’s platform has an intuitive interface and impressive reporting functionality. Analysts and leaders alike can drag and drop different dashboard components to have all the data they need in one place instantaneously. Mosaic makes insights easy to share, act on, and learn from, leading to better business decisions and a less chaotic financial cadence within your organization.

Suitable for: Tech-savvy organizations that want a more cohesive way to plan, model, and test new financial scenarios.

Support Options: Support tickets are opened online and managed by the Mosaic support team.

Key Features: The Custom Topline Planning feature accounts for sales capacity, average selling prices, ARR, and other sales metrics to provide the best path forward to boosting your revenue.

| Pros | Cons |

| What-if models and scenario testing features are designed for functions beyond finance. Now, HR, sales, and marketing can all take their seat at the table and contribute to strategic business decisions. | Mosaic’s capabilities are strong, but the learning curve is sharp. Customers need to spend ample time on the platform to utilize it to its fullest and experience its benefits. |

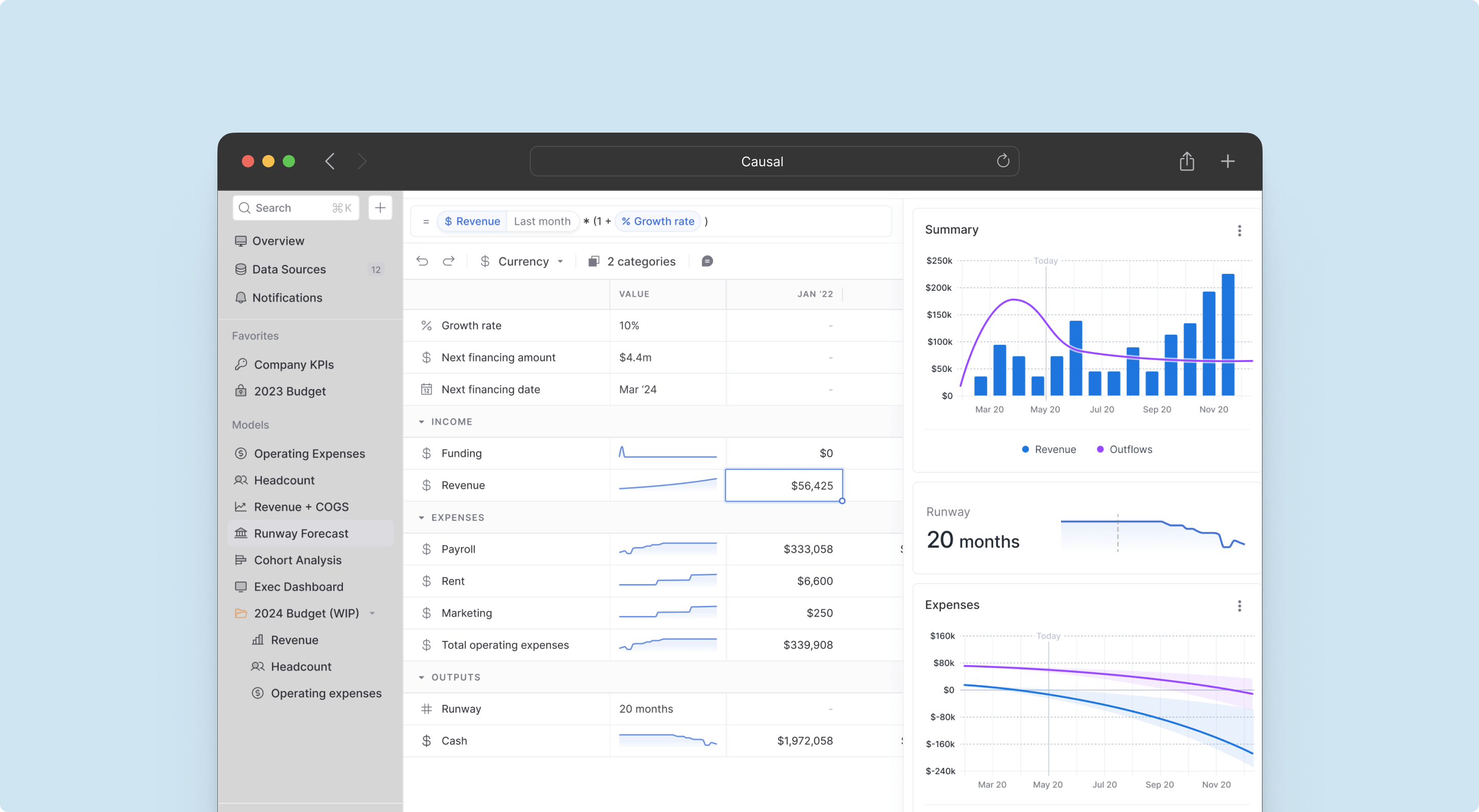

Live reporting is the bread and butter of Causal’s software solution. Instead of sending Excel sheets and trying to deal with multiple people editing clunky reports at the same time, Causal provides a one-point solution where every authorized user can make changes, collaborate, and see the most updated information. Great for modeling teams, business leaders, and financial experts, Causal is trying to shift finance from a department that gets caught playing catch-up to one that is at the helm of every major business decision.

Suitable for: Fast-growth companies that want a software that will grow with them.

Support Options: Customer support can be accessed via email or phone.

Key Features: Best-practice-oriented templates are a great way for users to start experiencing the benefits of Causal quickly. It helps organizations get started with more advanced modeling when they are ready to advance.

| Pros | Cons |

| Causal’s reports are versatile; with one report, investors can get their questions answered and department owners can get the insights they need to pull cost levers or take action to boost revenues. | Like most new tools, adopting Causal and learning how to make the most out of its offerings can take some time. Although you don’t need to be a computer science expert to master this solution, you will need some patience and determination. |

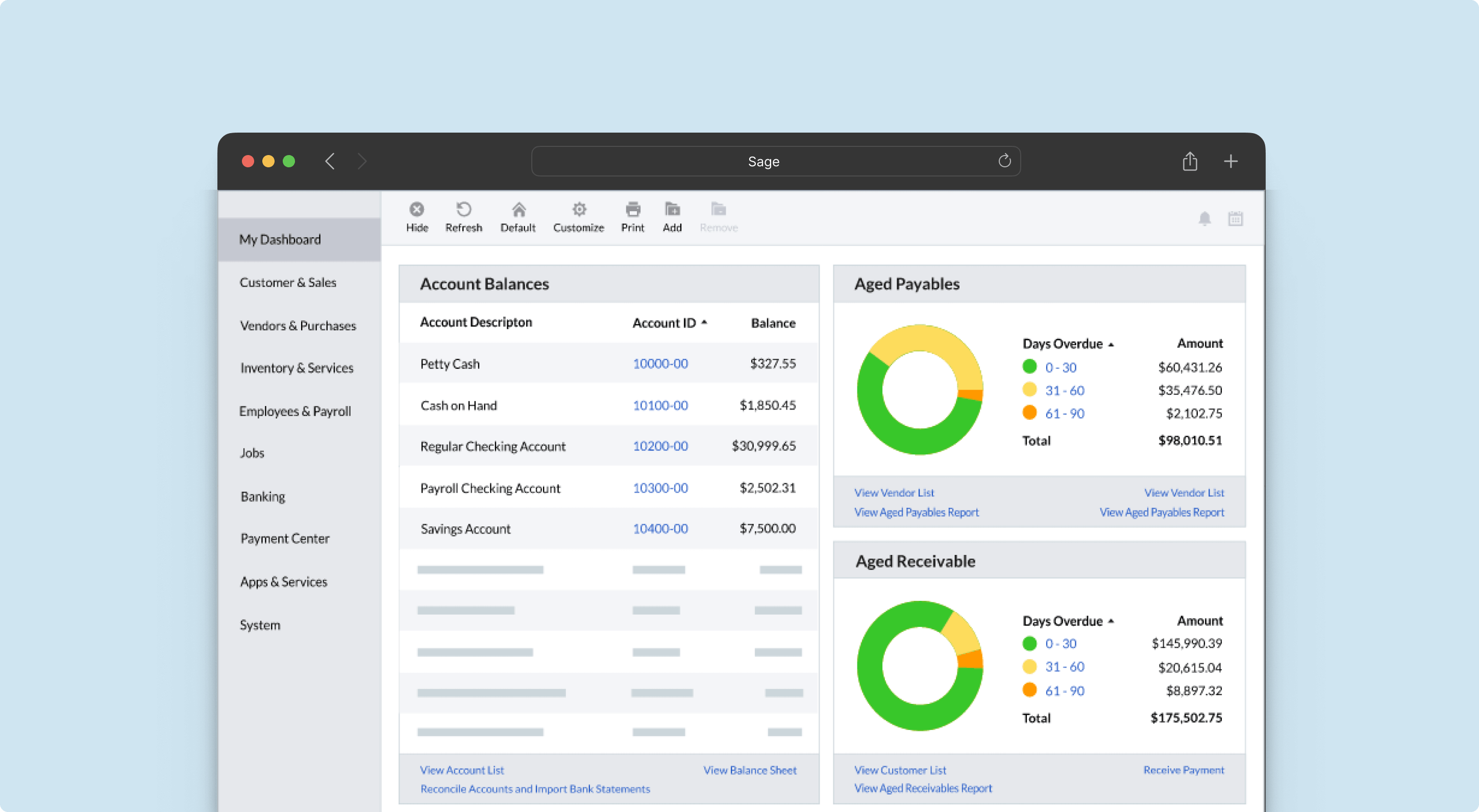

Around for nearly 25 years, Sage Intacct has been an industry leader in financial management software solutions for decades. For years, Sage Intacct has been working on the perfect cloud-based financial management software. Its product capabilities range from automating accounts payable, accounts receivable, and other core finance functions to interactive visuals and reports for leadership. A comprehensive FP&A solution, Sage Intacct can store large sums of data, analyze business trends, and provide accurate analytics to a range of audiences.

Suitable for: Ambitious businesses that need financial management software they can rely on.

Support Options: Support can be found online via chat, through email, or by phone.

Key Features: The Core Financials feature drives alignment between AP, AR, cash flow, and other finance and accounting functions. With Sage Intacct, business decisions can be made on up-to-date data.

| Pros | Cons |

| With a hybrid ERP and FP&A structure, Sage Intacct tracks money coming in and going out of the company, keeps source data clean, and is fully customizable. | Although the dashboarding capabilities are strong with this solution, it lacks some of the visualization sophistication of other products. |

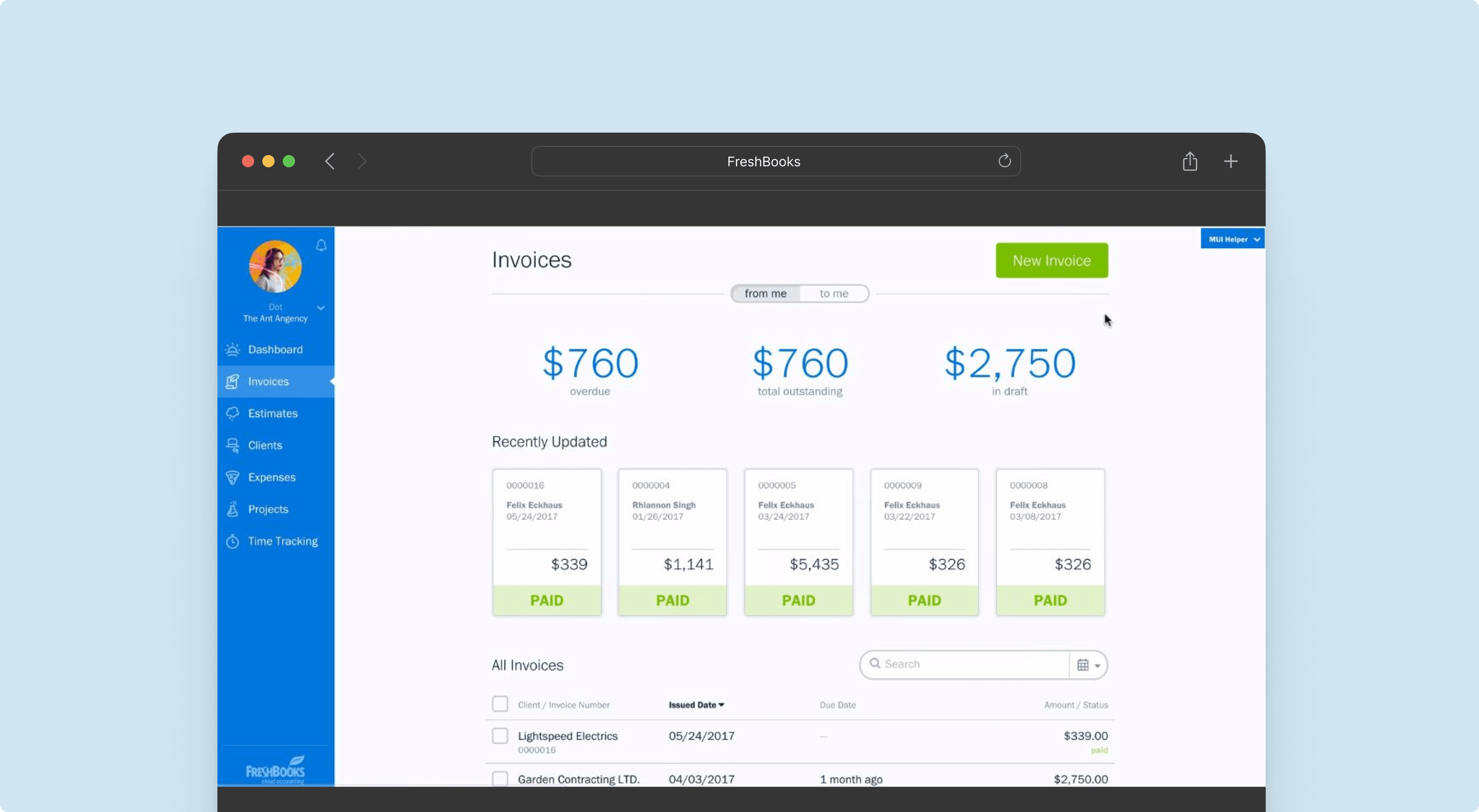

Known for bookkeeping and accounting functions, FreshBooks is great for small business owners, freelancers, and self-employed individuals to manage their business-related finances. This is a platform that gets the basics right; enabling simple invoicing processes and even some customer relationship functionality, FreshBooks is a tool that can get new businesses off the ground. However, for more robust FP&A needs, it may not meet all financial requirements.

Suitable for: Business owners with savings goals and invoicing needs who aren’t trying to overcomplicate everything else.

Support Options: Support can be found online via chat, through email, or by phone.

Key Features: There are dashboarding and reporting capabilities included in FreshBooks offerings, and those items, along with tracking everything you need for invoicing, filing taxes, and more create a product that can be used across industries.

| Pros | Cons |

| Perfect for individuals, the cost structure makes FreshBooks a great option for self-employed people are small businesses that are just getting off the ground. | It’s going to come up short when compared to many other mid-market financial management software solutions. It’s a bit more basic than its competitors and won’t be able to manage businesses that are creeping into that mid-market range. |

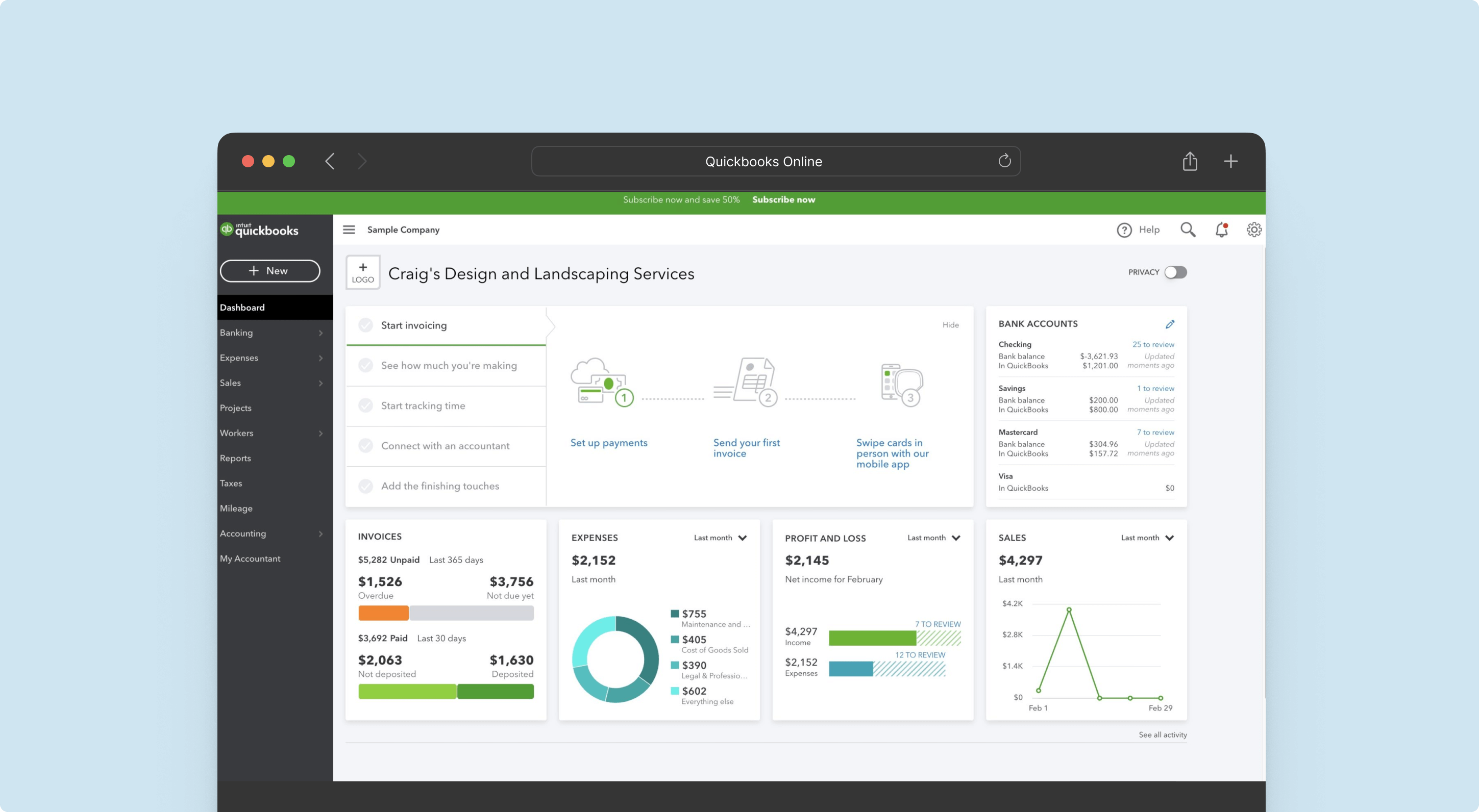

An all-in-one business solution, Intuit’s QuickBooks has grown from a basic accounting software for small businesses to a platform that tracks incomes, manages expenses, and makes tax time a breeze. For a free version, QuickBooks’ 30-day free trial makes this solution accessible for those business owners who are focused on expense tracking and reducing business costs. It also works well with Intuit’s TurboTax because the platforms share a parent company.

Suitable for: Self-employed people or small businesses that want to tighten up the basics of finance and make downstream processes easier.

Support Options: Support can be accessed via chat, phone, and email.

Key Features: Easy mileage tracking and expense reporting give users the best leg up when tax season approaches. This time of year can be stressful and chaotic, but with QuickBooks, most of the work is done ahead of time.

| Pros | Cons |

| Known for its ease of use, QuickBooks has always been designed with business owners in mind. No technical requirements, easy onboarding and training, and a painless implementation remove the barriers that so often stand in the way of using financial management software for business operations. | There is a mobile app for iOS and Android, as well as some pre-built reports, but QuickBooks does not offer the same advanced reporting capabilities or AI-powered modeling features that other solutions bring to the table. |

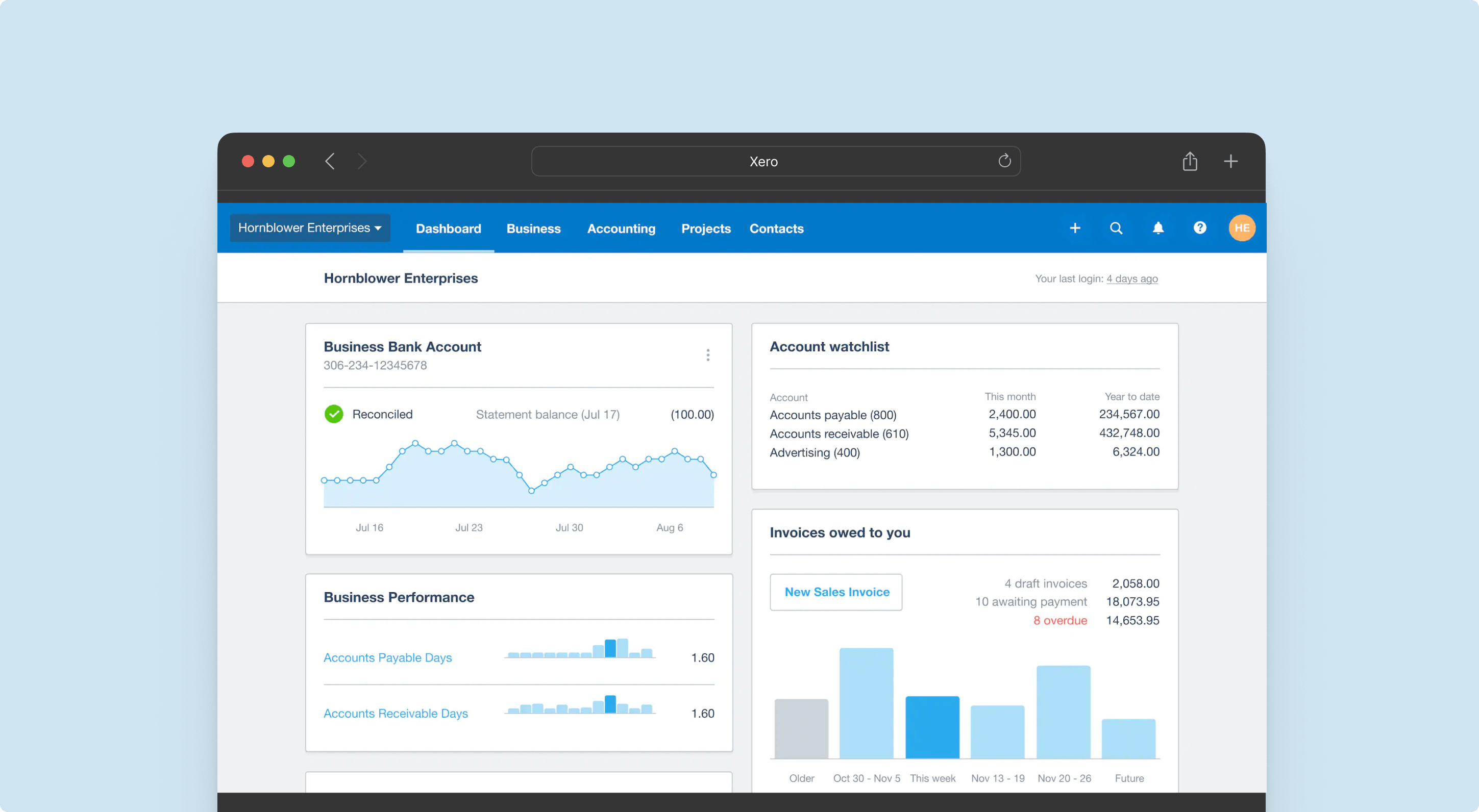

Whether you use a Mac or prefer the Windows operating system, Xero is a financial management solution that connects directly to all your business-related bank accounts to streamline budget management, expense tracking, and paying bills. Xero can be used to track inventory, store important files online, and create real-time financial reports. With strong data security measures in place and a helpful mobile app, you can run your business from anywhere, make financial decisions on the fly, and quickly adjust course when things get tough.

Suitable for: Organizations that need to get the basics right. If managing expenses and sending invoice reminders is cluttering up your to-do list, employ Xero to begin shifting your focus as a leader.

Support Options: Support can be contacted online or via email.

Key Features: Integrated bank transactions ensure that all your financial records are recorded in Xero and represent the most current financial snapshot. If you spend money on a business lunch, Xero will know before you finish your dessert, removing some of the tedious, admin-heavy work that often clutters the desks of entrepreneurs.

| Pros | Cons |

| Xero is a very practical financial solution that has perfected the basics of improving FP&A functionality. With an emphasis on core data cleanliness, Xero will keep your spending in line so you can focus on what matters most every day. | Automated reports and interactive dashboards only exist at a very basic level within Xero’s platforms. If you have a dynamic business with complex price mixes and a demanding leadership team, this solution won’t cover all the bases. |

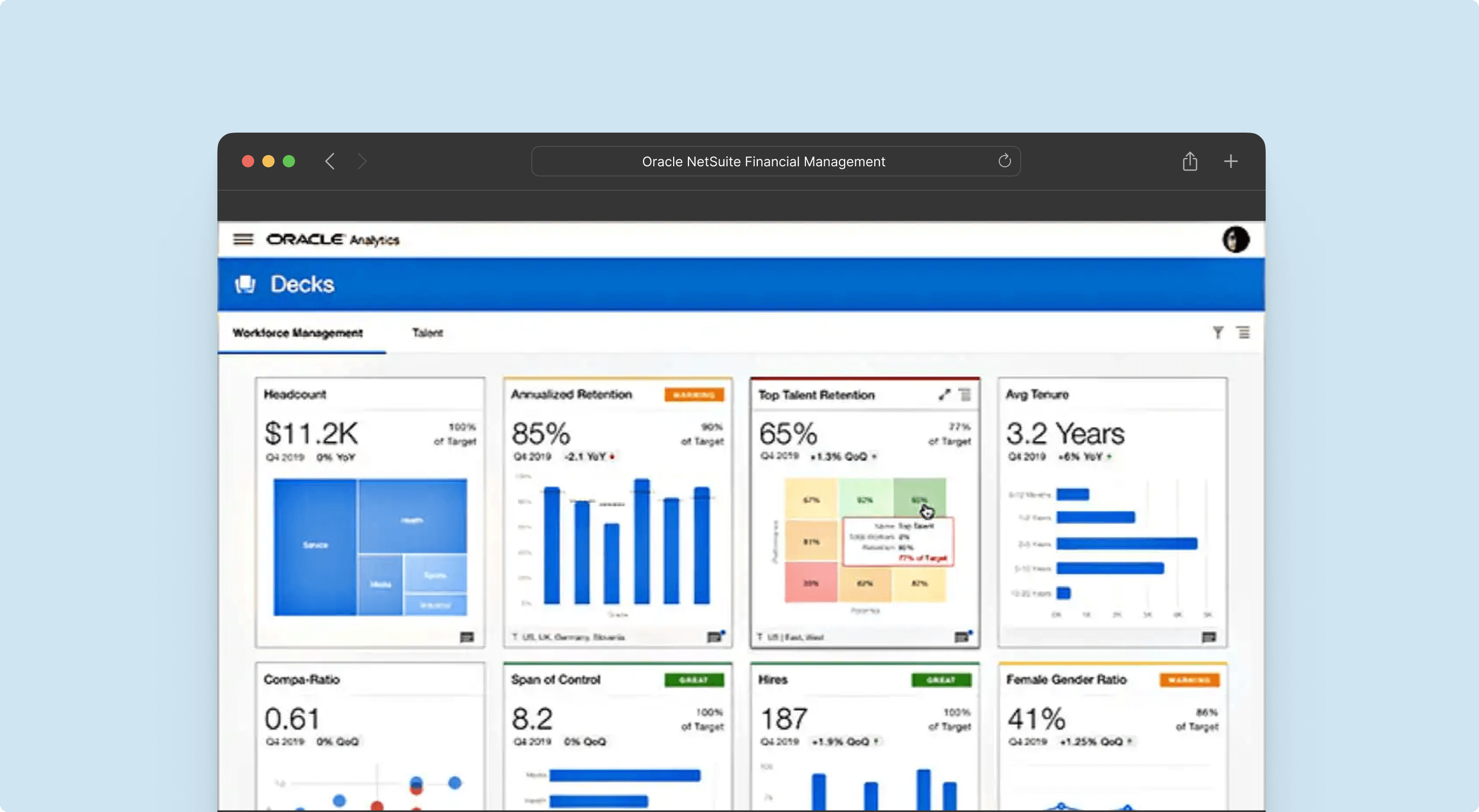

One of the most advanced ERP offerings on the market, Oracle NetSuite is a major financial management software that also extends into FP&A functionality. It has a long list of integrations and is used by over 34,000 businesses today. Because of its flexibility with currencies and other requirements, Oracle NetSuite is a chart-topper when it comes to finance software. There are reporting capabilities and built-in dashboarding features, but most organizations still choose to use an FP&A solution in congruence with NetSuite.

Suitable for: Mid-market businesses or larger that are looking for a trustworthy foundation for all their business data.

Support Options: Support can be found online via chat, through email, or by phone.

Key Features: NetSuite’s data warehousing capabilities make it a standout software solution for mid-size and large businesses. Unmatched data integrity and decent reporting functionality work together to make the platform valuable to its users on its own, but its real power comes into play when paired with one of the many available integrations.

| Pros | Cons |

| With a library of customizable reports and a single source of financial information, you can feel confident with NetSuite’s outputs. | A powerful ERP, NetSuite doesn’t have the same advanced reporting capabilities as some of the more targeted FP&A solutions. |

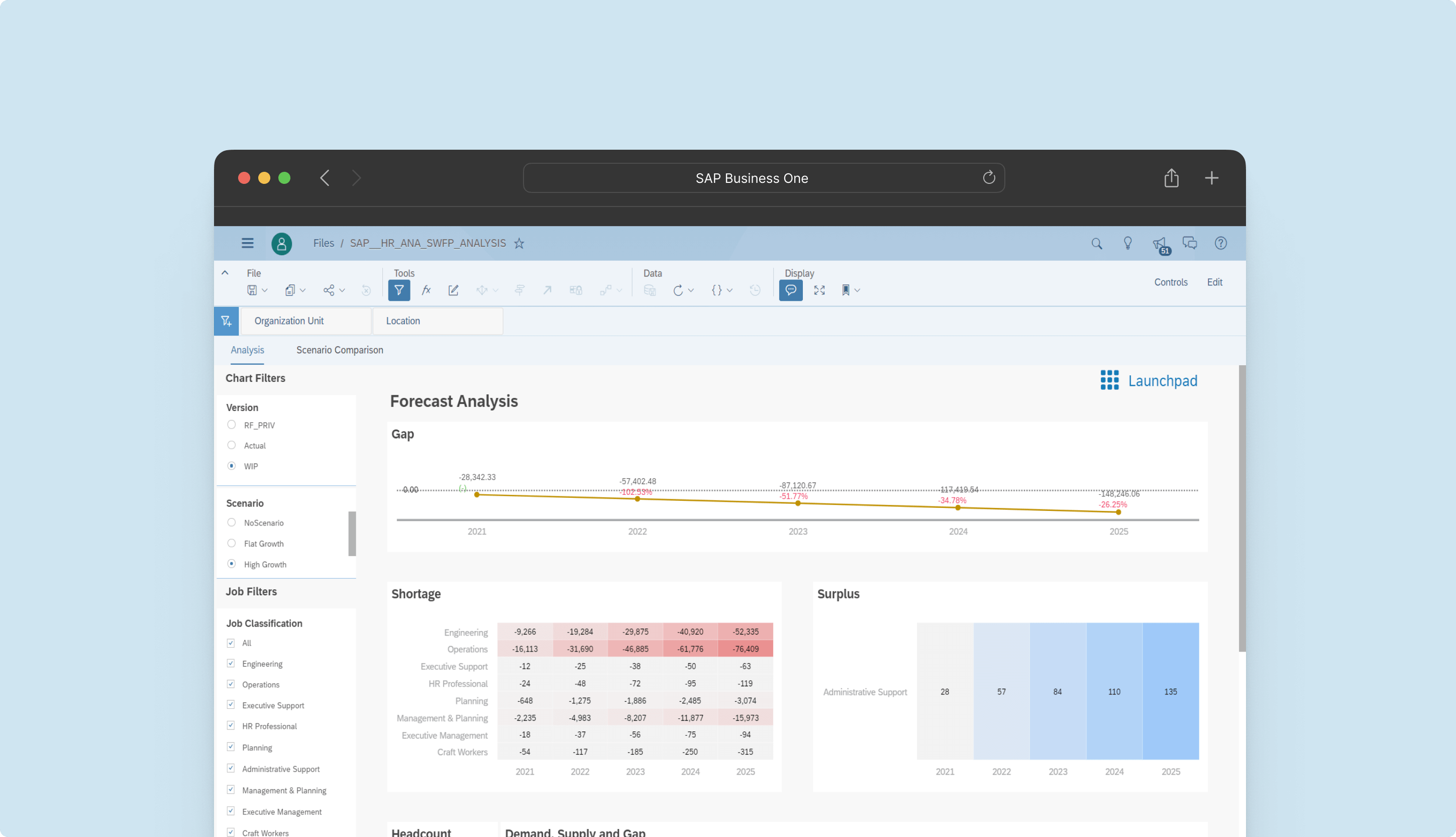

SAP’s ERP offering for small businesses comes in the form of SAP Business One. Similar to NetSuite, this solution started solely as an ERP before expanding into reporting and analytics for FP&A teams. Many tasks related to journal entries and accounts payable can be automated directly within SAP Business One, shifting the focus of these functions to more strategic items. SAP Business One’s impact doesn’t stop once it leaves the finance department; sales, inventory management, and many other functions are made easier because of this management software.

Suitable for: Finance teams that are looking to take center stage within the business and work more seamlessly with other functions.

Support Options: Support can be found online via chat, through email, or by phone.

Key Features: Positioning FP&A as a strategic “control center” within your organization, SAP Business One centralizes and streamlines the ways in which finance supports inventory management, marketing campaign management, and even warehouse planning.

| Pros | Cons |

| Truly capable of driving alignment within every organization, SAP Business One is a great tool that can be applied throughout the business, expanding much further than FP&A. | The reality of a solution like SAP is that its size can be a deterrent; it tries to do a lot and play in a lot of business areas, so it could lack specificity or customization features that are needed to optimize each functional business area. |

The corporate financial management solutions above are tried and true products that have been on the market for many years. As the role of FP&A changes, these solutions have to adapt and improve, and we feel confident that each one is investing in the future of finance for all of their customers. In the same way CRM solutions can alter the customer experience, these platforms will change FP&A from the inside. As with any business decision, the tool you choose needs to serve your needs, fit your requirements, and improve your team’s capabilities.

With Abacum, FP&A goes from running reports and searching through expense line items to a central business function that deploys tools to change how your business operates. It’s an organization that is unphased by change and sturdy enough to withstand the demands of today. Abacum’s solution should be paired with a reliable ERP, but once you have both of those products in place, the impact of FP&A will be limitless.

Financial management software is something that can change as your business does, but as a mid-market business, Abacum understands what it takes to manage a business that is growing, changing, and constantly shifting priorities.

If you’re looking to take charge of your finance function, start here.

Budgeting and accounting management are under the umbrella of financial management, but financial management overall is much broader. It encompasses all finance functions that a business needs to operate. While financial management considers things like next-generation reporting and intricate scenario modeling, budgeting software and accounting management tools focus more on traditional business tasks like AP, AR, and payroll.

Pricing is majorly dependent on the platform itself and the number of users. For some solutions, you might pay a few hundred dollars per month, but for others, it could be a few thousand.

The best financial management system for small businesses is one that works for your financial situation. If you’re looking for advanced reporting and analytics, focus on a solution that has robust offerings in that space. If you just want an ERP, something like SAP or NetSuite might be right for you.

Abacum provides an all-in-one financial management reporting platform. It makes it easy to communicate and inform leaders, get approval signatures when needed, and test out the impact of different business scenarios. From start to finish of each monthly cycle, Abacum’s offerings will improve financial management reporting every day.

Discover how finance automation drives better decision making