Key KPIs all finance teams should be tracking

Learn more ->

The debt-to-equity ratio (also known as the “debt-equity ratio” or “D/E”) is a measurement used to calculate how much debt a company uses to finance its current assets against its shareholder’s equity. In other words, it measures the amount of debt a company owes versus the value of its shares.

A high ratio indicates that the company has borrowed heavily compared to its current stockholders. In contrast, a low ratio suggests that the company has little debt and relies mostly on retained earnings and cash flow to fund operations.

A ratio greater than one means that the company has more debt than equity; conversely, a ratio less than one means that it has more equity than debt.

The debt-to-equity ratio is calculated by dividing the total payment obligations by the original investment into the company. When calculating the debt-to-equity ratio, finance leaders take into account both the initial investment and the earnings retained over time.

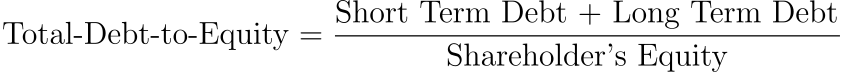

A common way to calculate the debt-to-equity ratio is to divide the sum of a company’s long-term debt and short-term debt by its total equity.

D/E = (Short-term debt + Long-term debt) / Shareholder’s Equity

The balance sheet of a company contains the data required to compute the D/E ratio. The amount of shareholder equity is calculated by taking the value of current liabilities from the value of total current assets on the balance sheet.

Assets = Liabilities + Shareholder Equity

This financial ratio helps lenders understand how much money a borrower needs to borrow, based on what it owns. In addition to the financial statements of a company, banks look at the following factors when calculating the debt-to-equity ratio:

A good debt-to-equity ratio depends on how much debt the company needs to grow and whether you are looking at a company in its early stages or a mature enterprise. The amount of additional money required to finance business activities and a company’s ability to obtain it depends on several factors. These include cash flow, revenue growth, interest rates, and borrowing money.

The most important factor is the company’s cash flow. If a company generates enough cash to pay off its business debt obligations, it doesn’t need to borrow money. However, if it lacks sufficient cash flow to cover its operating expenses, it must take out additional loans to keep functioning. When a company takes out business loans, it incurs additional costs, including interest payments, fees, and taxes. This increases its overall cost of doing business.

Another key factor affecting a company’s ability to raise funds is its revenue growth. Revenue growth indicates how quickly a company expects to increase its sales revenue. In general, the lower the revenue growth, the less likely it is that a company will be able to raise funds.

Interest rates also play a role in determining whether a company can afford to issue debt. Higher interest rates make it harder for businesses to access additional credit.

In addition to those three factors, another way to look at the debt-to-equity ratio is to view it as either a current ratio or a payout ratio. The current ratio compares the company’s net income to its total outstanding current debt. On the other hand, the payout ratio looks at how much of the company’s earnings go toward paying off debt versus investing in expanding the business.

As a rule of thumb for an average company, a D/E ratio below 1.0 is considered a relatively healthy value. Ratios above 2.0 are generally considered high. However, this average ratio will vary depending on the industry.