Get a complete view of your business with financial performance management software

Improve your financial management with Abacum. Start taking a proactive approach to budgeting and forecasting, while monitoring and analyzing your business operations in real-time to, ultimately, make smarter decisions that drive business growth.

FINANCE TEAMS DRIVING GROWTH WITH ABACUM

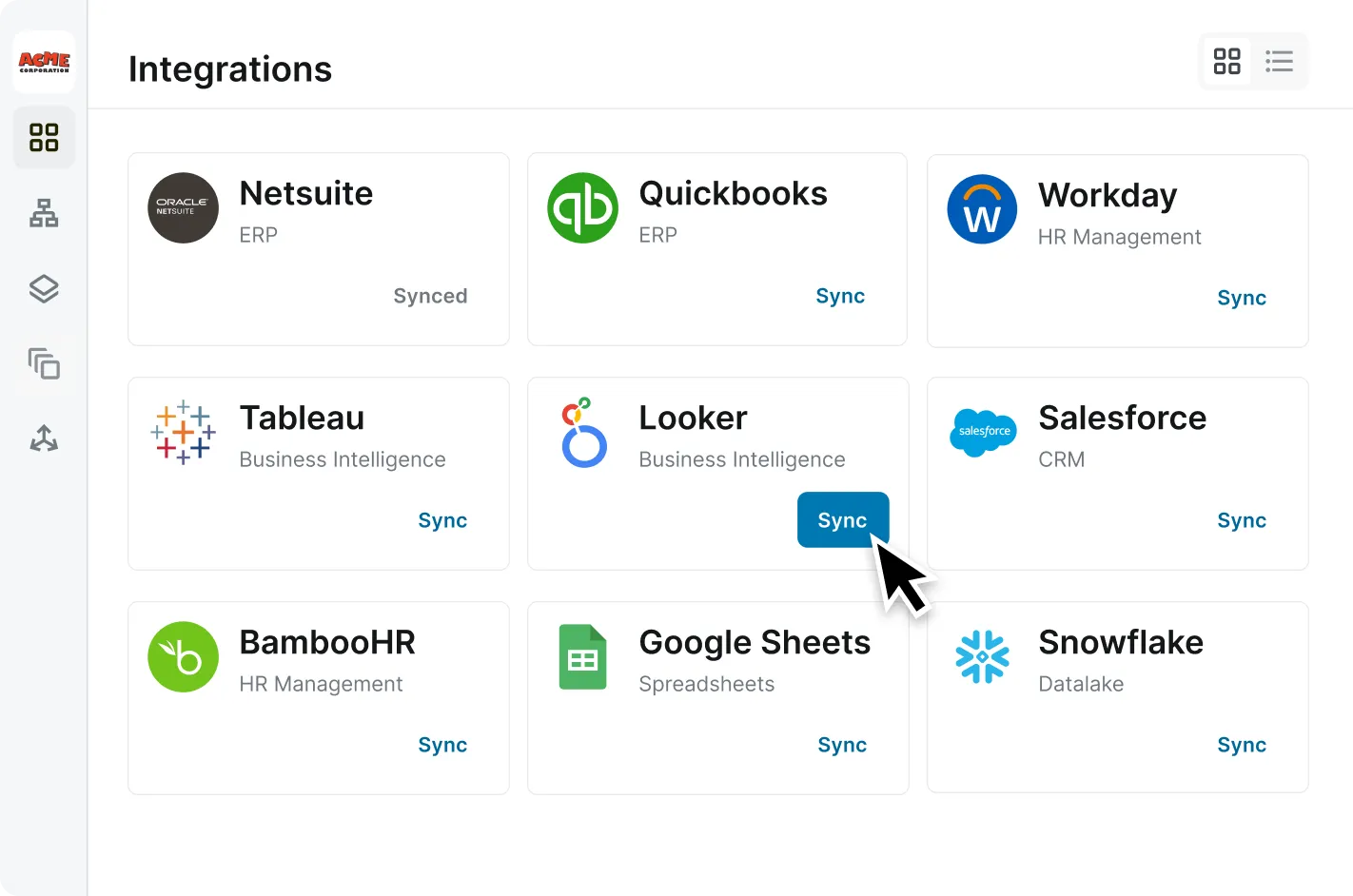

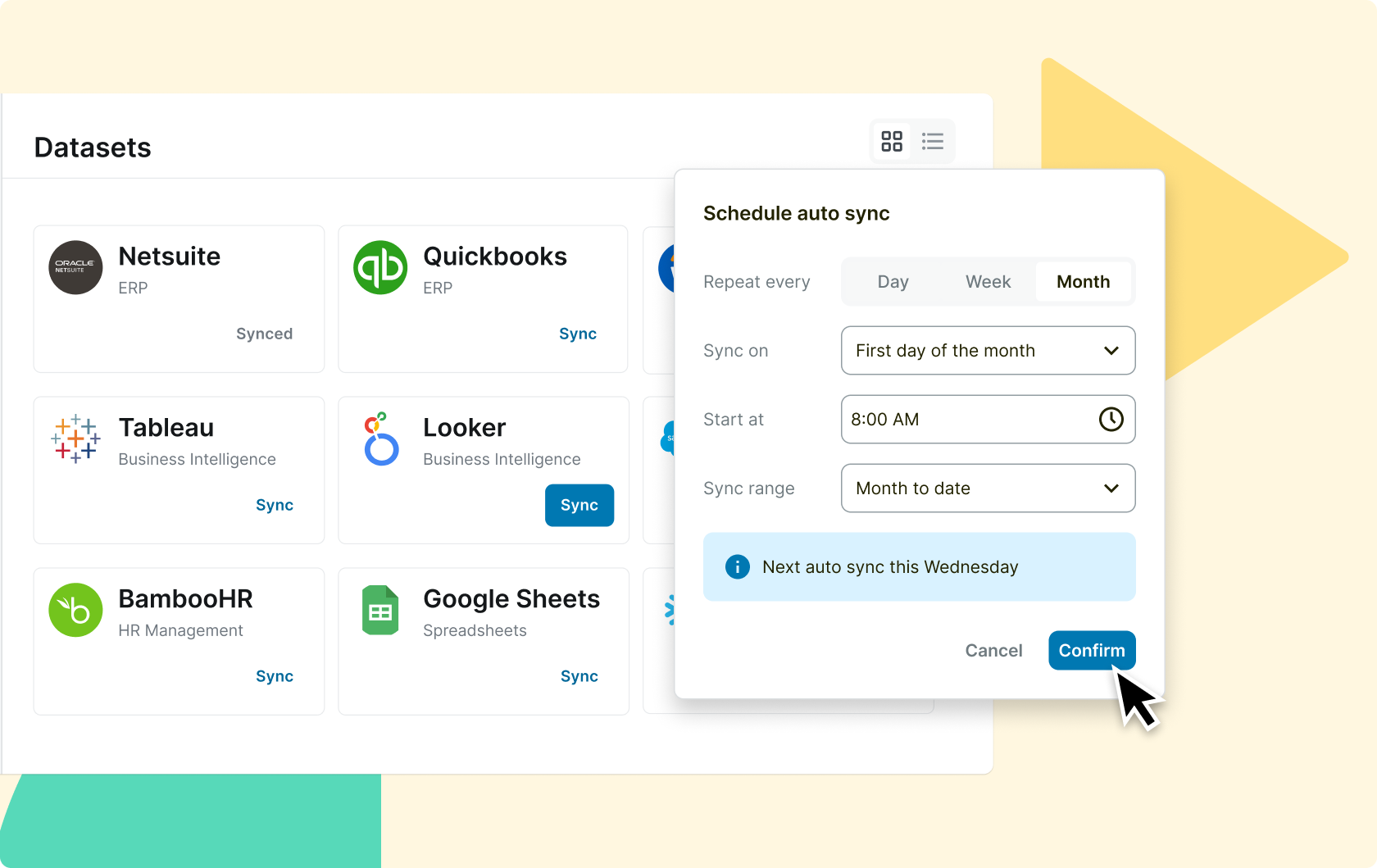

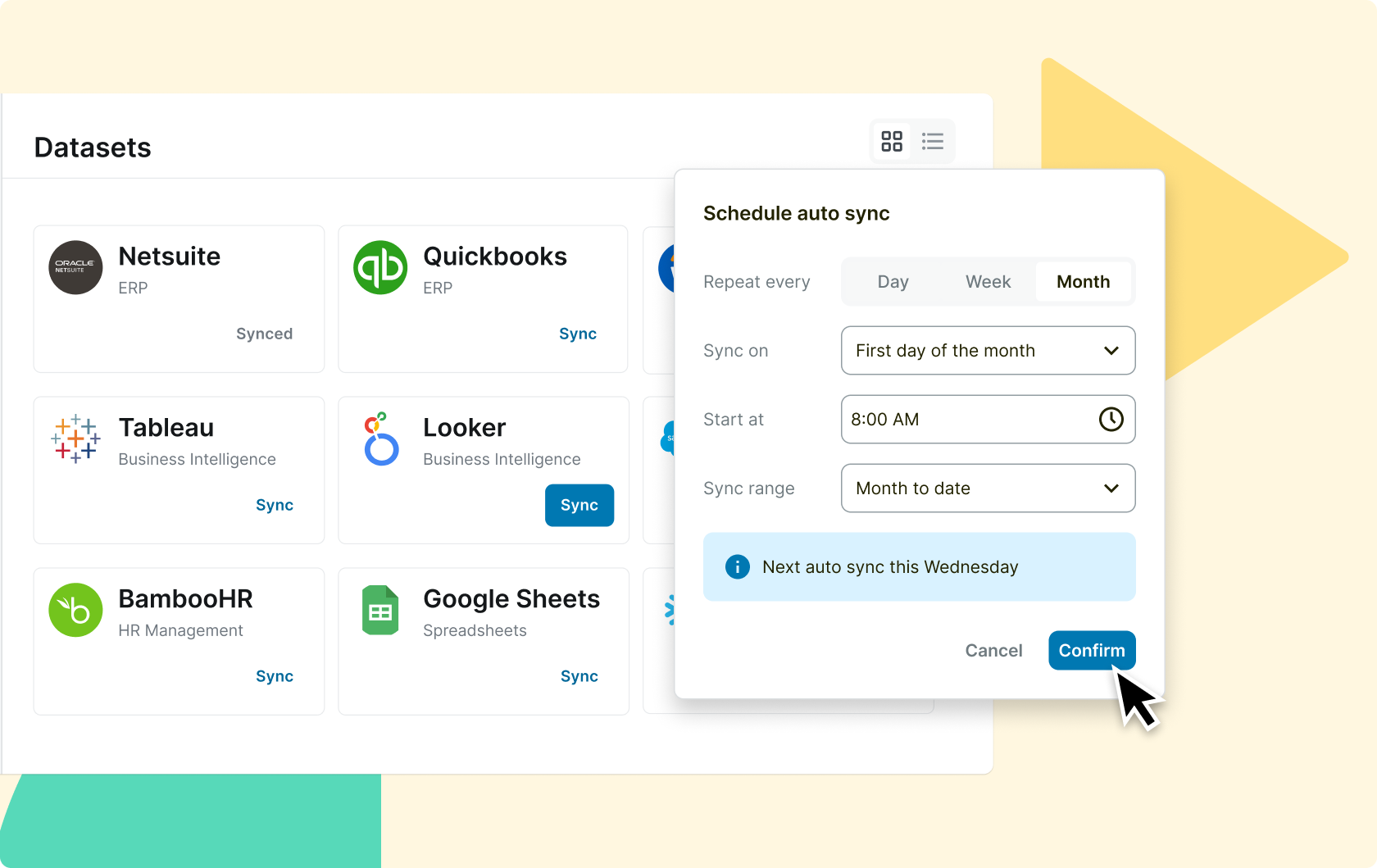

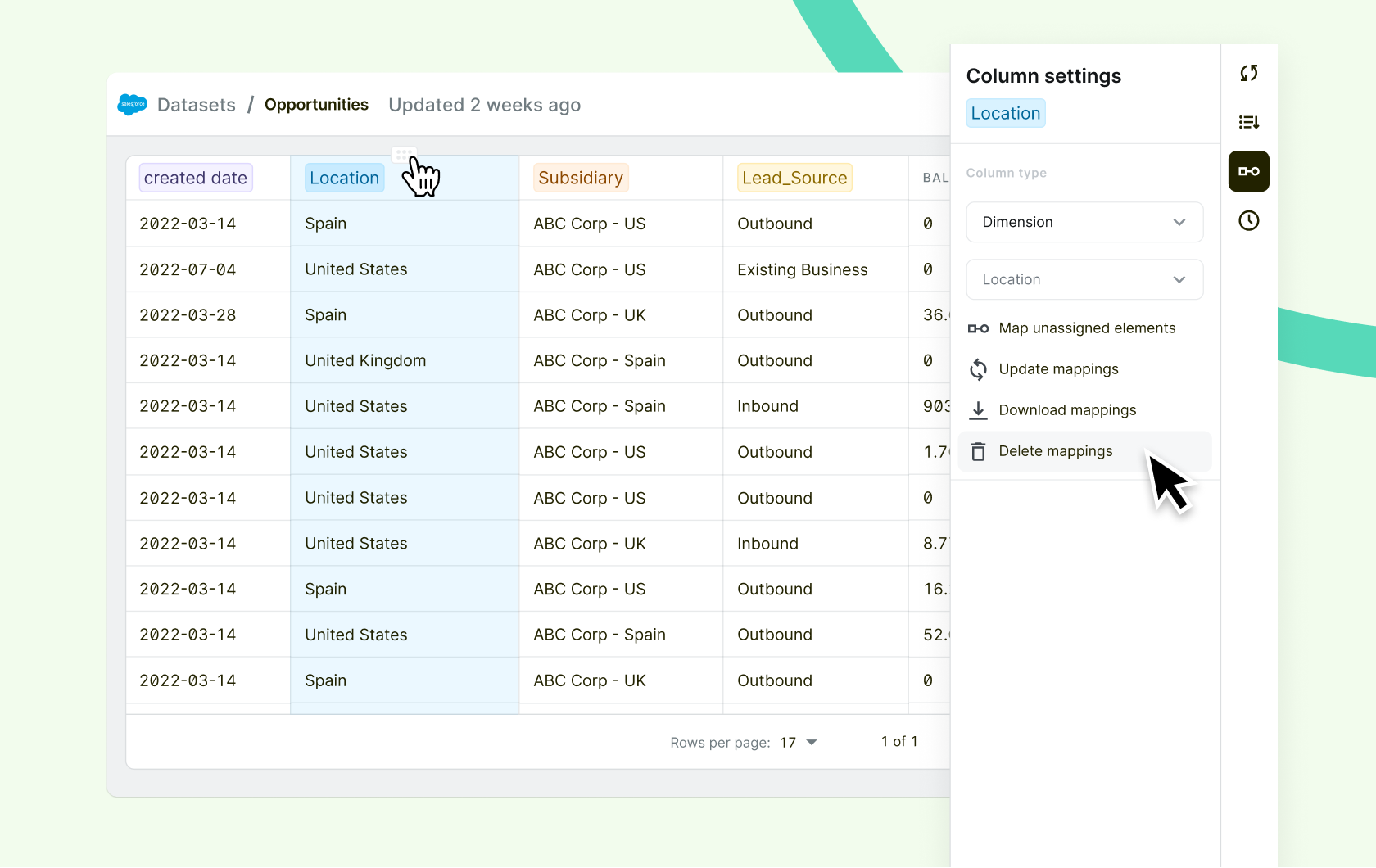

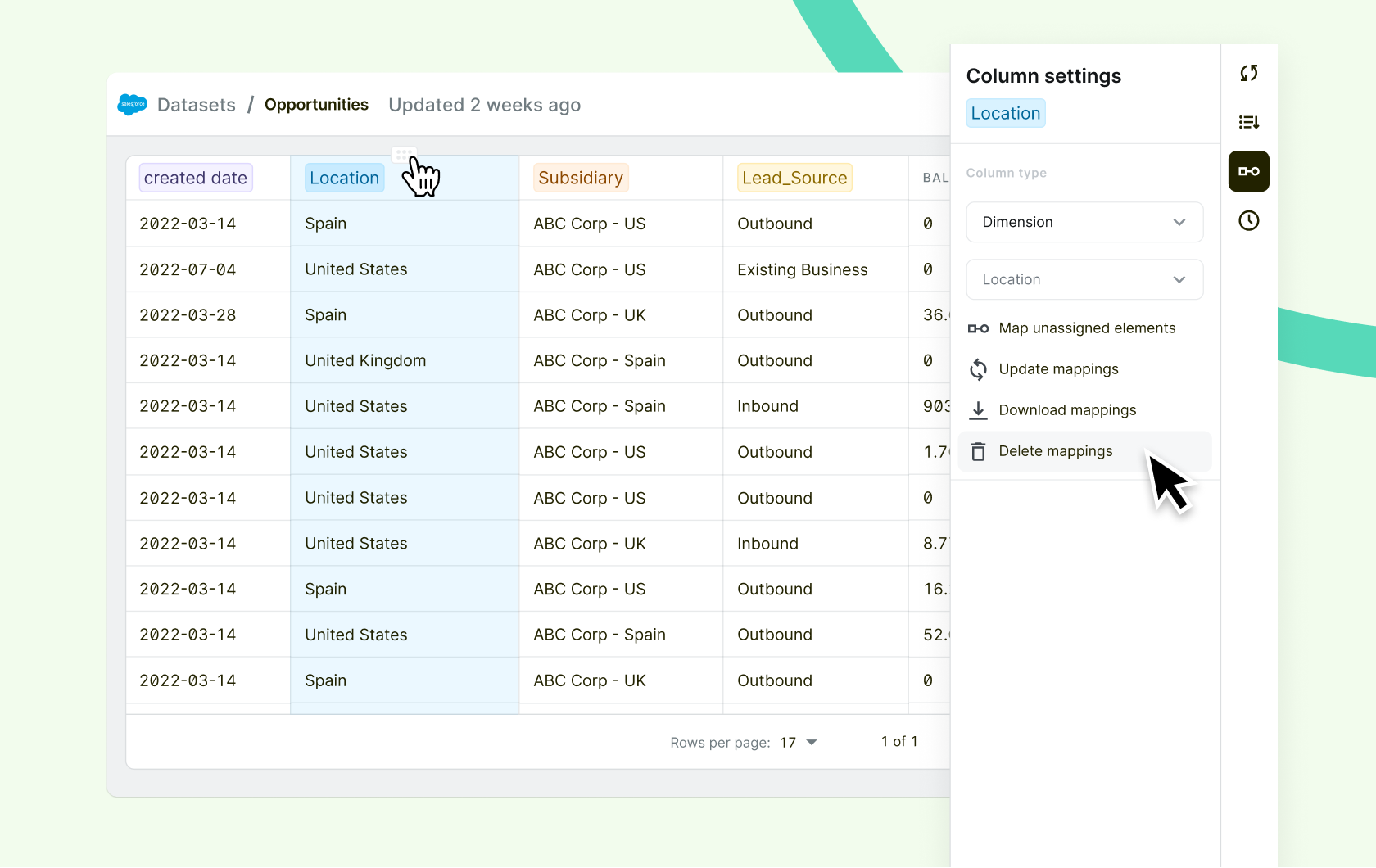

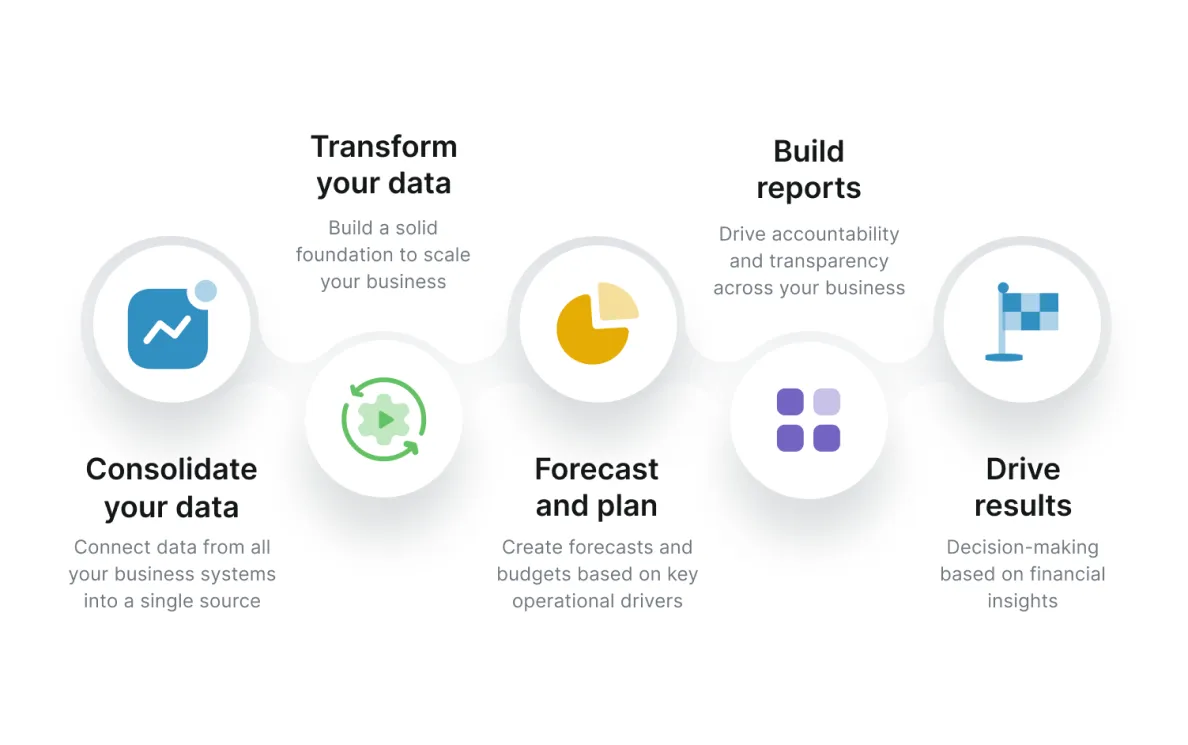

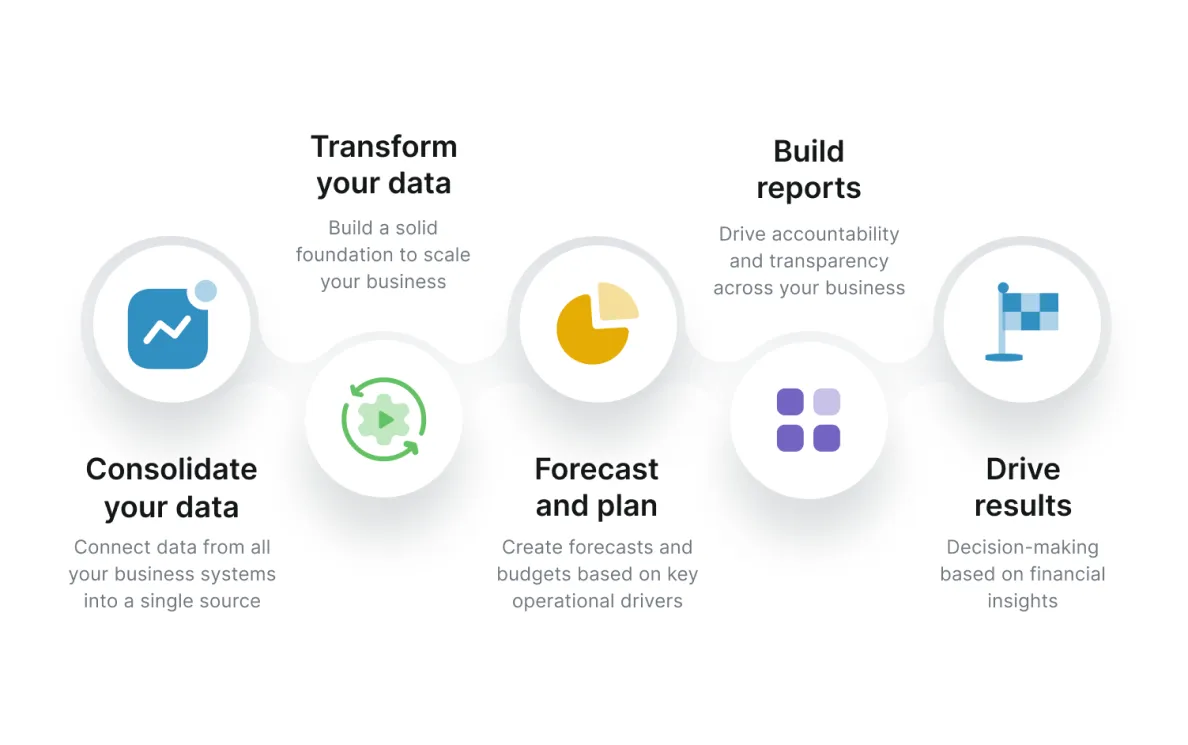

Streamline data management and focus on performance analysis

Abacum’s one-click data synchronization eliminates the manual copying and pasting required for data consolidation. Its streamlined workflows enable you to more efficiently collect data, define variables, and extract insights, all within the same platform, allowing you to focus on value-add tasks relevant to your company’s future performance. By optimizing your data management process, Abacum allows you to leverage your data for growth and make informed financial decisions to improve your bottom line.

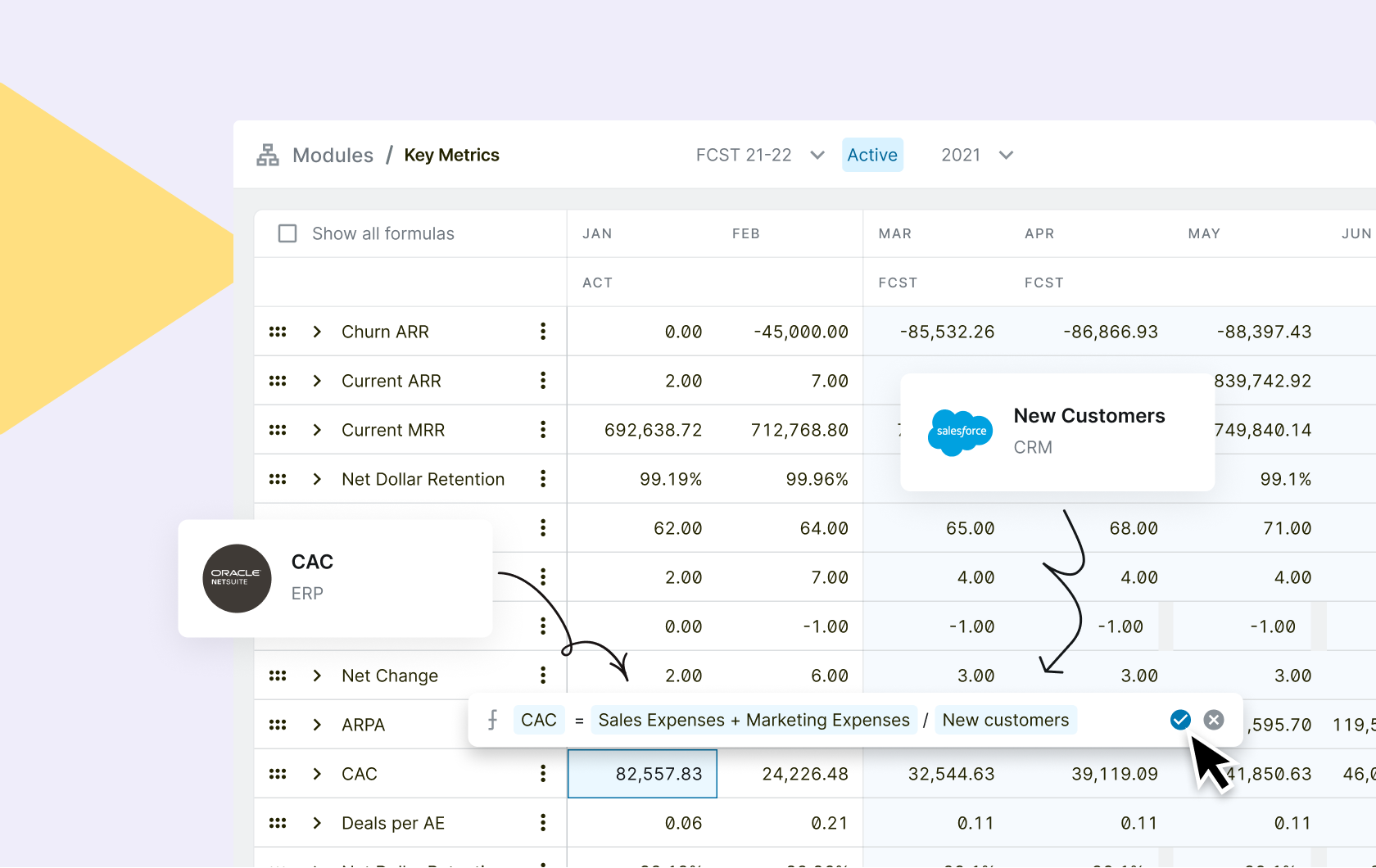

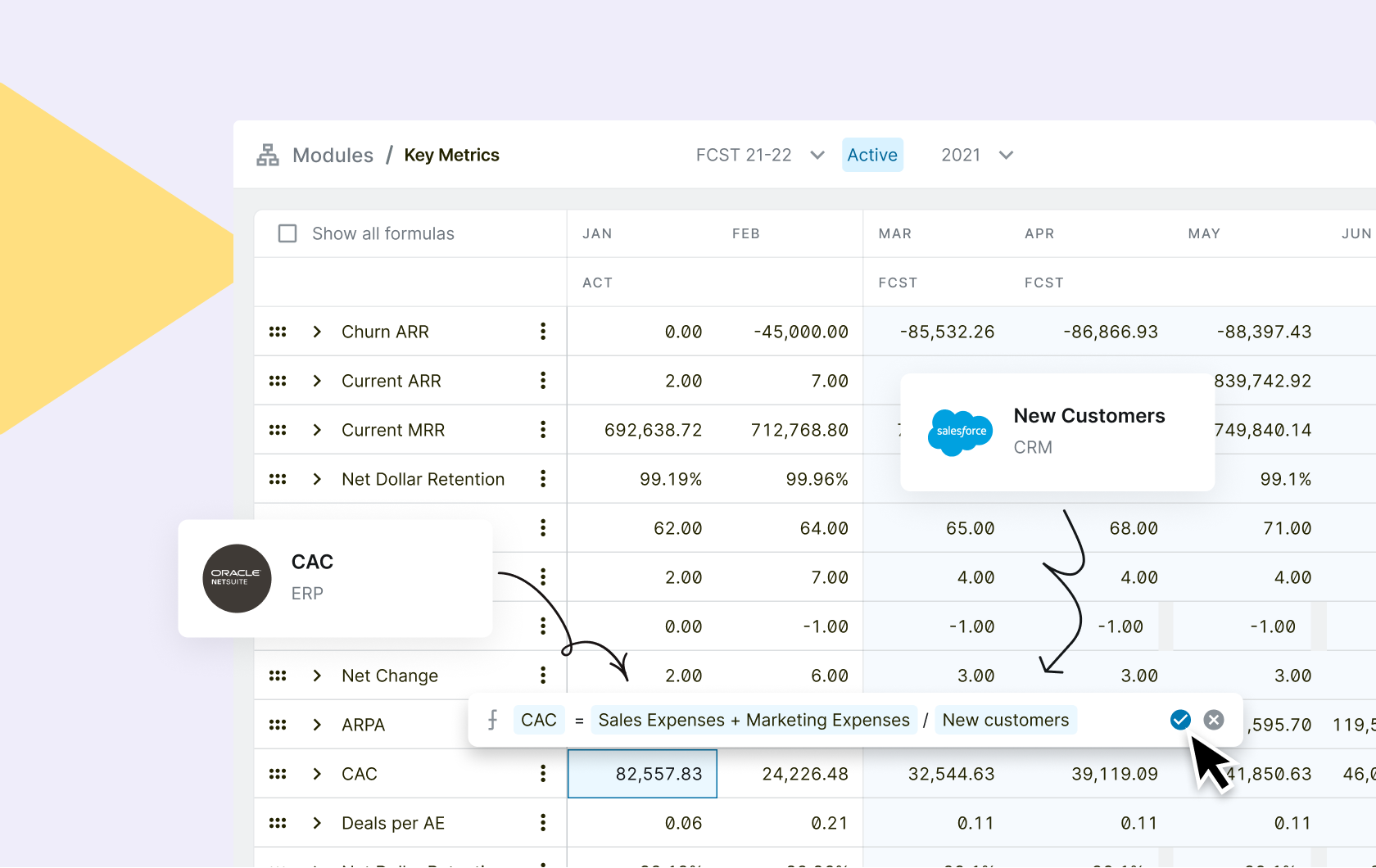

Balance precision and accuracy in financial modeling

In today’s fast-paced business environment, spreadsheets are no longer sufficient for effectively analyzing a company’s financial future. While still valid, they lack the dynamic capabilities required for accurate projections. To address this limitation, organizations can leverage financial performance management software, like Abacum, which provides accurate dimensional-level modeling. By consolidating and organizing all business data into a single, centralized platform, Abacum simplifies the forecasting process. This enables the delivery of detailed results segmented by customized dimensions, empowering finance leaders to plan based on precise and reliable figures. With Abacum, you can make better-informed decisions and effectively navigate your business’s financial performance in real-time.

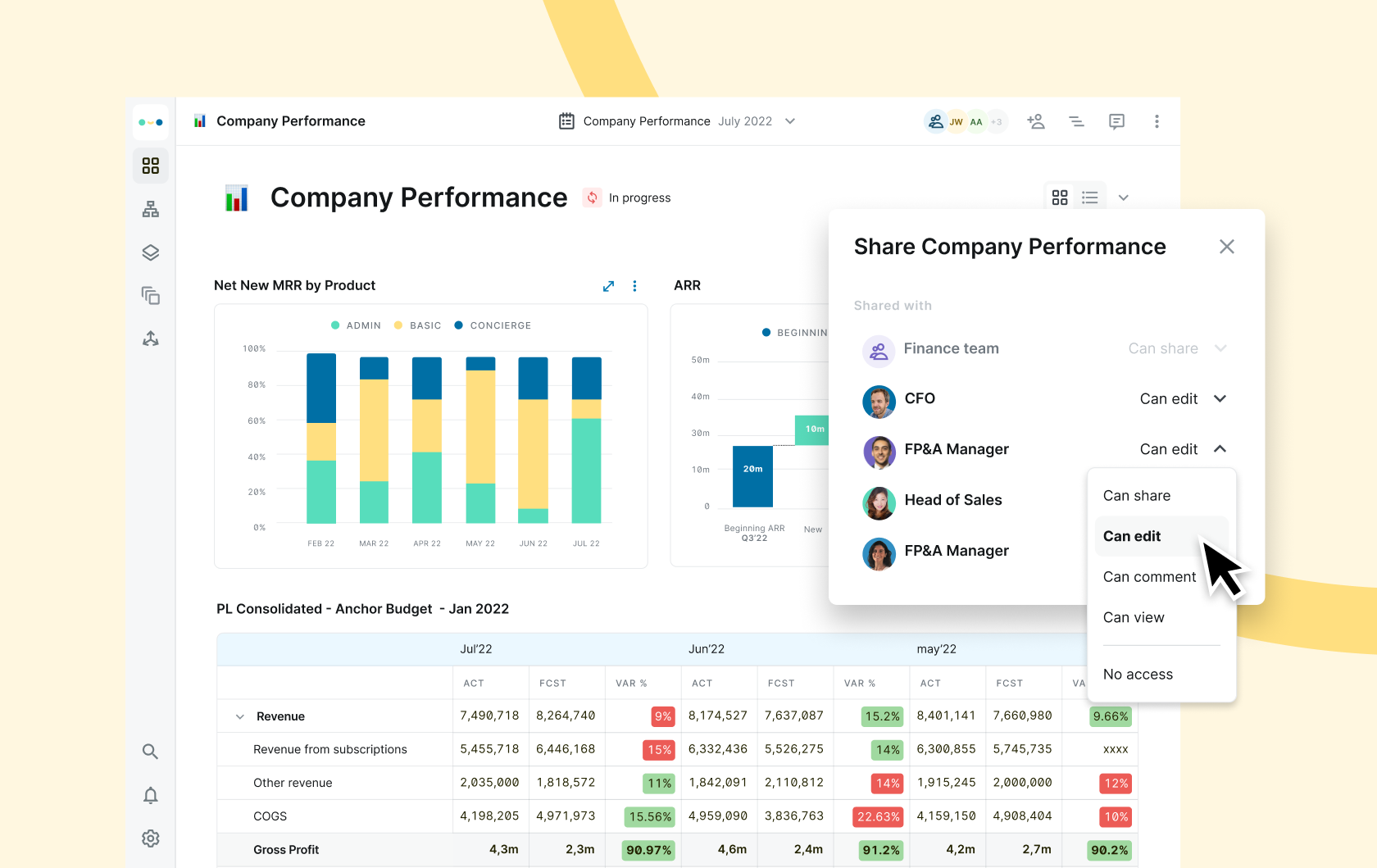

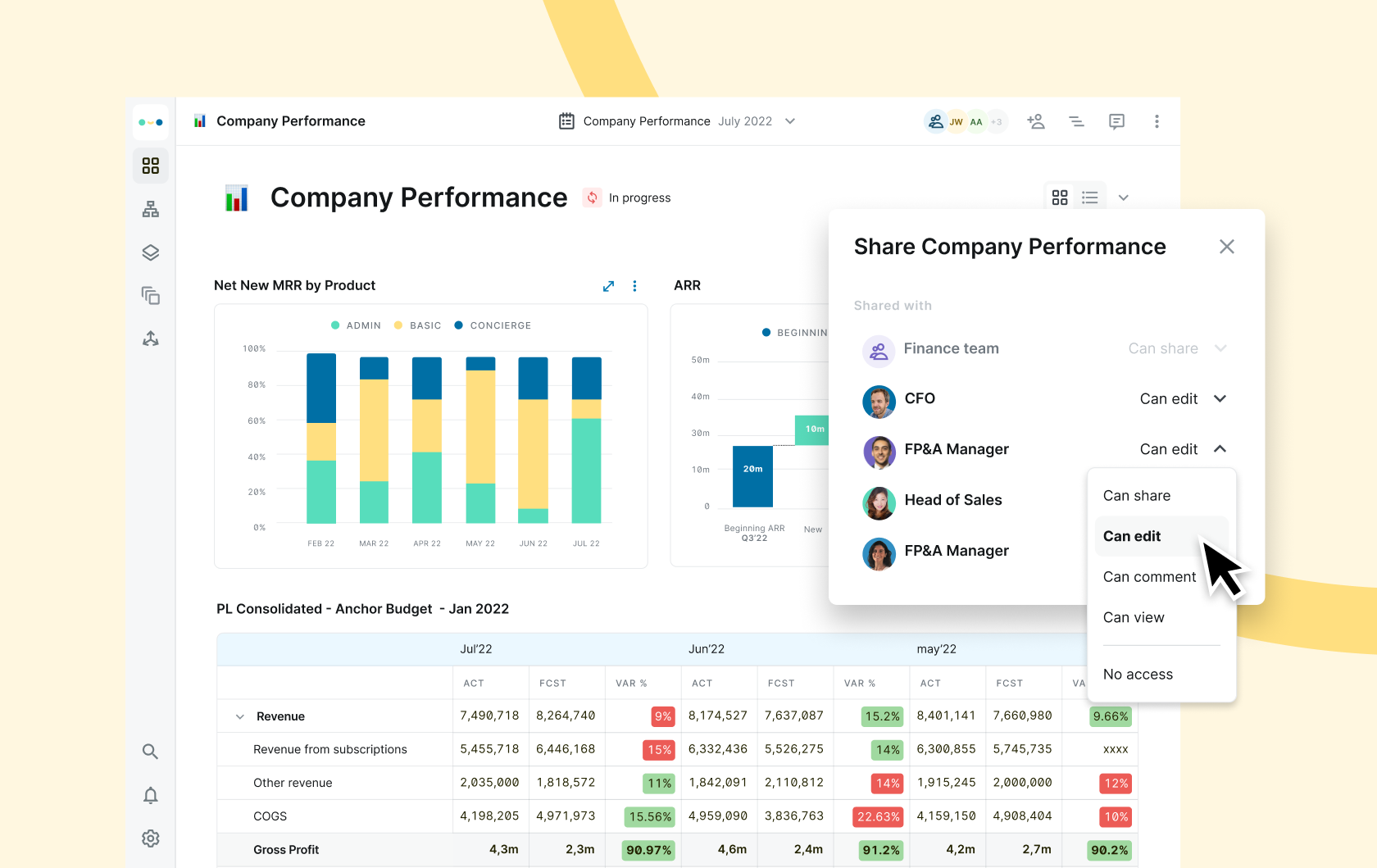

Break down data barriers for cross-departmental collaboration

Abacum is a robust business planning software that provides a complete suite of financial planning and analysis features. Its user-friendly interface, coupled with advanced collaboration and visualization tools, allows budget owners to effortlessly interpret and share complex financial performance data, enabling better foresight. Abacum’s finance workspace promotes transparency and collaboration across all levels of the organization, making it easy for everyone to participate in the process. By making Abacum a part of your tech stack, you will enable stakeholders from across your organization to take a more active role in the Finance process on a platform that is accessible to all, not just the spreadsheet-savvy.

Join the new era of financial reporting with Abacum

Embrace the new era of financial reporting and upgrade your financial processes with our cutting-edge financial performance management software. Abacum’s powerful automation and data validation features allow you to save time and improve accuracy, while also streamlining the process of comparing actual financial results with expectations. Its customizable platform makes sharing insights with stakeholders a breeze, which enables you to spend more time planning for the future. Moreover, Abacum’s intuitive experience helps your team collaborate seamlessly and stay aligned on business objectives. Don’t get left behind in the old way of financial reporting. Join the new era with Abacum.

As many integrations as your business needs

Abacum breaks down data barriers and empowers businesses to analyze and consolidate information from any source system with ease.

Xero

Tableau

Salesforce

Faster set up

Simplify the management of your data by consolidating it into a single source of truth

Dimensional level of data granularity

Elevate your decision-making by accessing detailed data insights

User-friendly interface

Collaborate seamlessly with your team using an intuitive platform

Drive business growth with financial performance management software

Say goodbye to tedious spreadsheet management and empower your finance team’s efficiency with Abacum. With real-time data and a single source of truth for all your business information, our financial performance management software helps finance leaders make strategic decisions that drive business growth. Its user-friendly interface and visualization features facilitate cross-departmental collaboration, making it easy for non-financial stakeholders to get involved. Unleash the full potential of your Finance department with Abacum, gain detailed insights on your business performance, and achieve better alignment towards your company’s objectives.

Be the finance hero your company needs

Join our Finance community and share how Abacum impacted your organization.

Michael Cikanek

VP Finance

“Getting the investor report done quickly while having accurate analysis & insights to show, was a key priority for the finance team. I saw the time & effort it took to prepare the reports, & I thought that it could be done in a better & more efficient way.”

SaaS

Vicente Esteve

CFO

“It’s great to have a tool that also serves the interests and needs of our investors. Abacum will provide them an easy way to view our performance and interact with us.”

SaaS

Maria Ares

VP Finance

“With 8 countries and the complexity of dealing with multiple currencies, Abacum automated our manual tasks, accelerated the process of P&L reporting, and gave us more time to produce better analysis.”

EdTech

Still have questions? We’ve got answers.

What is financial performance management software?

Financial performance management software is a specialized tool that helps organizations track and analyze their financial performance. This software provides detailed data and insights into essential business areas such as revenue, expenses, profitability, cash flow, and more.

It also helps in creating budgets and financial forecasts to facilitate informed decision-making. In addition, FPM software like Abacum generates real-time reports to ensure that the organization is achieving its financial objectives. As a result, FPM software is a crucial tool for business leaders who want to enhance their financial management practices and drive growth.

What is financial performance management?

Financial performance management (FPM) is the process of measuring, analyzing, and improving a company’s financial performance. It typically includes financial forecasting, budgeting, data analysis, and reporting to ensure that a company meets its targets and objectives. FPM helps identify areas for improvement in operations and suggests methods for driving efficiencies. It can also provide insights into potential risks or opportunities and help with decision-making.

What are the benefits of using performance management software?

Financial performance management software can provide organizations with a comprehensive overview of their financial status. This software enables managers to efficiently access crucial data, analyze trends, and make well-informed decisions. Automation of processes like budgeting, forecasting, and data analysis with modern software can increase efficiency and reduce operational costs.

In addition, such software can offer valuable insights into potential risks and opportunities, thus aiding organizations in making smarter decisions and maximizing their return on investment.

What is the difference between CPM and EPM?

CPM, or Corporate Performance Management, software is a type of performance management focused specifically on financials. It is managed primarily by the financial department, handling tax documents and financial statements. CPMs are designed to help organizations organize, analyze and report on their financial data to improve their decision-making. Businesses use CPM software to gain visibility into corporate performance through interactive dashboards, scorecards, advanced analysis, and more.

In comparison, EPM (Enterprise Performance Management) enables organizations to take an even deeper look at their performance by encompassing all areas of the enterprise across departments such as Finance, Sales, and Marketing. Companies can utilize this type of business performance management software to identify the success factors that can impact their overall performance and use data visualizations to make better decisions based on those insights. Through improved processes such as objective setting, key performance indicators (KPIs), strategy maps, and balanced scorecards, businesses have access to more holistic views of their organization’s dynamics.

Why is financial performance important for SMBs?

Financial performance is an important indicator for small and mid-size companies as it measures how well organizations are achieving their financial objectives. Financial performance includes both short-term and long-term goals, such as improving profitability, increasing revenue, and minimizing costs. By monitoring an organization’s financial performance, businesses can identify areas of improvement that need to be addressed. Furthermore, tracking financial performance allows companies to assess the overall health of the business and make decisions regarding future investments.

Is Excel a financial management system?

Excel is a spreadsheet program developed by Microsoft, and it can be used for financial management purposes. It has useful features that allow users to store and analyze data, create graphs and financial reports, and even build financial models. Excel is not a full-fledged financial management system, however. While it can provide some of the same functions as a dedicated financial management software package, it does not offer the same level of integration, automation, and reporting capabilities.

If you want to enhance your corporate performance management process, consider utilizing advanced software such as Abacum. Financial performance management software is a valuable resource for business leaders who aim to elevate their corporate performance management process by enhancing the way they monitor and manage their finances.

| Optimize Your Finances with Performance Management Software |