Financial and operational data consolidation made easy

Say goodbye to endless hours spent trying to extract data from all your platforms. With Abacum, you can automate the data consolidation process and have a single source of truth right at your fingertips.

TRUSTED BY MODERN FINANCE TEAMS GLOBALLY

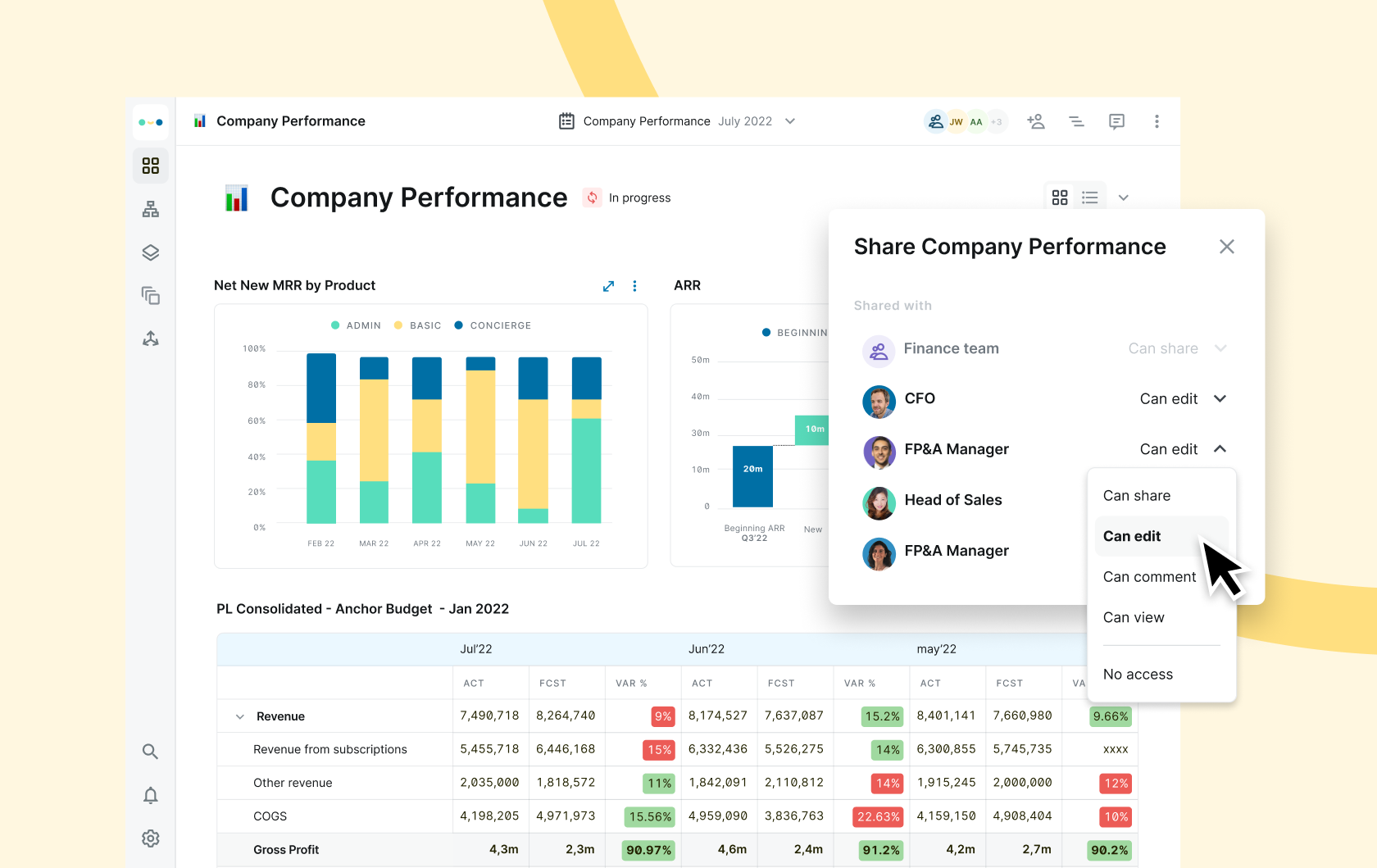

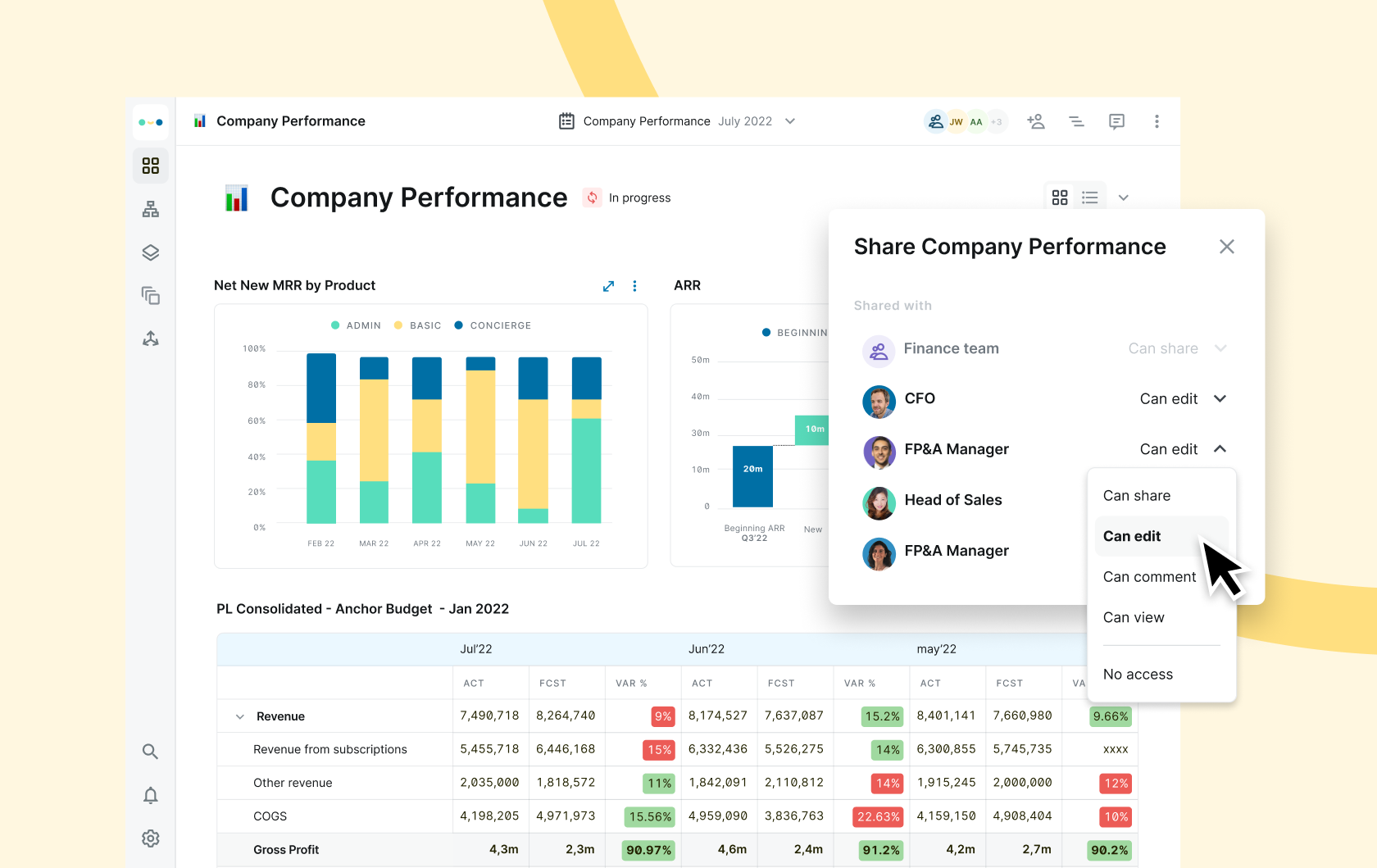

Gain insights without sifting through endless spreadsheets

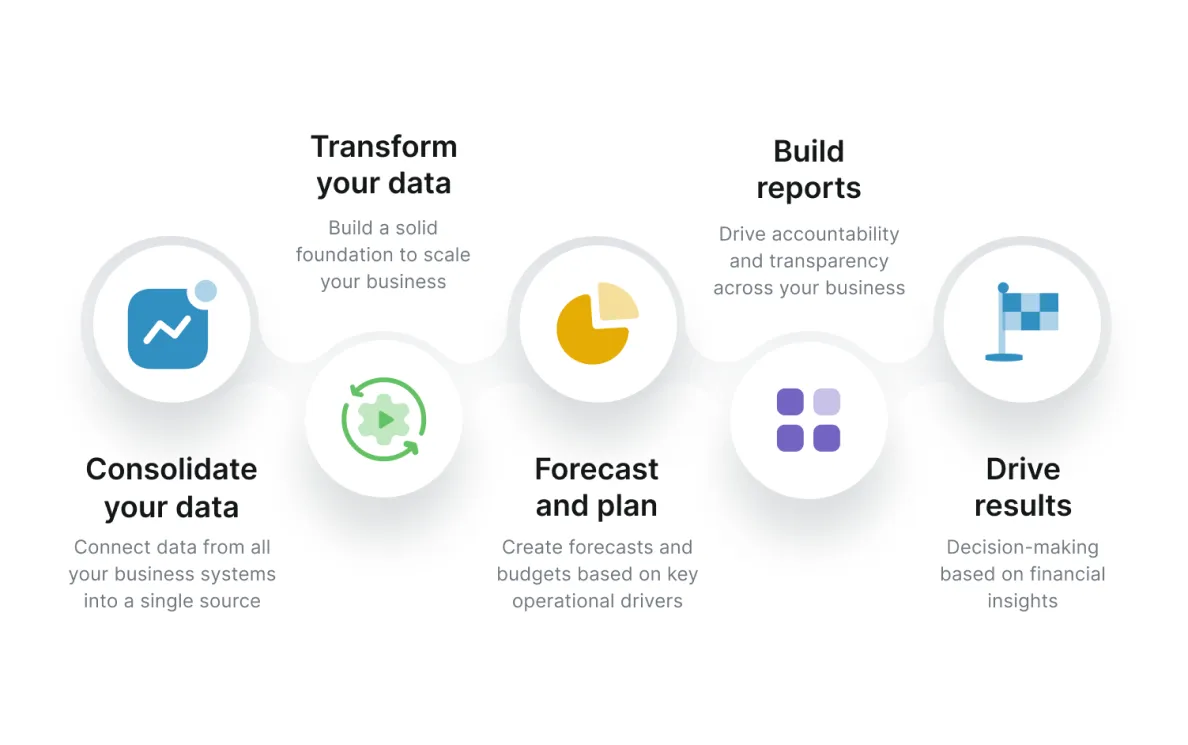

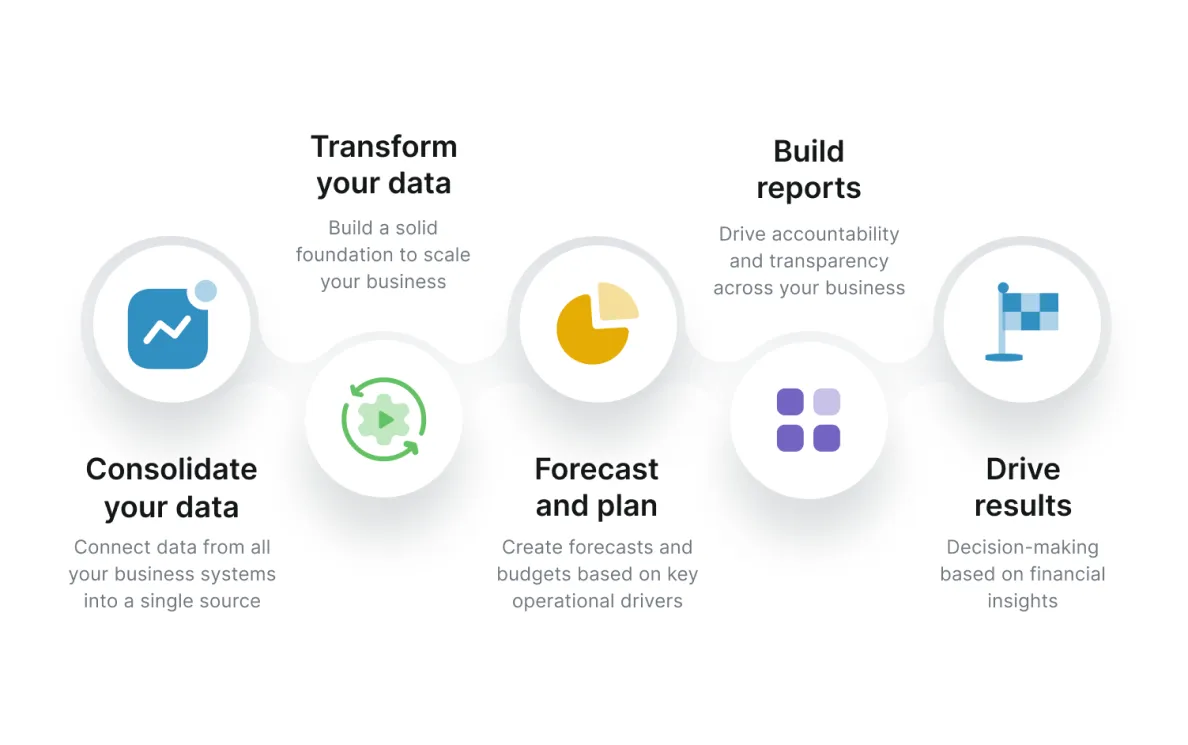

Accessing the right data can be a challenge for many businesses, especially when dealing with large amounts of unrelated spreadsheets or disconnected platforms. While spreadsheets are easy to create, many companies struggle to maintain them. This is because manually loading, cleaning, and validating all of a business’s data from multiple tabs is far from efficient. Luckily, Abacum can help you consolidate your data from multiple sources in a few clicks and transform it into valuable insights that drive decision-making and strategy development.

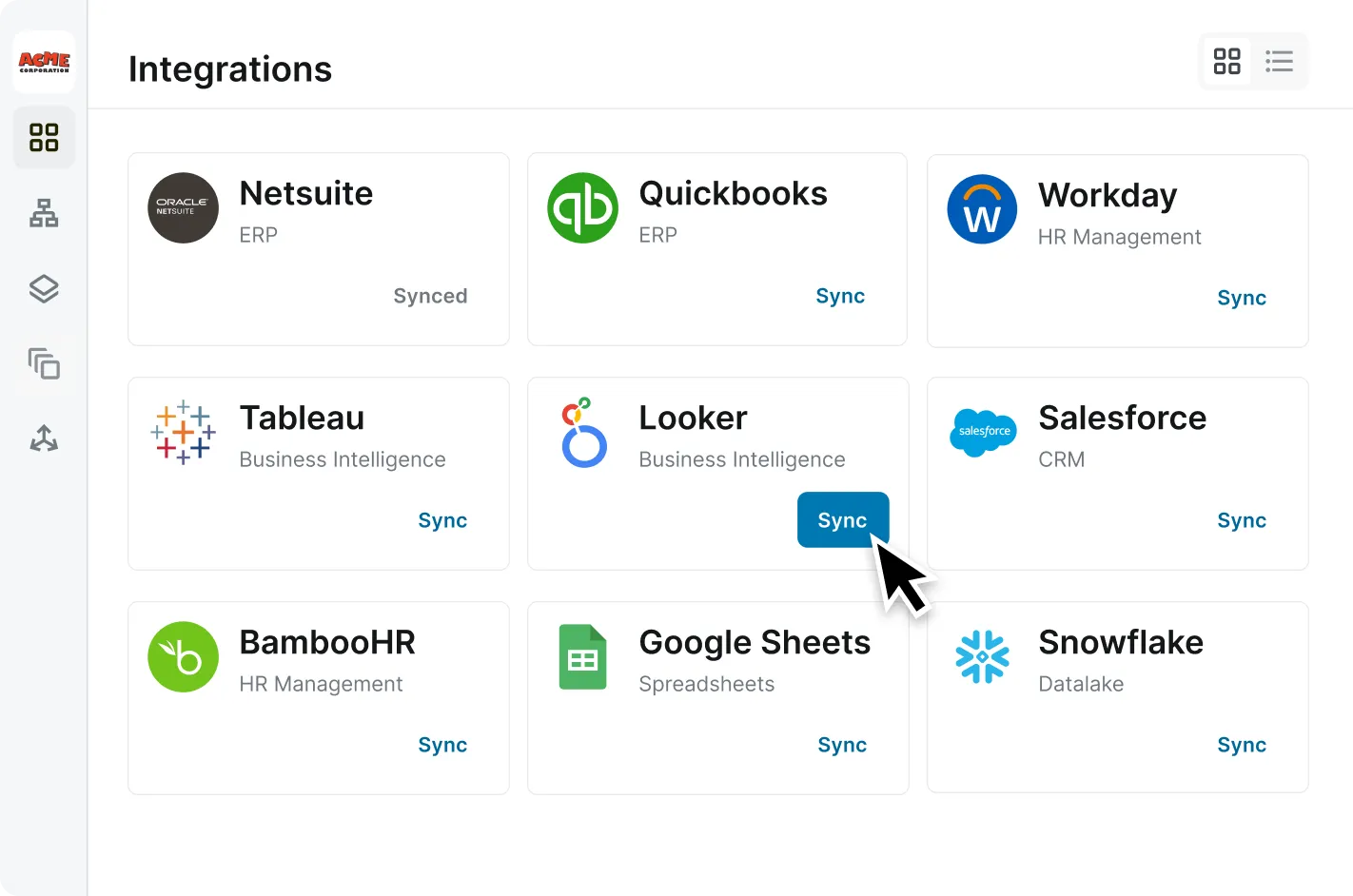

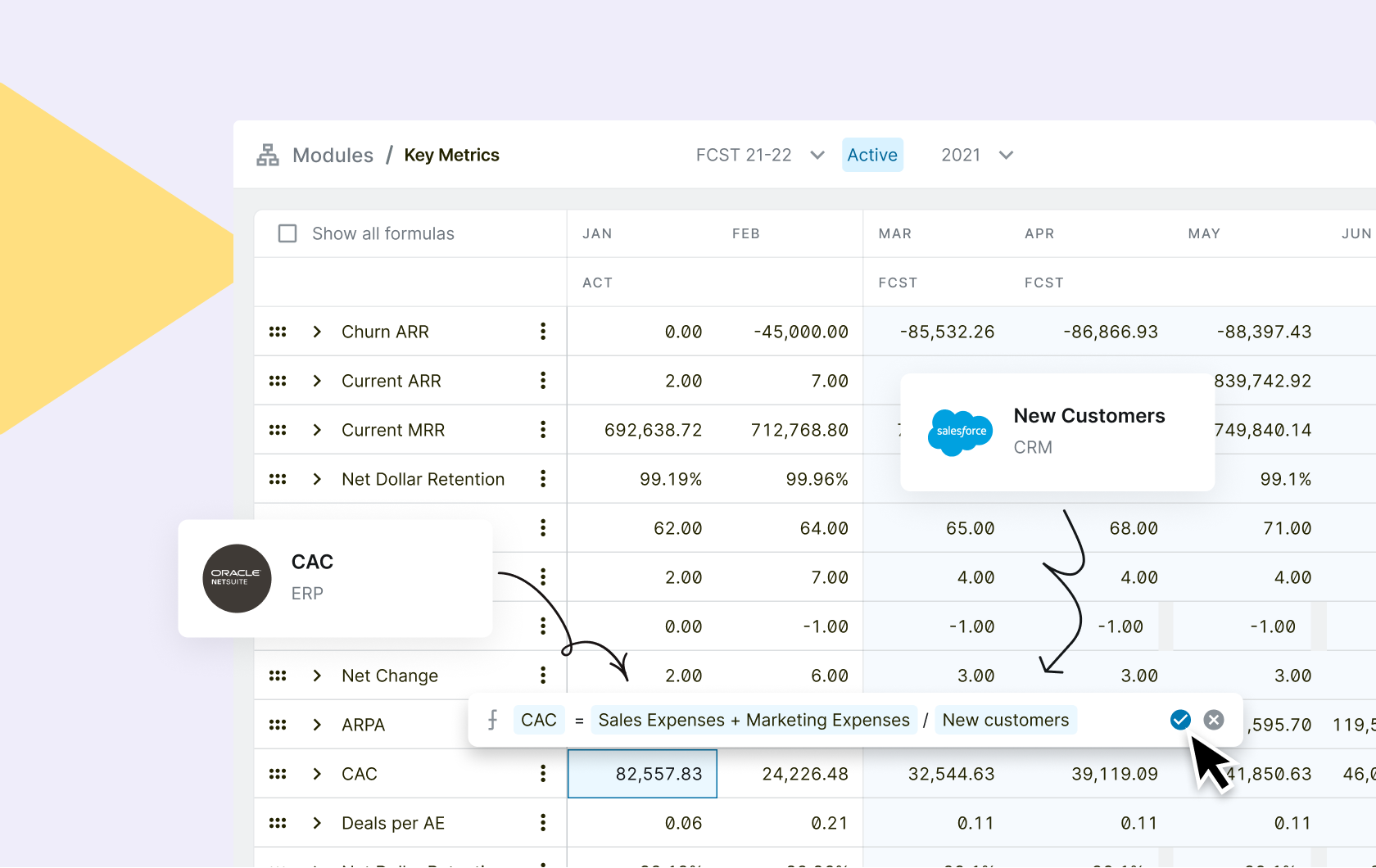

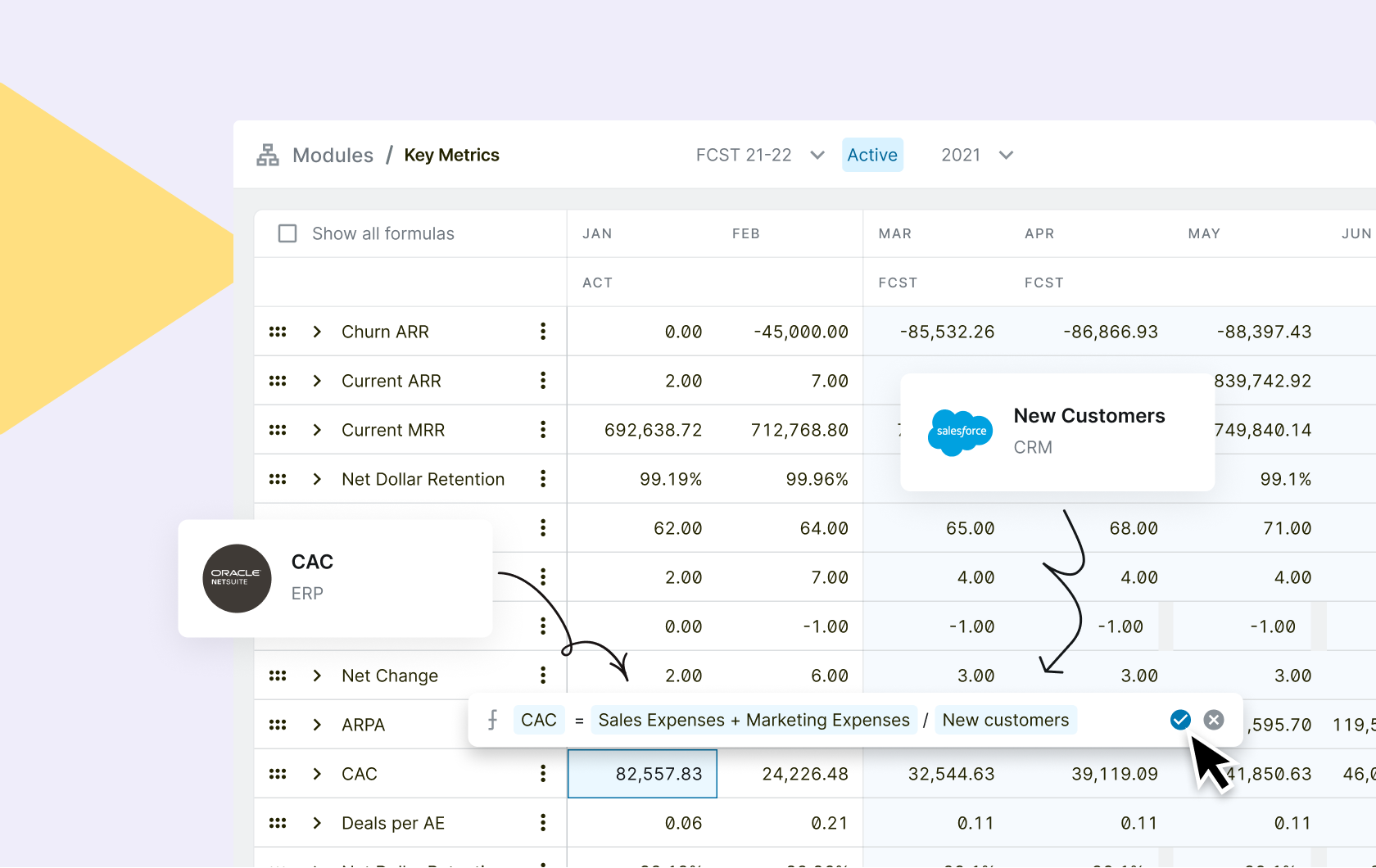

Integrate all your business software into a single source of truth

Abacum can help you consolidate your business information from multiple data sources into a single location by directly integrating with countless software that store business data. By connecting all of your tools and bringing your data into a single source of truth, you can gain visibility, remove data silos, eliminate data duplication, and minimize human errors caused by copying and pasting.

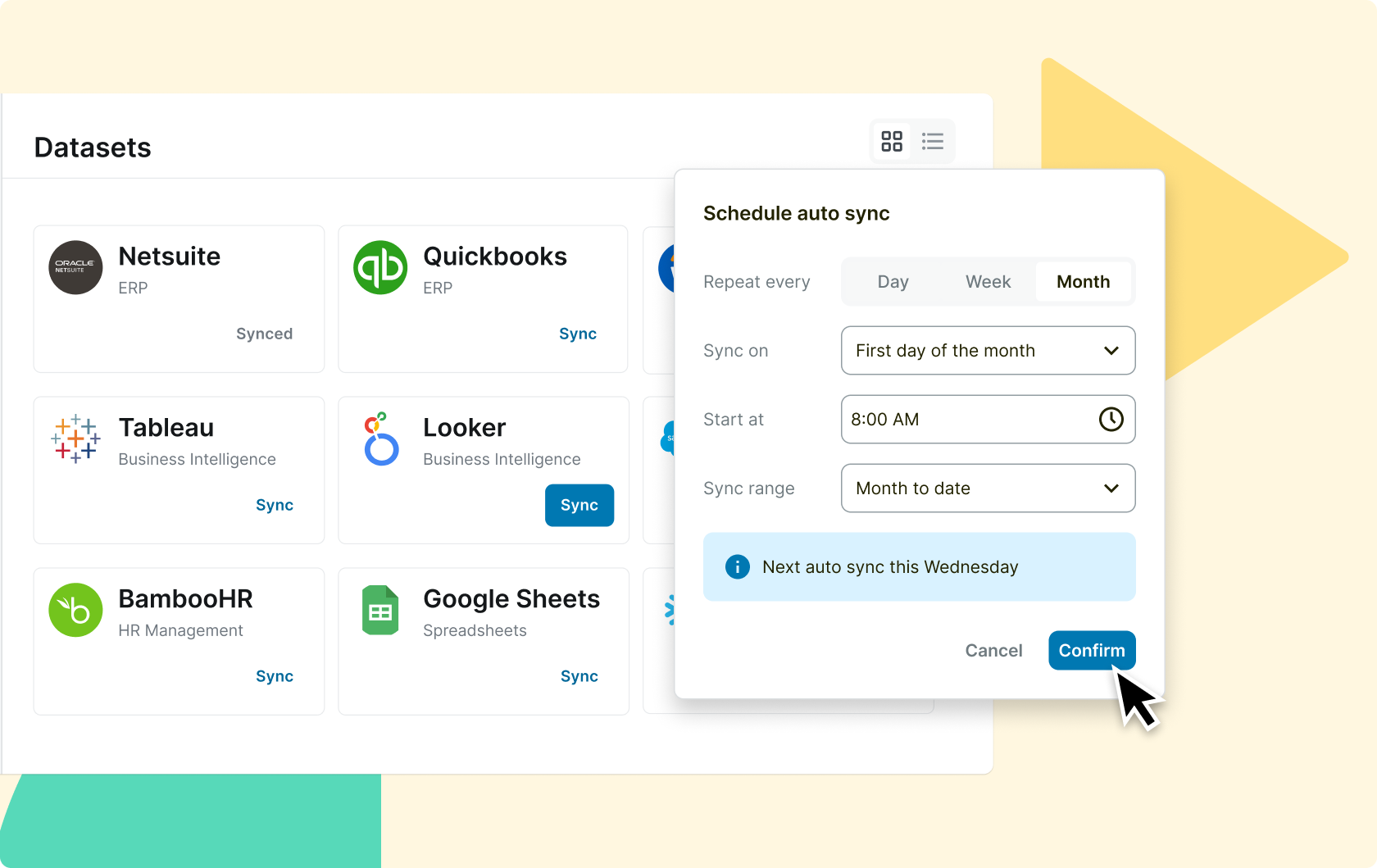

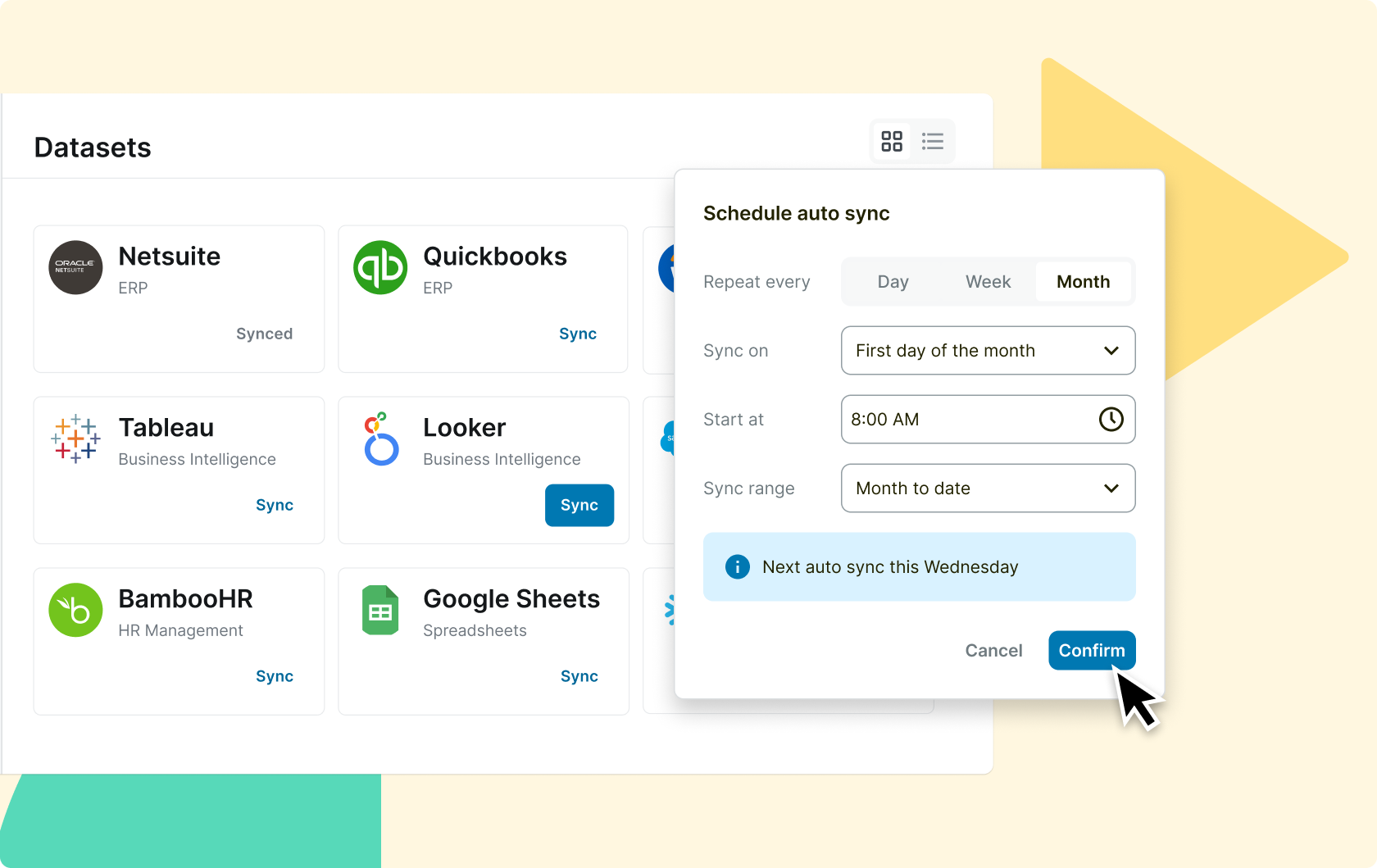

Simplify the process by making automation the priority

It is time to focus on value-adding activities and maximize your potential, instead of getting bogged down by manual, error-prone processes. Abacum enables you to automatically sync data from multiple sources in no time, saving you time and allowing you to concentrate on tasks that have a real impact on the business. This includes transforming raw data into highly accurate and actionable insights that will drive your company forward.

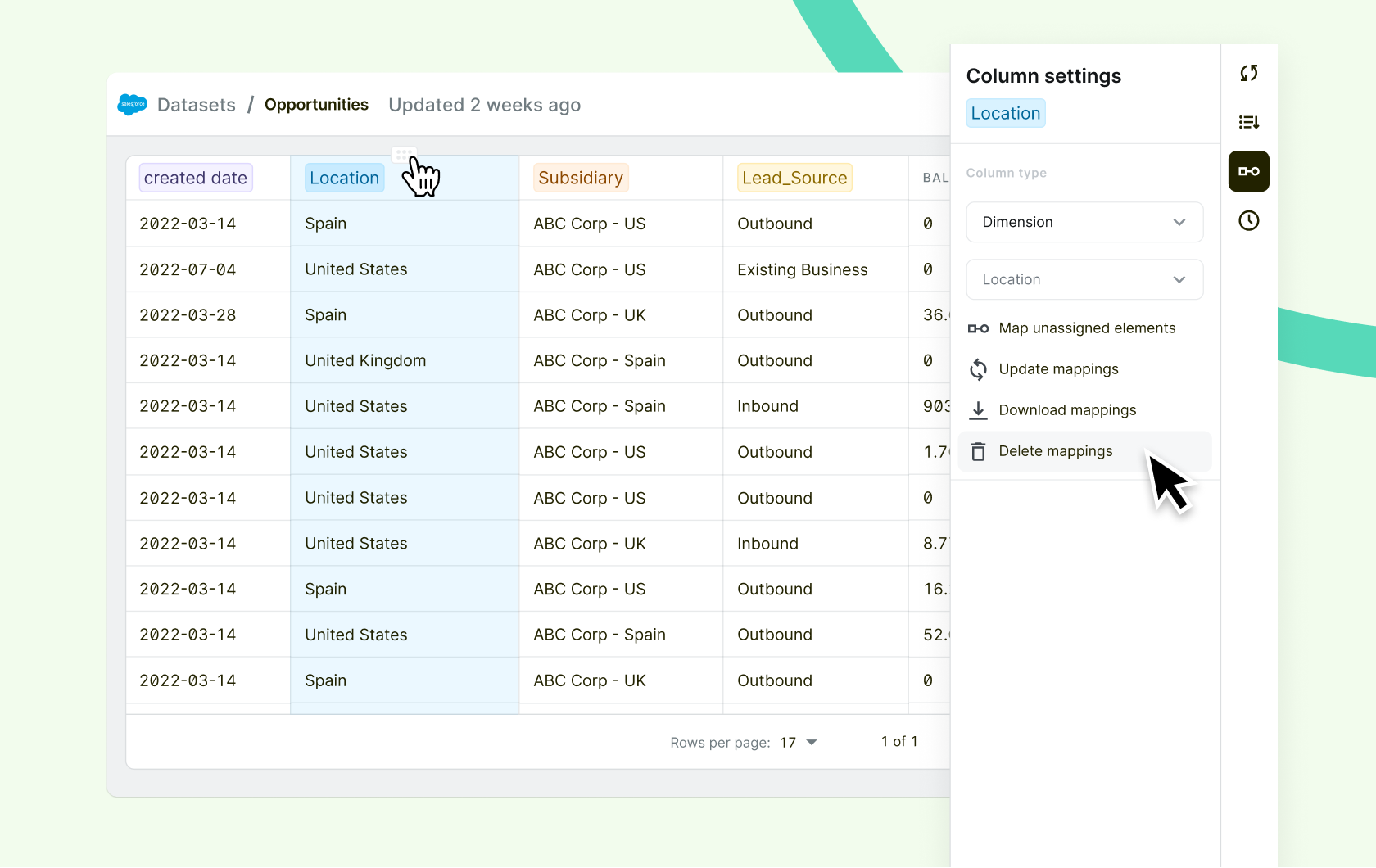

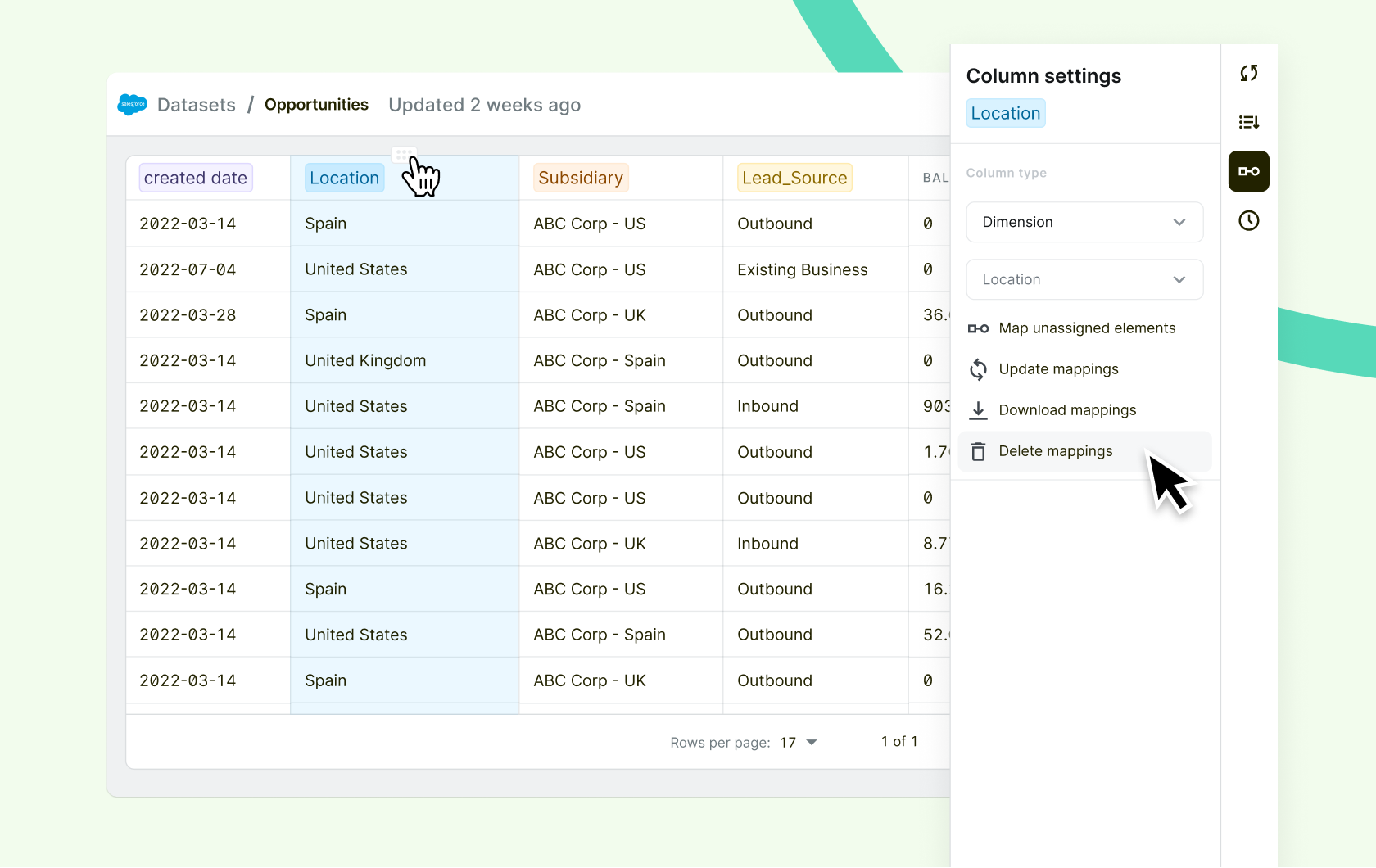

Focus on obtaining game-changing insights through in-depth analysis

By leveraging the dimensionality of your raw data, Abacum allows you to consolidate data as standardized, categorized inputs from each of your data sources – all at a fraction of the time it would take with a spreadsheet. This approach not only ensures that your business units operate with the same information, but also enables you to analyze information with a granularity that other solutions can’t process. As a result, you can spend your time exploring how to extract and use business insights more effectively, allowing you to make better, faster decisions.

No data source escapes us

Worried about whether your business software will connect with each other? Abacum integrates with all business systems, providing a single source of truth for a seamless experience.

Xero

Tableau

Salesforce

Minimize wasted time

Automate data consolidation to increase efficiency

SSOT

Centralize multiple data sources in one location

Execute faster

Get accurate data to make informed decisions faster

Go from chaos to order with consolidated data

Abacum is a powerful business planning software that helps you move from data to execution faster, allowing for more efficient decision-making. Its direct integrations and advanced collaboration features will allow you to centralize all of your company’s records in one place, creating a single source of truth that is accessible to your entire team. This allows you to make informed decisions based on accurate data, without having to waste time searching for information in multiple locations. With Abacum, you will be able to easily analyze different scenarios in real-time and make decisions based on a clear understanding of the business and the market.

Join our community to sync all of your business data

Centralize, standardize, and simplify your data consolidation capabilities with Abacum.

Javier Delgago

VP of Finance

“We went from budgeting in spreadsheets, to unlocking collaboration and better decisions with 30+ budget owners.”

Mobility

Frederikke Norborg

Strategic Finance

“We went from budgeting in spreadsheets, to unlocking collaboration and better decisions with 30+ budget owners.”

FinTech

Nerea de la Fuente

Finance Controller

“This is the future of reporting, no more Excels!”

FinTech

Still have questions? We’ve got answers.

What is financial consolidation software?

Financial consolidation software is a tool that helps organizations combine financial data from various sources, such as subsidiaries, departments, and divisions. This software solution automates the process of consolidating financial information, reducing the time and effort required for the task. It provides a single view of an organization’s financial health by aggregating data from disparate sources into one report.

Typically, financial consolidation software includes modules for data collection, validation, reconciliation, and reporting. It can also integrate with other financial software applications, such as ERP systems or accounting software. This allows Finance teams to streamline the consolidation process, reduce errors and inconsistencies in financial reporting, and gain insights into their overall financial performance.

Why is data consolidation important?

Data consolidation is the process of combining data from multiple sources into a single, centralized repository. This process is useful for several reasons: it reduces duplication of data and ensures accuracy across the organization, provides better decision-making by offering a holistic view of the organization’s financial performance and position, enables better forecasting ability by combining disparate sources of information into a cohesive model, and reduces costs associated with managing multiple data sets.

How can Abacum help consolidate your data?

Abacum’s business planning software is a powerful solution that helps Finance leaders drive business performance. Our software simplifies financial processes, allowing businesses to make informed decisions based on accurate, real-time data. With Abacum, your company can effectively manage finances, streamline operations, and increase operational efficiency.

By connecting multiple data sources to a unified platform through direct integrations, your Finance team can automate the categorization process of raw data with a simple sync button. This eliminates the need for manual copy-pasting work and displays business outputs in a fraction of the time.

Is it possible to consolidate your business data in Excel?

As a business leader, you may have heard that modern software can simplify the process of consolidating your business data. However, if you are wondering whether it is possible to consolidate all of your data using Excel, the short answer is yes.

It is possible to consolidate your business data in Excel. However, whether or not it is the best option for your business depends on several factors.

Consolidating data in Excel requires manual data entry and manipulation, which can be time-consuming and prone to errors. Additionally, as your business grows and the amount of data increases, it can become unmanageable in Excel.

Data consolidation software automates the consolidation process and provides a more efficient and accurate way to unify your company’s data. It also offers additional features such as version control and data validation to ensure the accuracy and consistency of your reports.

While Excel can be a useful tool for small businesses with limited data, as your business grows, it is important to consider investing in business planning software or financial consolidation software for more efficient and accurate reporting.

Is the data consolidation process the same as the financial consolidation process?

Data consolidation and financial consolidation are two distinct processes. Data consolidation involves combining data from multiple sources into a single, unified dataset. This often includes consolidating data from disparate formats into one format for easier analysis or presentation.

Financial consolidation, on the other hand, involves combining financial information from multiple subsidiaries or entities into a single set of consolidated financial statements. This involves taking the financial information from each subsidiary and combining it into one set of statements, taking into account any differences in regulations and accounting standards between the different entities.

What are consolidated financial statements?

Consolidated financial statements are reports that combine the financial information of a company and its subsidiaries or affiliates. These statements provide a comprehensive view of the financial performance and position of an entire group, rather than just individual companies.

In simpler terms, consolidated financial statements report the combined results of multiple entities that share common control. Their purpose is to eliminate intercompany transactions between the parent company and its subsidiaries, so that the financial information is presented as if it were from a single legal entity.