Top 10 financial planning software tools used by growing mid-sized businesses in 2024

Learn more ->

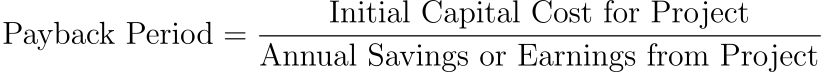

The concept of the payback period refers to the key metric used to determine the length of time a business investment takes to pay for itself.

This calculation allows investors to determine whether an investment decision makes sense financially and, hence, how much money it will take to reach the break-even point.

If you are looking to make a profit off of a potential investment, the payback period is essential because it determines how much time you must wait before turning a profit.

In general, business investments that generate positive cash flow over time are considered to have a shorter payback period. In contrast, an investment that produces negative cash flow over time is referred to as having a longer payback period.

The payback method is important because it lets you know how long it takes to recover the costs of a project or business investment.

The shorter the payback period, the better. However, the length of the payback period depends on several factors, including the type of project, the size of the project, and the expected return on investment. If a project is large enough to require multiple phases, each phase may have a different payback period. In addition, some types of projects can take longer to complete than others.

There are different kinds of payback periods, including:

The break-even point focuses on the amount of revenue required to achieve a no-profit, no-loss scenario. This metric considers the amount of money required to start seeing a return on investment rather than the length of time it will take a company to start making a financial gain.

In contrast, the payback period method looks at how much time it takes for a company to recoup its original investment and reach a certain level of profit. A payback period of three months indicates that it takes just three months to make enough money to recover the initial investment.

While both concepts are important, they are different. The break-even point measures the profitability of an investment opportunity, while the payback period measures the speed of a project. They are often confused with one another because they sound alike. However, there is no such thing as a payback period without a break-even point.

In corporate finance, successful companies calculate the payback period by dividing a project’s initial cash outlay by the annual cash flow it brings in. They might assume that the net cash inflow is constant each year to calculate the payback period formula. The outcome is expressed as a number in years or fractions of years.

Learn more ->

Learn more ->

Learn more ->