Customer acquisition cost (CAC) is a critical indicator for businesses looking to grow their revenue. This metric helps companies understand how much money is spent on each new customer over a given period of time.

The term “customer acquisition costs” refers to the entire process of acquiring a new customer. Which includes building awareness of the brand, getting leads, qualifying those leads, converting the leads into prospects, closing deals, and retaining customers.

The goal of this metric is to measure the value of each dollar spent on acquiring a new customer, and hence the return on investment (ROI). Additionally, the CAC metric is frequently used in conjunction with customer lifetime value (CLV) to assess the value provided by a client.

Why is CAC important?

Customer acquisition costs are often overlooked, but it is important to understand how much money a business is investing in marketing costs, sales expenses, and even customer success when acquiring and retaining clients.

There are many reasons why measuring the cost of acquisition of a customer is important. Below are a few of the most essential benefits:

- It helps determine whether or not the marketing investment is successful.

- It evaluates a sales team’s performance in closing deals. A change in strategy may be necessary if some accounts demand greater work from the sales team.

- It proves an organization’s value to investors and enterprises.

- It provides valuable insights to make better-informed decisions about where to allocate resources.

What is considered a customer acquisition cost?

The term CAC refers to the total amount of money spent on marketing, sales, and other activities that are intended to attract new customers.

This may include things like discounts, free trials, referral bonuses, etc., so it is not always the same as the cost you pay for an advertisement or a piece of content, for example.

Moreover, the cost of customer acquisition can also include any fees charged by third-party vendors who help with the sale.

Check the list below to ensure you are taking into account the most crucial costs associated with acquiring customers.

- Employee salaries involved in the Marketing and Sales process

- Marketing and Sales team benefits, commissions, and bonuses

- Training and support

- Hardware, software, and hosting fees

- Advertising and marketing campaigns costs

- Lead generation costs, such as outsourced agencies

- Free trials, discounts, affiliate programs costs, and referrals rewards

How to calculate & improve CAC

Calculating customer acquisition costs can be tricky because there are many variables involved. The following are some examples of what you should consider when calculating your CAC:

- Lead generation efforts: How long did it take to generate your first lead? What was the conversion rate? Was the content effective enough to convert the prospect into a qualified lead?

- Sales cycles: How long does it typically take to close a deal?

- Marketing budgets: How much was allocated towards lead generation versus other areas?

- Sales teams: How many people do you have working on the account? Do you need more? Less?

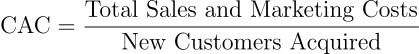

Once we have all the data in place, the CAC can be calculated by simply dividing all of the costs spent on acquiring new customers (marketing expenses and cost of sales) by the number of customers that were acquired during the period the money was spent.

However, there are several limitations to using this metric, despite it being a crucial indicator for measuring the success of acquisition efforts.

First, a company may make marketing efforts that do not yield immediate results. For example, a company may invest heavily into SEO but they may not necessarily start to see real returns until six months down the road. In this case, you may want to use a different calculation method.

Second, a company may have invested in sales and marketing tactics that don’t directly lead to acquisition. For example, a salesperson might spend a lot of time networking with prospects, but never actually close a deal. These types of activities often go unrewarded and therefore aren’t included in the overall cost of acquiring a customer.

Third, companies may choose to ignore certain costs associated with their acquisition process. For example, a large enterprise may decide to outsource its lead generation efforts, which would reduce the amount of time spent generating leads. This could result in a lower CAC since less time is spent on generating leads. However, this same company may also decide to hire additional salespeople, which will increase the total cost of acquiring a customer, even though they didn’t spend any extra money on lead generation.

Fourth, a company may choose to measure CAC differently than how we described above. For example, a business may report CAC based on the average revenue per customer over a given time period. This type of measurement is useful for comparing one company against another, but it does not provide us with information about whether or not the company has been successful at acquiring potential customers.

The bottom line is that measuring CAC is only part of the equation. It provides us with valuable insight into the effectiveness of our acquisition strategy, but it doesn’t tell us everything we need to know. To truly understand if we are making progress toward our goals, we must look beyond just the numbers.

Tips for lowering your CAC

The most expensive part of any business is getting new customers.

So how do you keep your CAC low? There are many ways to achieve this goal. Some companies focus solely on reducing their CAC. Others focus on optimizing their profit margins. Still, others work to improve their churn rates — the percentage of customers who stop paying for their subscriptions. And some companies try to increase lifetime value and revenue per customer.

While each approach has merit, here are four things every business should consider doing to lower its CAC:

- Know your customers: Knowing your customer helps you build products that meet their specific needs. For example, knowing what types of people use your product will allow you to develop features that target those groups. Also, understanding how your customers interact with your brand will help you understand where to invest resources in your digital strategy.

- Engage them early: Earlier product engagement reduces acquisition costs per customer. When you engage customers earlier, you minimize the risk of losing them to competitors as you build stronger relationships. In addition to saving money, engaging customers early creates a better overall customer experience.

- Keep them coming back: Creating a positive customer experience keeps customers engaged with your brand. Keeping customers happy increases retention rates, which leads to an increased LTV.

- Be honest with yourself: If you are honest with yourself, you will see that there is no such thing as a free lunch. Every dollar spent on acquisition means fewer dollars available to invest in other areas of your business. So before you start spending more money on acquisition, ask yourself if it makes sense from an ROI perspective.