Transform your investor relations with a best-in-class board reporting software

Automatically update investors and key stakeholders, create your fundraising strategy, and easily report and track all your financial and operational metrics.

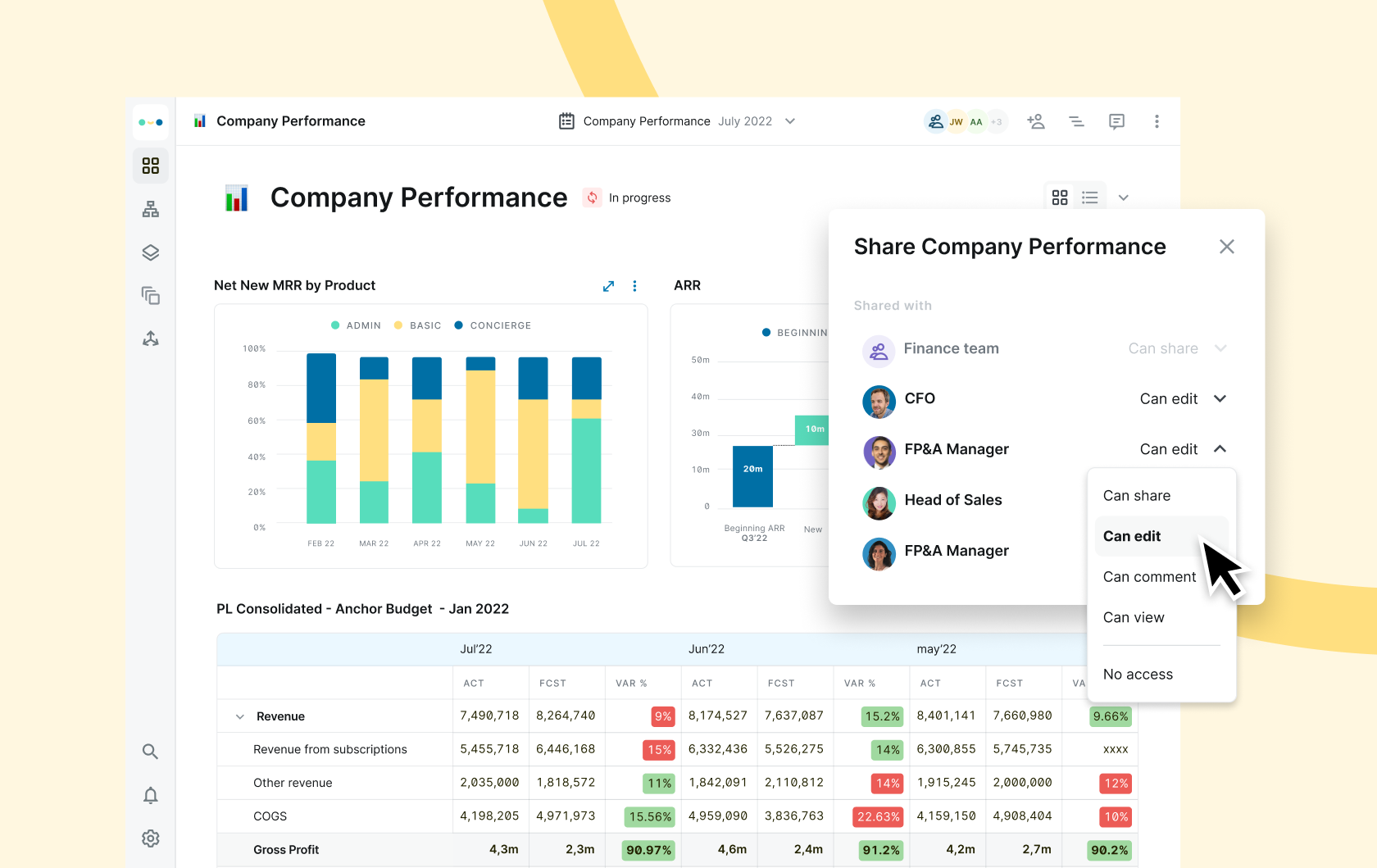

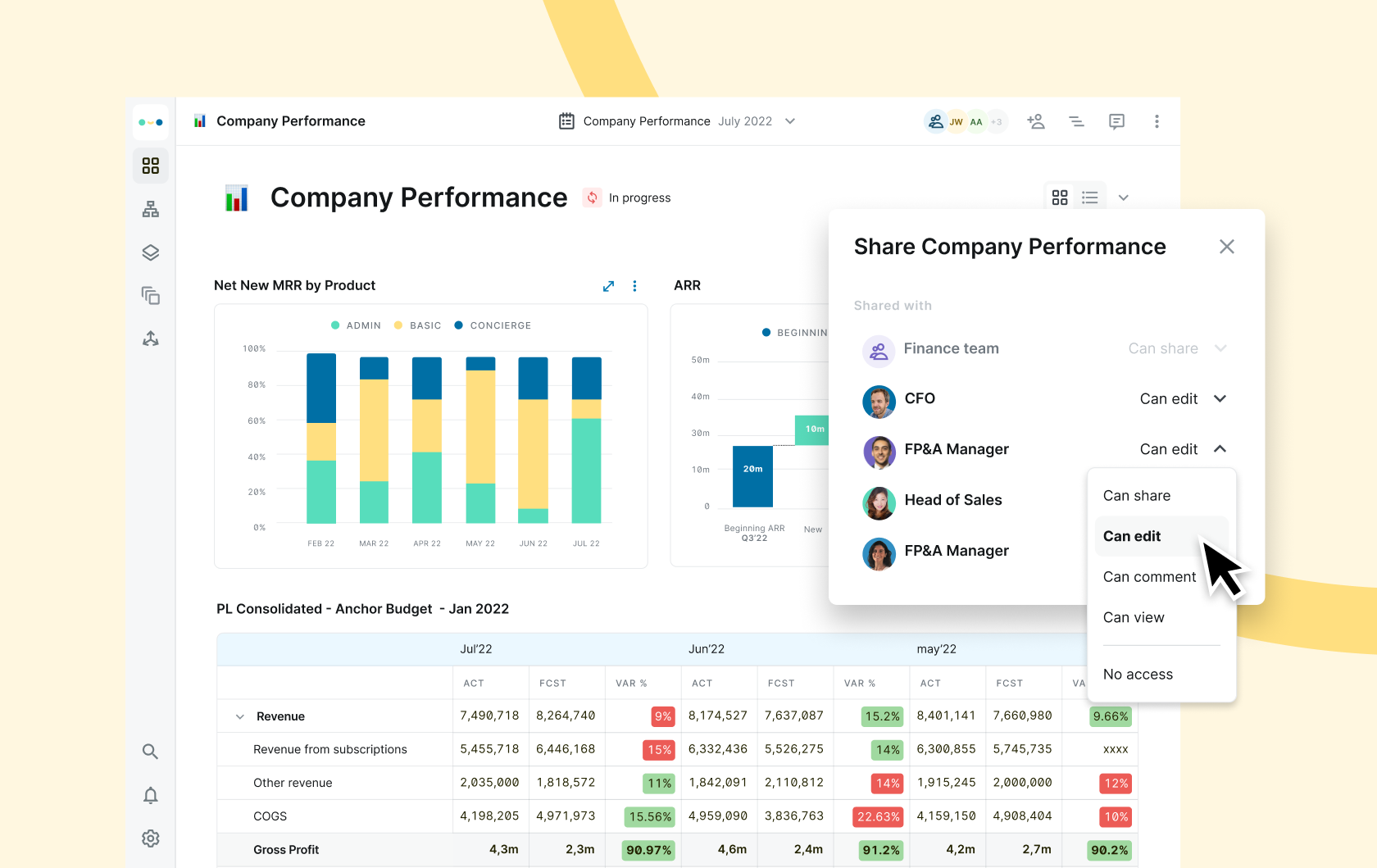

FP&A TEAMS SHARING INVESTOR REPORTS IN ABACUM

Focus on building trust and support with your investors

In today’s fast-paced business environment, it is crucial to keep your board members well-informed. Abacum allows you to share real-time financial and operational data, ensuring your investors consistently have the answers they need. By efficiently streamlining board reporting, you can focus on cultivating trust, building investor confidence, and tackling the most pressing questions for your business. Abacum empowers you to effectively engage with your investors, guaranteeing they are always informed and prepared to offer the operational support your business requires.

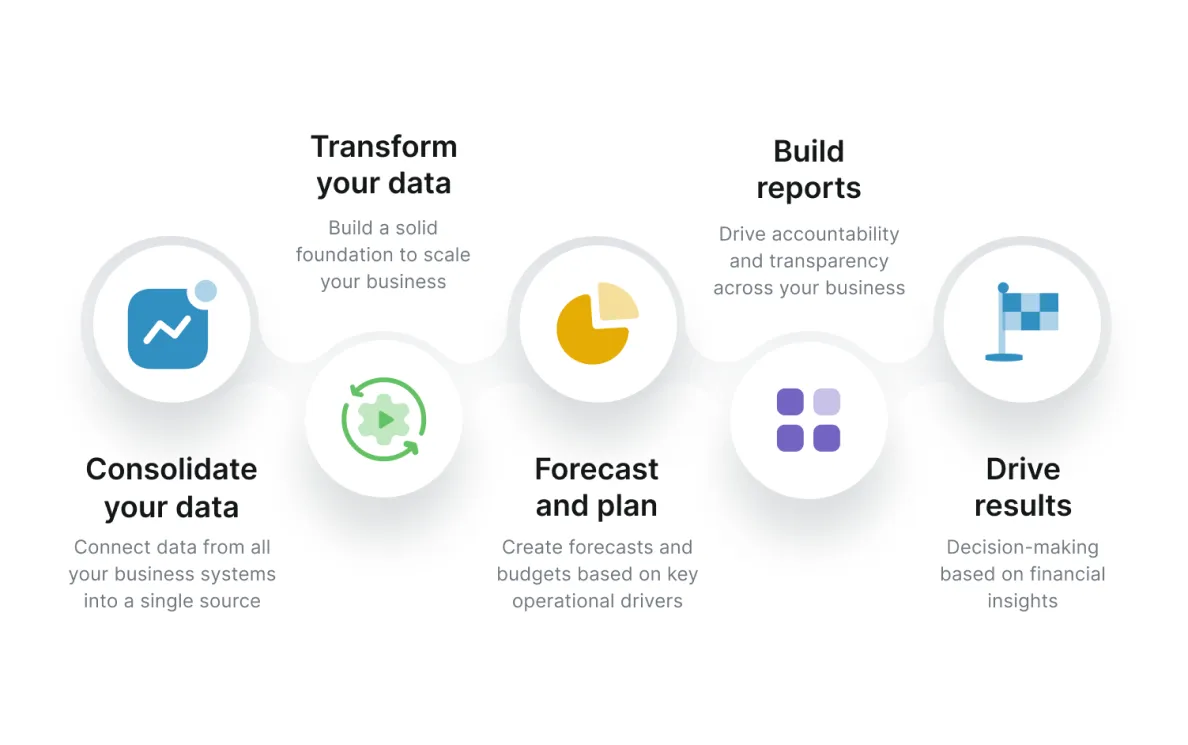

Your board reporting made easy with Abacum

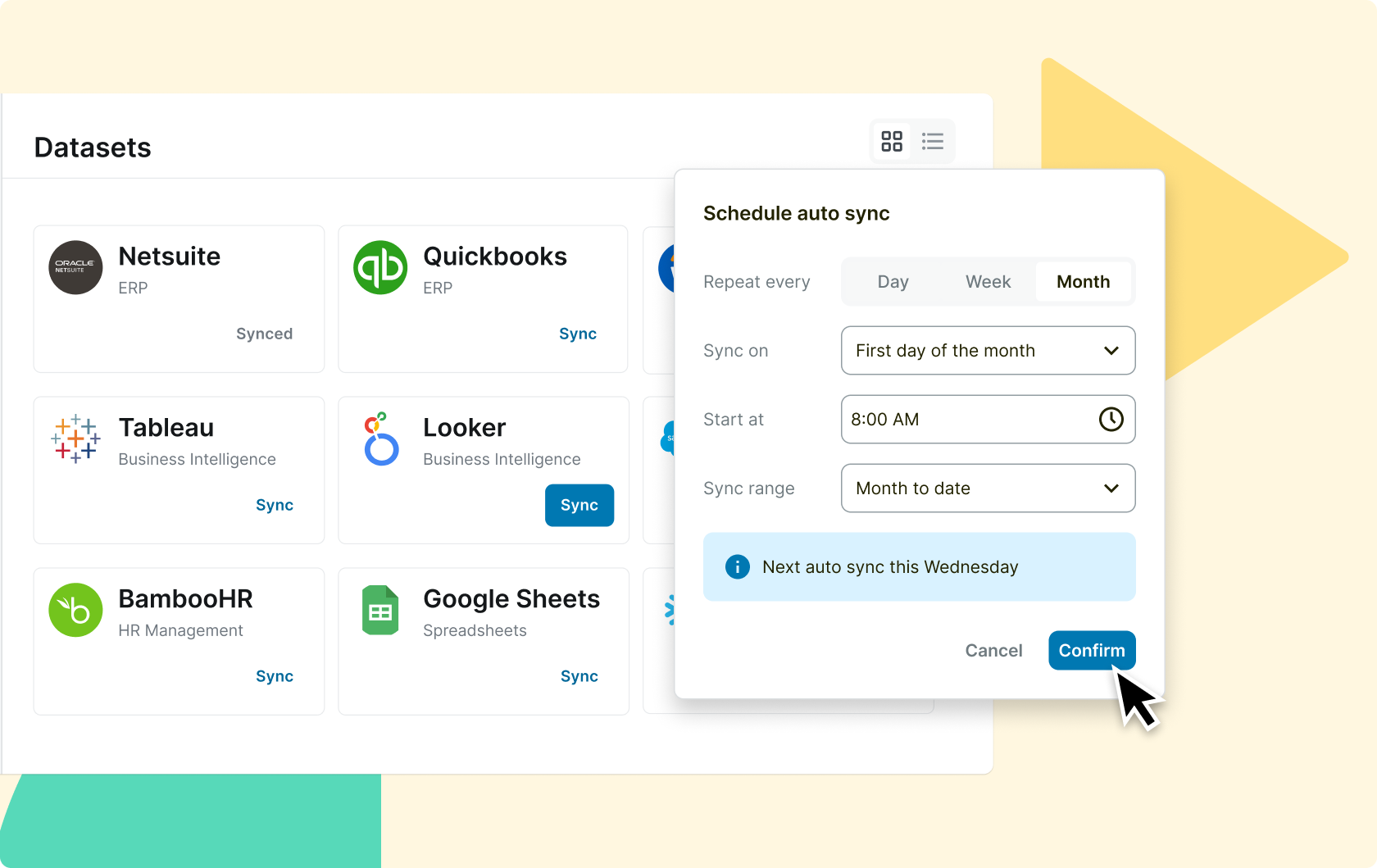

Making sure your investors are up to date should not demand hours of manual work. Abacum enables you to automate and create custom reporting templates. With best-in-class integrations, you can automatically report and visualize financial, operational, or workforce metrics. Robust user permissions allow you to securely manage and share reports with both investors and board members. Crafting an engaging investor update has never been this fast, Abacum allows you to concentrate on the discussion rather than the preparation.

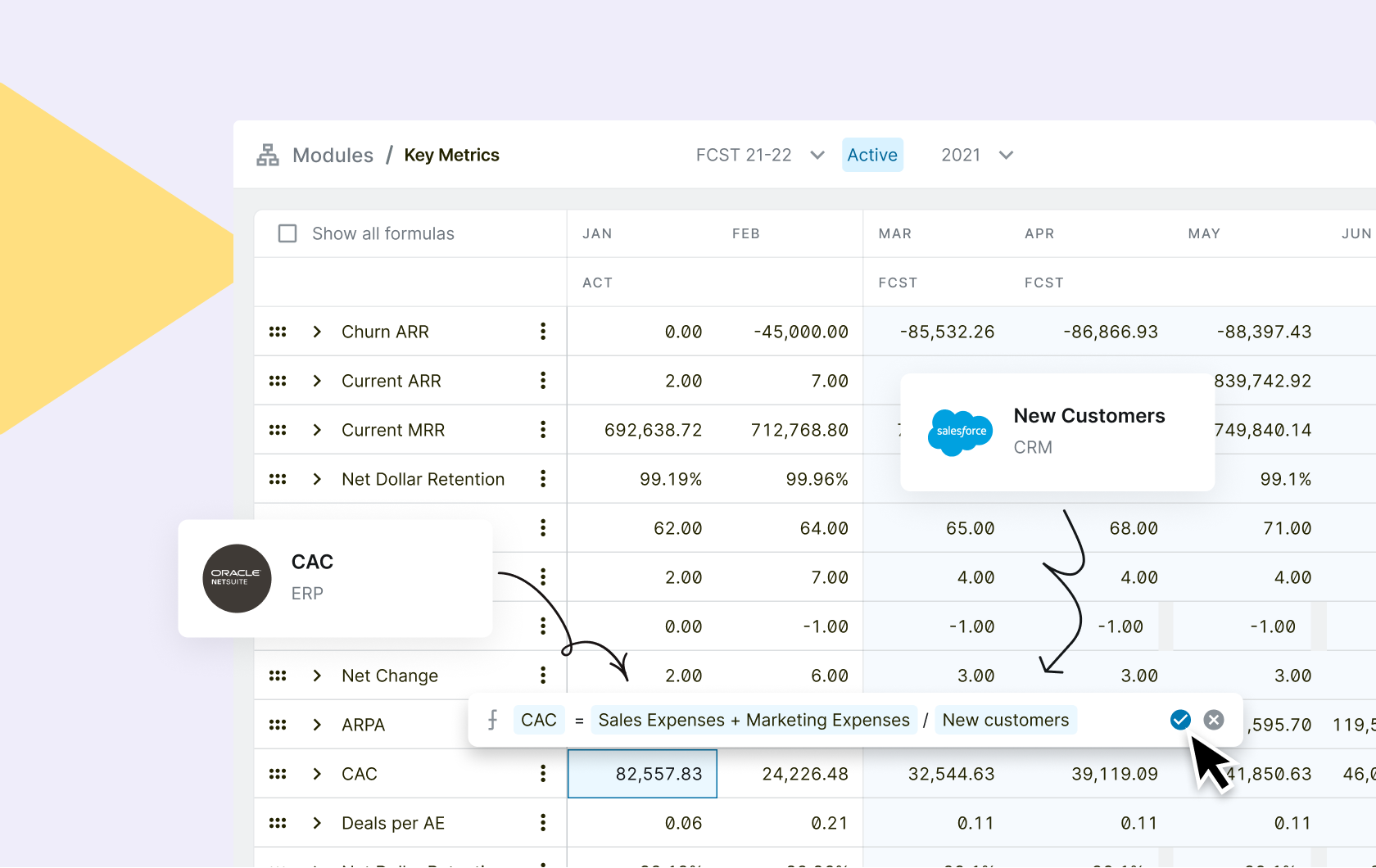

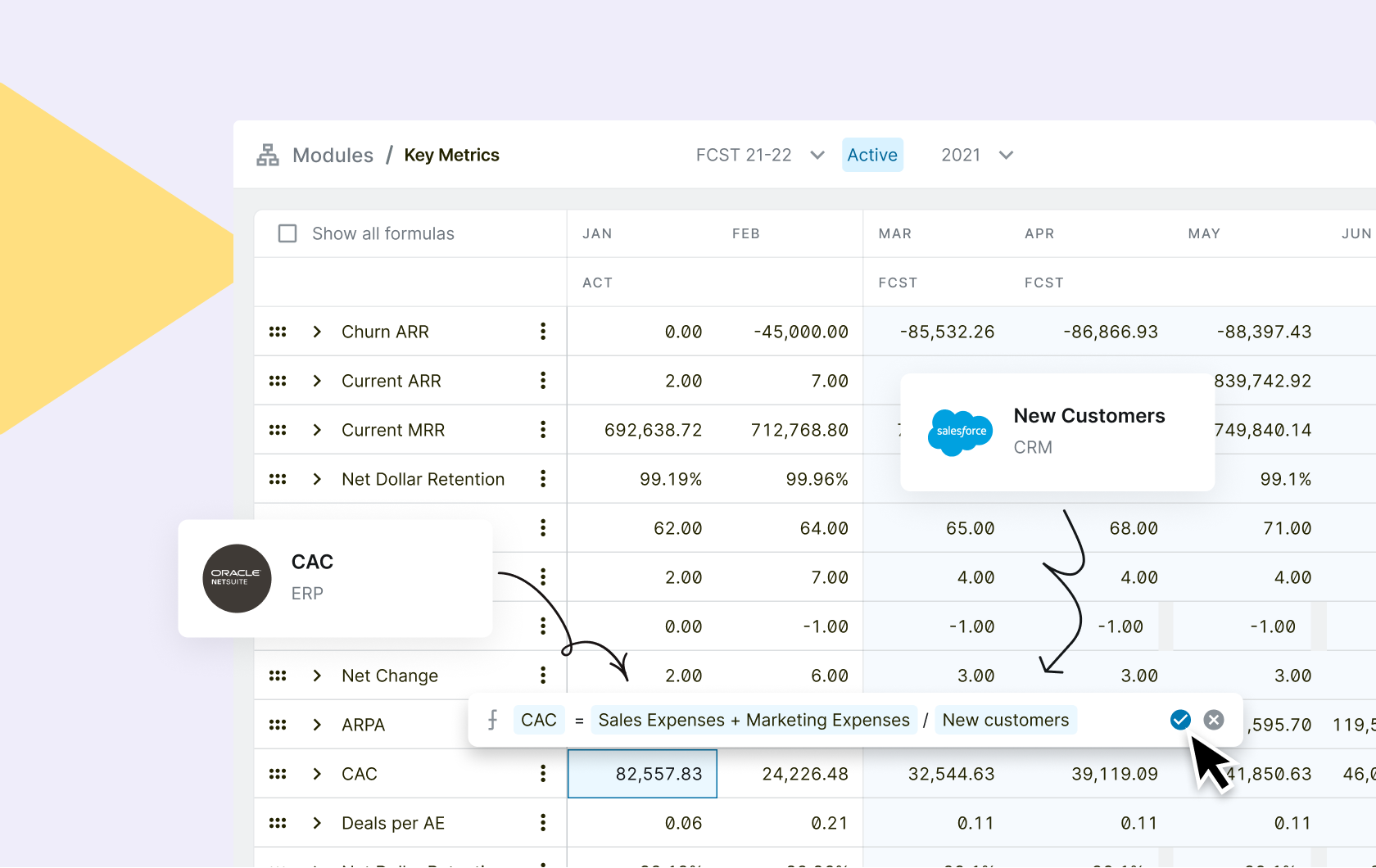

Your fundraising due-diligence on autopilot

When it comes to fundraising, a clear and compelling financial story and business strategy makes all the difference. Abacum streamlines your fundraising process, turning it into a smooth exercise. By always having up-to-date metrics, you can confidently respond to investor questions, due diligence requests, and more importantly deliver the answers needed to secure your next funding round.

Financial reports now skip spreadsheets

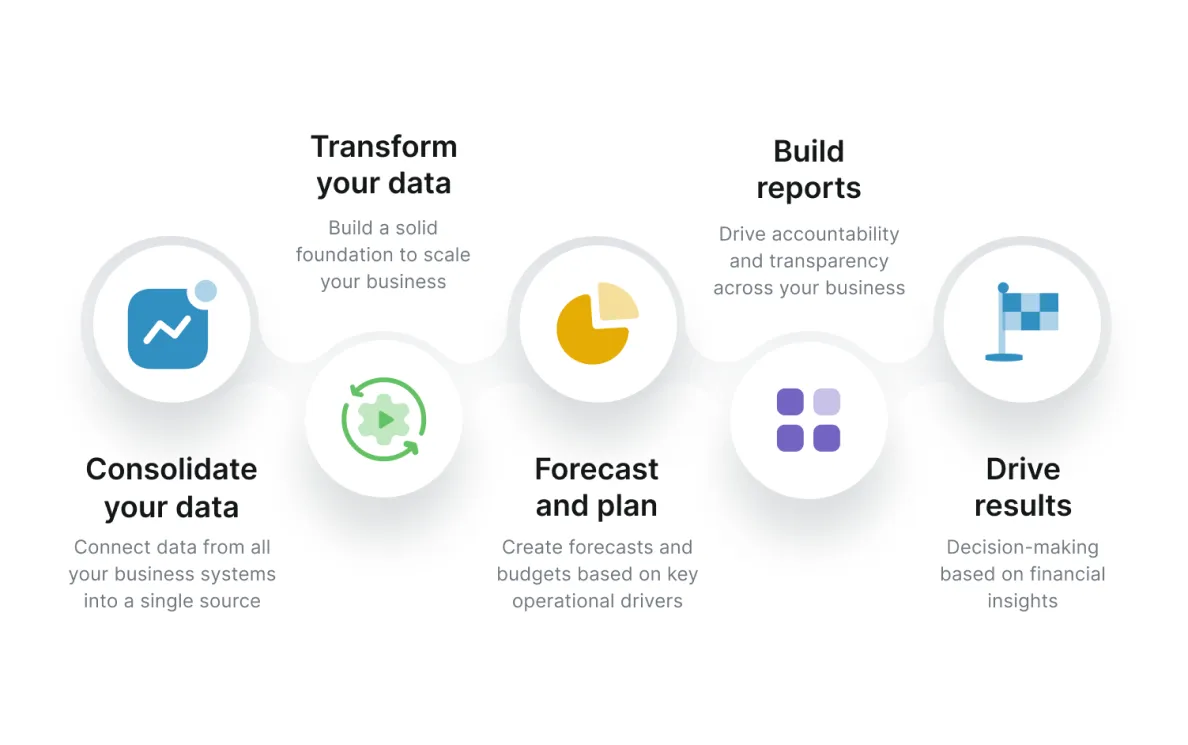

FP&A software has transformed financial analysis by providing a centralized platform for more accurate and efficient financial consolidation. Abacum’s automation and data validation features can help you save time to focus on what really matters and improve accuracy. With Abacum, you can deliver actionable insights in a visually engaging format that all stakeholders can understand. Don’t get left behind in the spreadsheet dark ages!

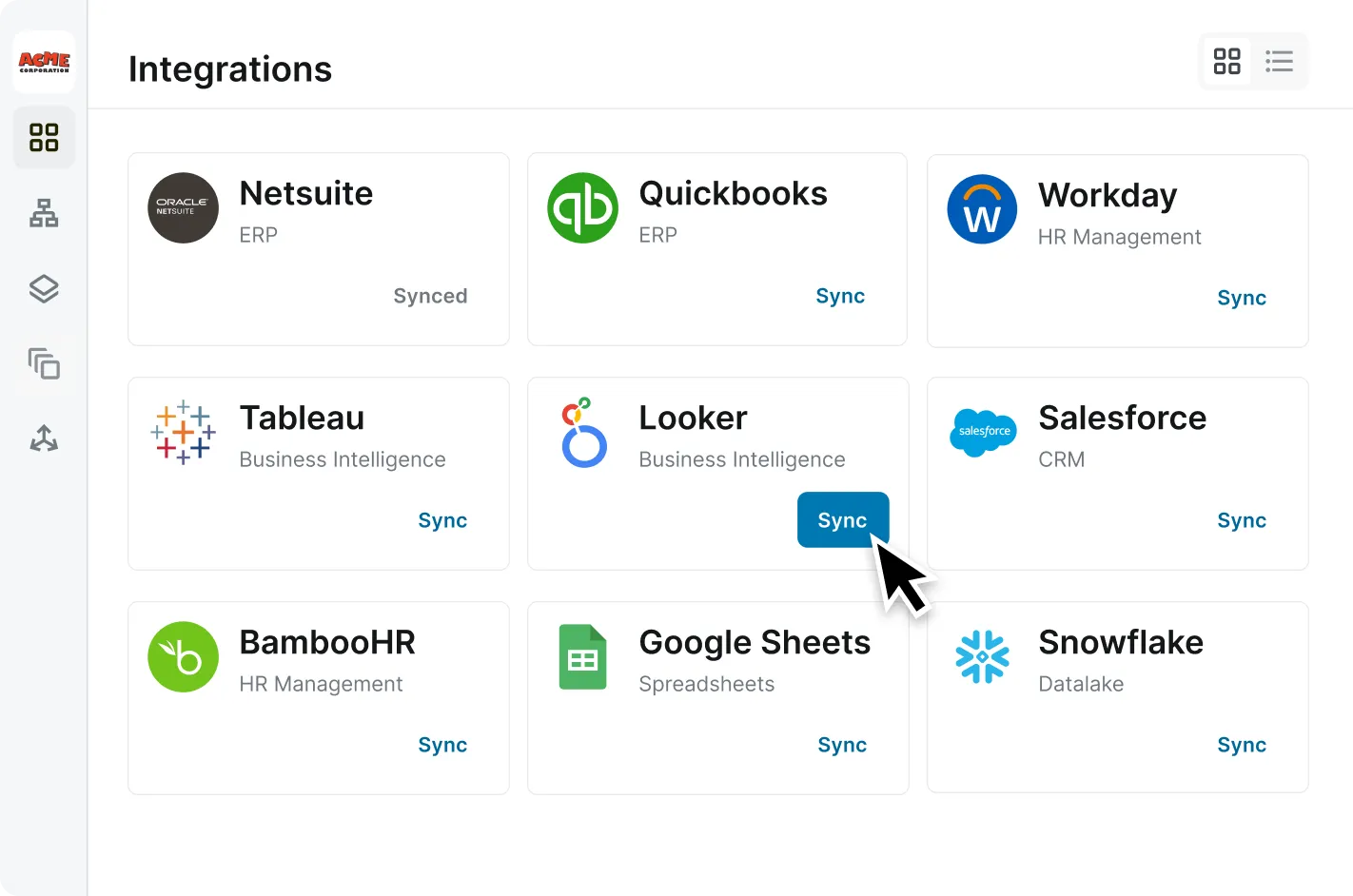

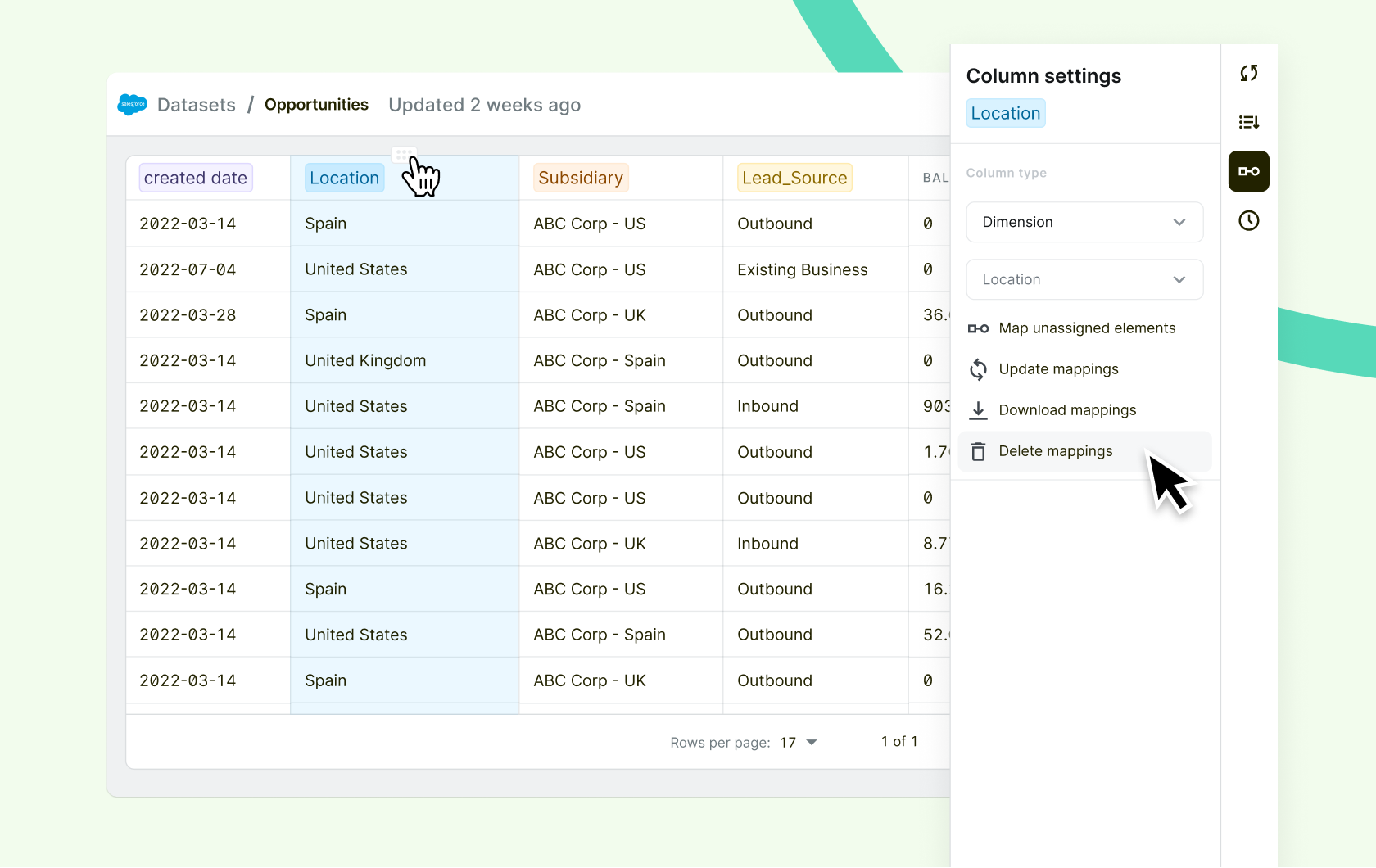

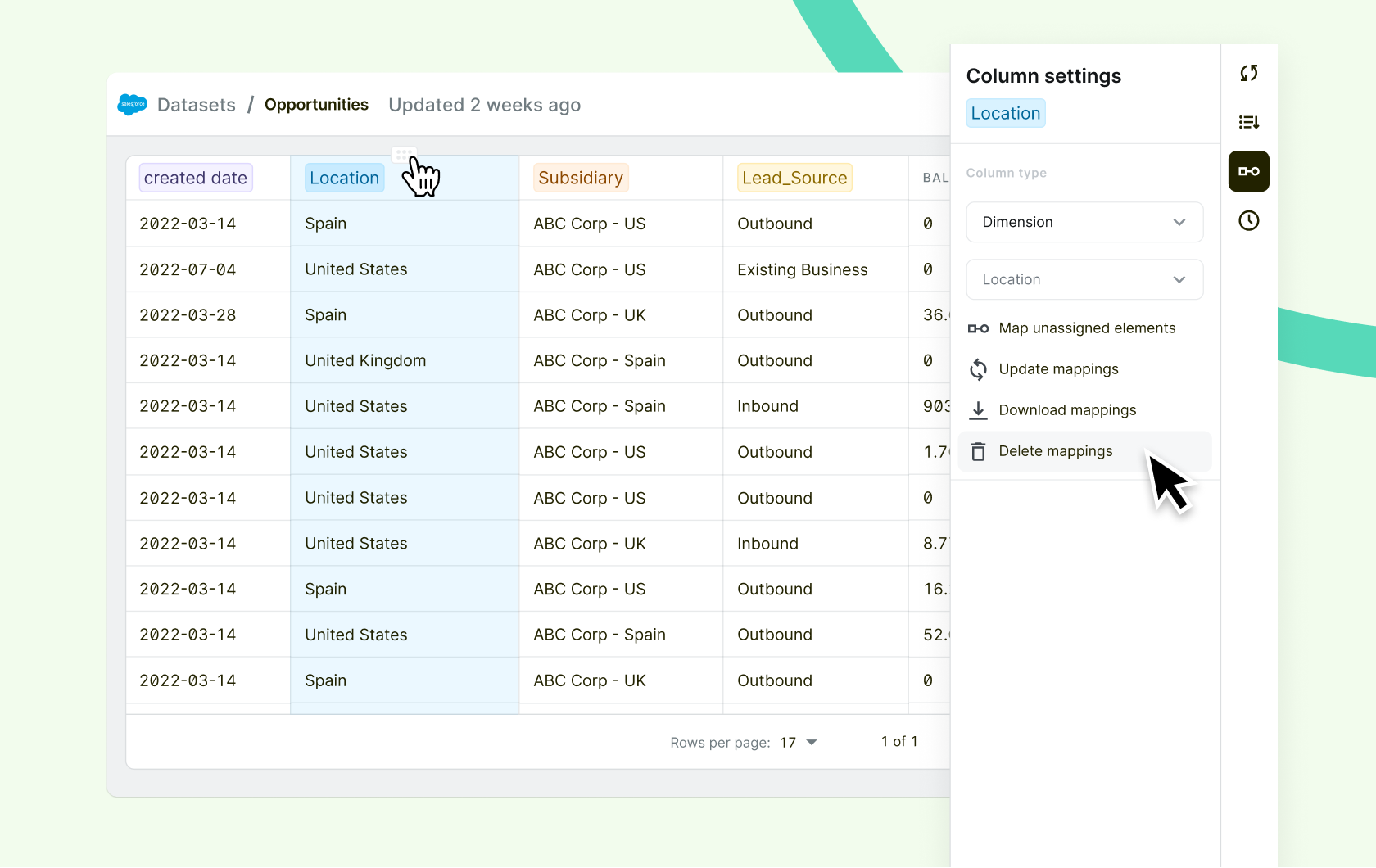

Automate board reporting with direct integrations

Abacum integrates with your existing financial and operational systems to automatically gather and consolidate your metrics and create an insightful performance overview.

Xero

Tableau

Salesforce

Track all your metrics

Build custom and share ready dashboards that centralize all your data for easy sharing with investors

Update with just one click

Share investor updates with just one click and easily manage access with custom user permissions

Share investor updates with just one click and easily manage access with custom user permissions

Start having productive board meetings that focus on the discussion not the reporting

Transform your board meeting into your most impactful conversation

With limited resources and an ever-changing market landscape, having an automated board reporting software will significantly impact your decision-making and investor relationships. By leveraging Abacum’s board reporting software, you can start fostering trust, transparency, and execution while accelerating your fundraising efforts. Do not let time-consuming investor reporting processes hold your startup back, start running productive board meetings today.

Join the companies using Abacum to streamline their board reporting

Join our community to improve your board reporting and be prepared for your meetings.

Diego D.

CFO

“Great tool to gather insights and prepare my reporting for investors. I now find it much easier to prepare my reports, which saves me tons of time.”

Small-Business (50 emp.)

Ana Muñoz

Head of Corporate Finance

“Abacum helped us automate complicated data sets that were really demanding and helped us work efficiently, even with the same limited resources.”

FinTech

Stedwin C.

CFO

“The ease of use to sync data and present to stakeholders in a clear, concise, digestible format. Excellent Platform.”

Mid-Market (51-200 emp.)

Still have questions? We’ve got answers.

What is Board Management Software?

Board management software is designed to help you streamline and improve the reporting overview and effectiveness of your board meetings and investor relations. It helps startups manage their board members and other stakeholders in an efficient and secure manner using a single platform.

What is Board Reporting Software and how does it benefit tech companies?

Board reporting software is specialized in helping venture backed companies prepare, organize, and present their quarterly or annual meeting materials. Startups can benefit from using a board reporting software thanks to the automation of board meeting preparation, ensuring accurate and up-to-date financial and operational metrics, and enabling effective decision-making for investors.

What is a board intelligence platform?

A board intelligence platform is a comprehensive software solution designed to empower a board of directors with the necessary tools, processes, insights, and data to make informed management decisions. A board intelligence platform has several features such as a board portal, board books, native collaboration features, document management, and data analytics, to create a centralized board portal for all board-related activities and information.

How can board reporting software improve decision-making during your investor meetings?

Investor reporting software will improve decision-making by providing a real-time overview of the relevant information, allowing board members to make informed decisions. This type of product offers real-time company updates, and ensures that investors have access to the latest data. Additionally, it also promotes the collaboration between founders and investors by offering various communication features, such as comments, agendas, calendar management, which enable board members to share insights and feedback.

What are the key features to look for in top-quality board reporting software?

The key features you can look for in a reporting software include:

a. An intuitive user interface: An easy-to-use platform that enables board members to quickly access and navigate essential documents, tasks, agenda items, and resources.

b. Document management: A centralized system to access board materials. Including managing, organizing, and distributing board materials, while supporting version control and access permissions.

c. Collaboration tools: Features that promote communication and collaboration, such as chat functions, annotation capabilities, and secure document sharing.

d. Security: Robust data encryption and user authentication measures to protect your company’s financial performance.

e. Customization: The ability to tailor the software to your organization’s specific needs, including custom reports, templates, and workflows.

f. Integration: Compatibility with your existing business systems such as QuickBooks, Netsuite, Salesforce, Tableau, Snowflake, and others.

How does board reporting software streamline the board meeting process?

Board reporting software streamlines the board meeting process by automating the consolidation of your operational and financial data. Immediately reducing the time and effort spent on reporting preparation, allowing you to focus on strategic decision-making with your board.

Can board reporting software help improve corporate governance and compliance?

Board reporting software can help improve corporate governance and compliance by providing a transparent and efficient system for managing board-related tasks. This includes tracking important deadlines, maintaining records of meeting minutes and board decisions, and ensuring that all required documentation is readily available for review. By centralizing these processes, board reporting software reduces the risk of non-compliance and helps organizations adhere to regulatory requirements.

How do I measure the ROI of investing in board reporting software for my organization?

To measure the ROI of investing in board reporting software, consider the following factors:

a. Time savings: Assess the reduction in time spent on administrative tasks related to investor or board meetings, such as data preparation, report formatting, performance commentary, and distribution.

b. Improved decision-making: Evaluate the impact of more informed decision-making on the organization’s performance and strategic direction.

c. Compliance and governance: Determine the value of reduced risk and increased adherence to regulatory requirements.

d. Cost savings: Compare the cost of the software to potential savings in reduced headcount as a result of board reporting automation

How can I ensure a successful implementation of board reporting software within my organization?

Ensuring a successful implementation of board reporting software within your organization involves several key steps:

a. Clearly define your objectives and requirements for the software, taking into consideration the needs of your board members and the specific challenges your organization faces.

b. Research and select a software provider that aligns with your organization’s needs and budget.

c. Engage key stakeholders, including board members and administrative staff, to gain buy-in and support for the implementation process.

d. Establish a timeline for implementation, including milestones for training, data migration, and system customization.

e. Provide comprehensive training for all users to ensure they understand the software’s features and can effectively use.